The Benefits of Outsourcing Bookkeeping for Small Business Growth

MyIRSRelief

DECEMBER 2, 2024

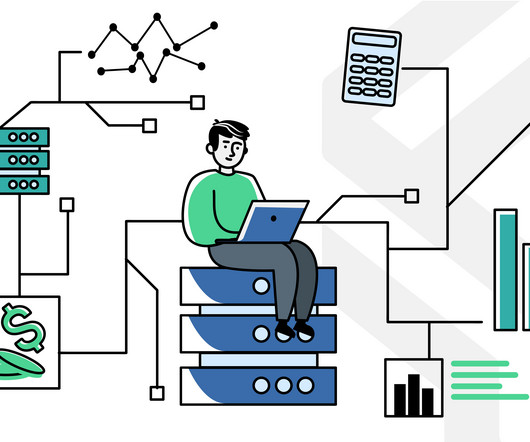

Access to Expertise and Specialized Knowledge Outsourced bookkeeping services provide access to a team of financial experts who specialize in various aspects of accounting and finance. Cost Savings Hiring, training, and retaining an in-house bookkeeper can be costly.

Let's personalize your content