Are you a specialist or a generalist accountant? Should You Stick or Switch?

Mark Lee

OCTOBER 15, 2024

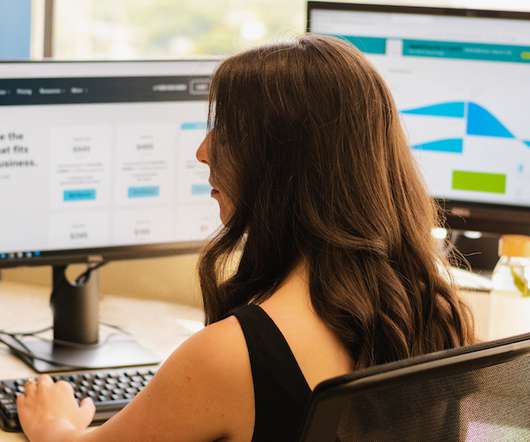

Perhaps the most common specialism is ‘tax’ – which is actually a pretty wide subject in it’s own right. Cloud bookkeeping software I used to doubt the validity of accountants suggesting that their choice of cloud bookkeeping software was a genuine specialism. Absolutely nothing at all.

Let's personalize your content