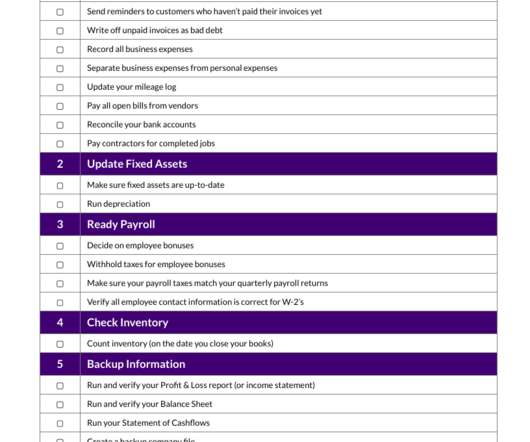

Side Hustlers! Don’t Forget to Pay Your Small Business Taxes

inDinero Tax Tips

MARCH 31, 2021

Quick Note: This article is provided for informational purposes only, and is not legal, financial, accounting, or tax advice. Don’t Forget to Pay Your Small Business Taxes appeared first on inDinero. You should consult appropriate professionals for advice on your specific situation. The post Side Hustlers!

Let's personalize your content