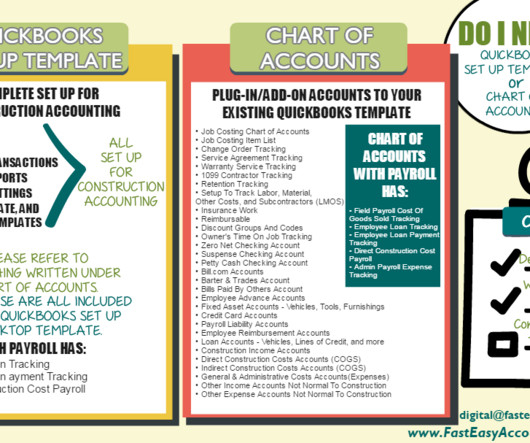

Tracking Construction Business Finances Through QuickBooks Desktop

Randal DeHart

MAY 24, 2024

The power of effective bookkeeping using QuickBooks Desktop - plus an Important Update from Intuit. Keeping track of sales, earnings, expenses, and purchases is fundamental to your construction business's overall health and sustainability. Is it worth the aggravation?

Let's personalize your content