How to Dissolve a Company in Bad Standing Before Year-End

CPA Practice

OCTOBER 28, 2024

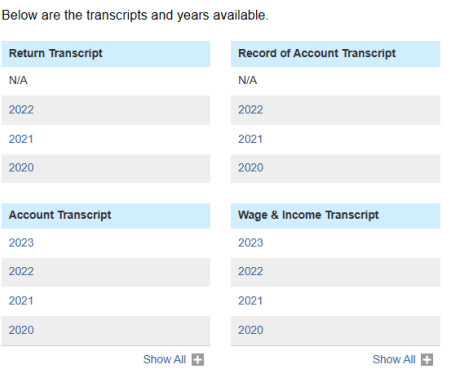

In addition, any business permits or licenses used in those states should be canceled. File a Final Tax Return When dissolving a business, one of the key steps is filing the last federal, state and local tax returns. Any outstanding tax obligations must be paid.

Let's personalize your content