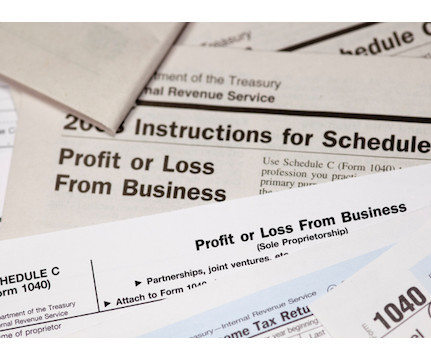

The Election to Apply the Research Tax Credit Against Payroll Taxes

RogerRossmeisl

MARCH 28, 2022

The credit can be used by certain even smaller startup businesses against the employer’s Social Security payroll tax liability. Subject to limits, you can elect to apply all or some of any research tax credit. Let’s take a look at the second feature.

Let's personalize your content