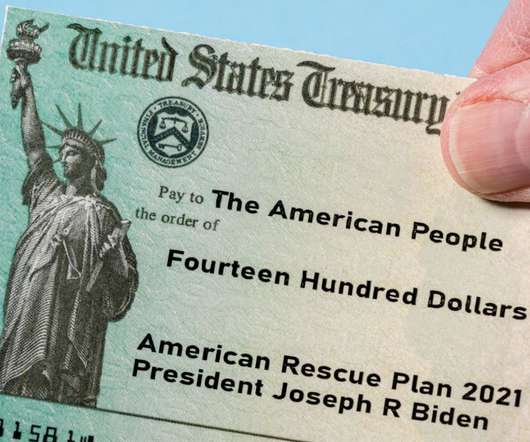

SBA Releases Interim Final Rules Regarding PPP Second Draw Loans

RogerRossmeisl

JANUARY 11, 2021

BACKGROUND CARES Act The CARES Act provided the original legislation authorizing the Small Business Administration (SBA) to make loans to qualified businesses under certain circumstances.

Let's personalize your content