How to Correct Errors on Your Individual or Business Tax Return

MyIRSRelief

OCTOBER 4, 2024

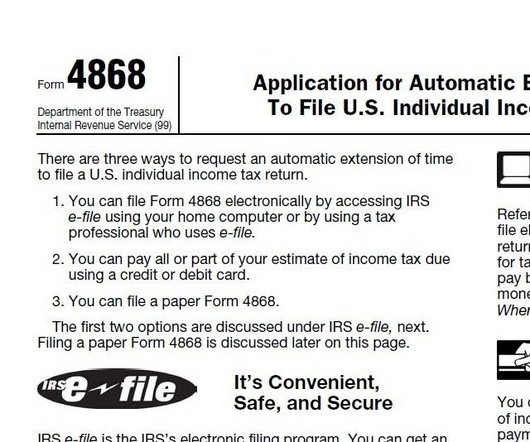

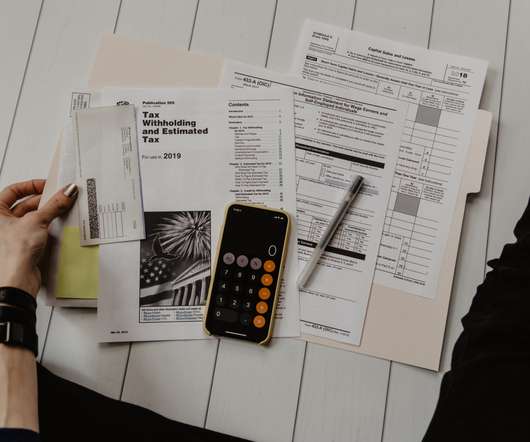

Gather Documentation: Collect all necessary documentation to support the correction. Individual Income Tax Return, to correct the error. Attach Supporting Documents: Include any forms or schedules that are being changed or were omitted from the original return. Corporation Income Tax Return.

Let's personalize your content