Top Remote Accountants of the Week | October 17, 2024

Going Concern

OCTOBER 17, 2024

Sign up now to view the complete candidate list and connect with potential hires.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Going Concern

OCTOBER 17, 2024

Sign up now to view the complete candidate list and connect with potential hires.

Snyder

AUGUST 12, 2022

What are bookkeeper duties? Sometimes grasping the difference between bookkeeping and accounting can be tricky. Both bookkeepers and accountants work with your finances, both help make your tax reporting a smooth experience. How to choose a bookkeeper? What a small business owner should know: what is bookkeeping?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Next-Level Fraud Prevention: Strategies for Today’s Threat Landscape

Outsourcing Vs. In-House: The Ultimate Battle For Better Collections

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

The Silent Crisis: Why Finance Lags in Digital Transformation and How to Accelerate AI Adoption

Going Concern

OCTOBER 24, 2024

TAX AND ACCOUNTING CANDIDATES FTE Tax and Accounting | Candidate ID #22557459 Certifications: EA, Intuit Tax Academy Education: MBA Accounting, JD Experience (years): 6 years of overall experience Work experience (detail): Tax senior with a national tax service International tax experience National client tax practice Adept at tax research Client niches: (..)

Next-Level Fraud Prevention: Strategies for Today’s Threat Landscape

Outsourcing Vs. In-House: The Ultimate Battle For Better Collections

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

The Silent Crisis: Why Finance Lags in Digital Transformation and How to Accelerate AI Adoption

Going Concern

OCTOBER 10, 2024

ACCOUNTING CANDIDATES FTE Accounting | Candidate ID # 22574493 Certifications: EA in process Education: BA Business Experience (years): 20+ years accounting experience Work experience (detail): Currently Accountant & Office Manager at a CPA firm Full cycle accounting, reconciliations, financial reporting AP/AR, payroll processing and quarterly (..)

CPA Practice

JUNE 24, 2024

I asked ChatGPT what forms it recommended for a CPA firm. Here is the answer I got (since ChatGPT is nondeterministic, you won’t get the exact same answer I got.): For a CPA (Certified Public Accountant) firm, creating and utilizing various forms and templates can significantly streamline practice management tasks.

Going Concern

NOVEMBER 21, 2024

TAX CANDIDATES FTE Senior Tax Accountant | Candidate ID #23560436 Certifications: EA in process Education: BBA Accounting Experience (years): 7+ years in public accounting Work experience (detail): Tax manager with a CPA firm Client account clean up Prepared 500+ returns in 2024 tax season Reviewed 200+ returns Client niches: Manufacturing, Hospitality, (..)

CPA Practice

MAY 12, 2023

Expanding Teams with Outsourced Professionals It wasn’t that long ago that accounting firms were reluctant to bring in offshore resources to round out their teams and meet client needs. By partnering with an outsourced provider, CPA firms can deliver vital data using technology-driven resources that deepen client “stickiness” and commitment.

ThomsonReuters

FEBRUARY 28, 2024

She decided to skip law school and instead took a job as a bookkeeper, finding her chosen profession and going back to school to earn her CPA. Meeting with a tax preparer after the year has closed is like trying to drive your business forward in a car, while the car is in reverse and you’re only using the rearview mirror to guide you.”

Ryan Lazanis

APRIL 4, 2022

Do you want to know how to start a bookkeeping business or accounting firm in 2022? Great news, because this step-by-step guide will cover the critical 7 steps you’ll need to follow to set up a modern bookkeeping practice and to land your first clients. Marketing your bookkeeping services to find new clients.

Going Concern

SEPTEMBER 19, 2024

TAX AND ACCOUNTING CANDIDATES FTE Tax and Accounting | Candidate ID #15191471 Certifications: EA in progress Education: BA Accounting Experience (years): 7+ years tax and accounting experience in public accounting Work experience (detail): Leads a team of 5+ tax professionals Preparation and review of more complex tax returns Client account leadership (..)

CPA Practice

JUNE 20, 2024

Top 500 accounting firm PAAST, based in Coral Gables, FL, merged with SKJ&T (Sanson, Kline, Jacomino & Tandoc), a CPA firm in Miami, effective May 1. The combined firm continues to work out of their existing offices in Coral Gables and Miami. Originally founded as Sanson, Kline, Jacomino & Co.

Going Concern

JANUARY 17, 2025

Insurance, Beverage, Professional Services, Medical Practices Tech Stack: TaxSlayer, UltraTax Remote Work Experience: Y Salary: $75-$85k Timezone: Eastern Sign up for FREE to learn more about this candidate FTE Tax Senior / Manager | Candidate ID #5306426 Certifications: IRS CCA, CPA CA Education: BA Accounting, MS Accountancy Experience (years): (..)

MyIRSRelief

FEBRUARY 1, 2022

A CPA or Certified Public Accountant, or EA Enrolled Agent is a specially trained professional who knows all of the necessary rules and regulations regarding business finances. This includes the very important topic of taxes (preparation, planning and representation).

Going Concern

AUGUST 31, 2023

Education: BBA in accounting Candidate ID # 18756621 Proven client-facing team leader provides full cycle accounting, bookkeeping & more to a wide range of client industries! Tech Stack: QBO, QBD, UltraTax, etc.

Going Concern

SEPTEMBER 5, 2024

TAX AND ACCOUNTING CANDIDATES FTE Tax and Accounting | Candidate ID #22410136 Certifications: CPA Education: BS Accounting, MBA Experience (years): 15+ years accounting experience Work experience (detail): Currently a Tax Senior at a CPA firm Experience with expense planning for S-corps Filed 150+ SMB and individual tax returns last season Tax planning (..)

Going Concern

OCTOBER 3, 2024

ACCOUNTING CANDIDATES FTE Accounting and Audit Senior/Manager | Candidate ID # 22561641 Certifications: CPA Education: BBA Accounting and Finance Experience (years): 15+ years of experience in audit, accounting and finance Work experience(detail): 6 years in public accounting Director level in Accounting Services Managed staff of up to 8 in both US (..)

ThomsonReuters

FEBRUARY 13, 2024

Clearly outline all services that your firm provided (e.g., 1040 preparation, financial advisement, bookkeeping). Regardless of how your firm bills (e.g., Here are some basic ways to keep your tax preparation invoice process moving smoothly through the most demanding time of year: Establish file-naming conventions.

Going Concern

MARCH 6, 2025

TAX AND ACCOUNTING CANDIDATES FTE Tax and Accounting Senior / Manager | Candidate ID #23923930 Certifications: CPA Education: BS Accounting, MBA Experience (years): 14+ years accounting and tax experience Work experience (detail): 10+ in public accounting Full cycle accounting, led bookkeeping team of 5 Financial reporting and year end work papers (..)

Nancy McClelland, LLC

JANUARY 15, 2023

As you might imagine, we get quite a few inquiries for tax preparation services, but a) we only do taxes for our small business accounting & bookkeeping clients, and b) we only work with clients in Illinois, Indiana and Wisconsin. Tax Preparer. It’s an arena rife with underrepresentation issues.).

Nancy McClelland, LLC

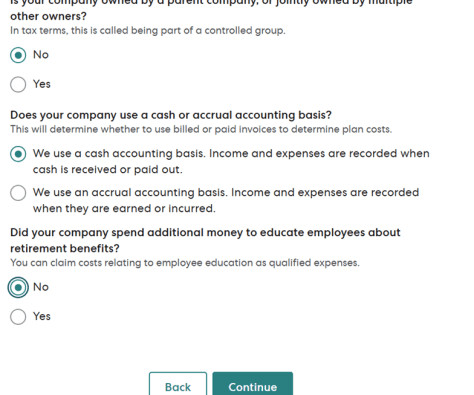

APRIL 5, 2024

This week, I discovered a gift that Gusto created for tax preparers with clients that use the Gusto+Guideline combo — a reporting tool that will literally prepare the Form 8881 “Credit for Small Employer Pension Plan Startup Costs” for you. And now we’re superstars to them.

Going Concern

FEBRUARY 13, 2025

TAX AND ACCOUNTING CANDIDATES FTE Senior Tax and Accounting | Candidate ID#23814240 Certifications: CPA Education: BA, MA Financial Accounting Experience (years): 15+ years accounting experience Work experience (detail): 3+ in public accounting Accounting, payroll and tax filing with 40+ clients Client advisory, tax planning, financial review Prepares (..)

CPA Practice

DECEMBER 13, 2023

Clients that struggle to get their tax paperwork together for your appointment are illustrating their need for a bookkeeping service that may be more affordable than they imagine. Make Recommendations The bane of many tax-only firms is that they often give away valuable insights and resources to clients without charging for them.

Going Concern

FEBRUARY 27, 2025

TAX AND ACCOUNTING CANDIDATES FTE Tax and Accounting | Candidate ID #23885265 Certifications: QBO ProAdvisor Education: BS Accounting Experience (years): 15+ years accounting experience Work experience (detail): 10 in public accounting Supervisory and bookkeeping review Business and individual tax return preparation Client facing and advisory Client (..)

ThomsonReuters

JUNE 15, 2021

Starting your own CPA firm may seem like a distant fantasy, but with barriers to entry lower than they’ve ever been, it could be closer than you think. Most small CPA firm owners have years of experience working for larger firms and find themselves wanting to utilize that experience to serve clients in their own way.

Going Concern

JANUARY 9, 2025

TAX CANDIDATES FTE Tax Senior | Candidate ID #23616387 Certifications: EA Education: BS Accounting, MS Taxation Experience (years): 10+ tax and accounting Work experience (detail): 6+ in public accounting 3 in healthcare industry Full cycle accounting and financial reporting Prepared tax filings for individuals, SMBs, partnerships, nonprofits 30% review (..)

Going Concern

JANUARY 2, 2025

TAX CANDIDATES FTE Tax Senior / Manager | Candidate ID #23674176 Certifications: EA Education: BS Accounting, MS Accounting and Finance Experience (years): 20+ years accounting and tax Work experience (detail): 10+ years in public accounting Remote team management experience Tax planning and compliance, advisory 70% review during 2024 tax season Preparation (..)

Ryan Lazanis

JANUARY 23, 2023

3) They Can Handle Most Tasks As long as you provide clear instructions, a skilled VA can handle various tasks such as bookkeeping, appointment scheduling, or even complex administrative duties. 4) They Free Up Your Time Too many CPAs and firm owners have a whole host of tasks they’re handling that are eating up their precious time.

Nancy McClelland, LLC

DECEMBER 1, 2023

They do a nice job of speaking both to bookkeepers and tax professionals, as well as tech-related and accounting-adjacent firms. I feel like the bookkeeping and accounting practices are often dancing technology circles around tax firms — and yet CPAs still look down on them as if they were data entry robots.

Nancy McClelland, LLC

DECEMBER 1, 2023

They do a nice job of speaking both to bookkeepers and tax professionals, as well as tech-related and accounting-adjacent firms. I feel like the bookkeeping and accounting practices are often dancing technology circles around tax firms — and yet CPAs still look down on them as if they were data entry robots.

Going Concern

DECEMBER 20, 2024

TAX CANDIDATES FTE Tax Senior | Candidate ID #23636747 Certifications: EA Education: BS Experience (years): 5 years tax experience Work experience (detail): All in public accounting 5 tax seasons preparing returns for HNWIs and SMBs 300+ returns per season, 50-50 individuals, businesses Client-facing with S-Corps, partnerships, trusts Business development (..)

Going Concern

SEPTEMBER 26, 2024

ACCOUNTING CANDIDATES FTE/PTE Accounting | Candidate ID #22552637 Education: AA Accounting Experience (years): 25+ years of accounting experience Work experience (detail): Currently with a CPA firm Supervisor of bookkeeping team Manages client list, accounting, financials, advisory Onboarding clients and software conversions Client niches: Retail, (..)

Going Concern

AUGUST 1, 2024

ACCOUNTING CANDIDATES FTE Accounting Manager | Candidate ID #22056820 Certifications: QuickBooks ProAdvisor Education: BA and MS Accountancy Experience (years): 6+ years accounting experience Work experience (detail): 4+ in public accounting 2+ years managing an accounting team 14+ full cycle accounting clients New client set up creating processes (..)

Going Concern

MAY 23, 2024

FTE Senior Tax and Accounting | Candidate ID #20455103 Certifications: CPA in progress Education: BA, Accounting & Business Administration Experience (years): 4+ years in public accounting Work experience (highlight): Staff Accountant at a CPA firm Full client care including accounting, bookkeeping, tax and audit In 2024 completed 100+ returns, (..)

Going Concern

NOVEMBER 14, 2024

ACCOUNTING AND ADVISORY CANDIDATE FTE Accounting and Advisory | Candidate ID #23535017 Certifications: QBO ProAdvisor, Xero Advisor, CPA Education: BS Accounting, MA Accounting in process Experience (years): 5+ years of overall accounting and finance experience Work experience (detail): Currently senior accountant with a CPA firm Implements cloud (..)

Ryan Lazanis

JULY 21, 2022

How a future-ready firm can seamlessly share the engagement letter. Engagement letters for your accounting or CPA firm is a legal document agreement sent to your clients that describes the overall business relationship with your client, clearly defining: Services included and how they’ll play out. Bookkeeping Services (Accrual).

Basis 365

MARCH 30, 2023

Many business owners didn't even know this existed and were comparing our pricing against bookkeepers or CPA firms and needing to understand why there were such extremes. The bookkeeper-only option will be part of the bottleneck of the business's growth. CPA firm : CPAs are generally going to be the most expensive option.

CPA Practice

JULY 31, 2023

Offshore accounting solutions offers a lot of benefits to CPA firms such as lower labor costs in offshore locations while maintaining a high level of service quality. Common examples include bookkeeping, data entry, tax preparation, payroll processing, accounts payable/receivable, and financial analysis.

Going Concern

AUGUST 22, 2024

TAX AND ACCOUNTING CANDIDATES FTE Tax and Accounting | Candidate ID #22103110 Certifications: CPA Candidate Education: BS, Accounting Experience (years): 7+ years of overall experience Work experience (detail): 6+ years with CPA firms Mentoring and training the accounting team Tax return preparation for individuals, SMBs and Nonprofits Prepared monthly, (..)

Going Concern

SEPTEMBER 12, 2024

TAX AND ACCOUNTING CANDIDATES FTE Tax and Accounting | Candidate ID #22480782 Certifications: CPA in process Education: BA Accounting, MS Accounting / Taxation Experience (years): 15+ years accounting experience Work experience (detail): 10+ in public accounting Prepares 300+ returns per season Full cycle accounting experience State and local tax filing (..)

Going Concern

JUNE 6, 2024

TAX CANDIDATES FTE Tax Senior | Candidate ID #12942644 Certifications: CPA in process, certification goal in 2024 Education: BBA Accounting Experience (years): 12 years experience in tax and accounting with public firms Work experience (detail): Currently a Tax Senior with a regional firm Complex partnership return preparation and review Tax Associate (..)

Going Concern

DECEMBER 12, 2024

TAX AND ACCOUNTING CANDIDATES FTE Tax and Accounting | Candidate ID #23625350 Certifications: EA in process Education: AS General Studies, BS Experience (years): 15+ overall experience Work experience (detail): 3+ in public accounting Prepares individual and SMB tax returns Processed payroll for 70+ clients Monthly accounting and financial preparation (..)

CPA Practice

JUNE 8, 2023

The accounting profession has been facing a staffing crunch brought on by fewer college graduates entering the profession and experienced tax practitioners transitioning to different careers in accounting. Taxfyle ranked within the top 15% in the Inc.

Basis 365

DECEMBER 2, 2024

Basis 365 Accounting is not a CPA firm and does not provide tax advice, tax preparation, or filing services. Readers should consult with a qualified tax professional or CPA for guidance tailored to their specific financial or tax situation.

Xero

OCTOBER 4, 2022

Yet, no matter how good technology becomes, small businesses will always need the advice, support and coaching from an accountant or bookkeeper to enable long-term business success. I reached out to CPA firms who told me our business was too small or I would not be able to afford them.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content