The Best Small Business Bookkeeping Solutions

xendoo

SEPTEMBER 10, 2021

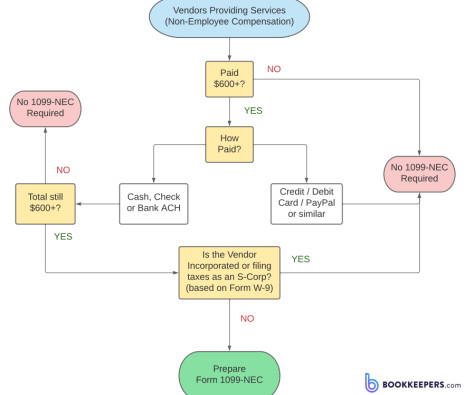

This gives you the freedom and confidence to focus on your business, knowing your financial needs are in expert hands. . Business Tax Preparation and Filings. Taxes represent a unique SMB bookkeeping demand. Partnering with an online accounting firm like Xendoo can ensure that you file the appropriate form.

Let's personalize your content