Enrolled Agent Near Me: Comprehensive Tax Services for Individuals and Businesses

MyIRSRelief

OCTOBER 11, 2024

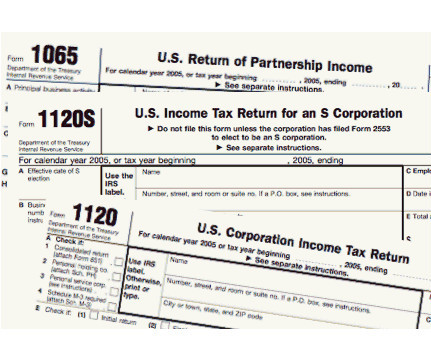

This article will delve into the various tax services offered by Enrolled Agents, including personal tax preparation, business tax preparation, personal tax planning, business tax planning, IRS and state tax audit representation, back tax help and resolution, and 941 payroll tax problem resolution.

Let's personalize your content