How to Correct Errors on Your Individual or Business Tax Return

MyIRSRelief

OCTOBER 4, 2024

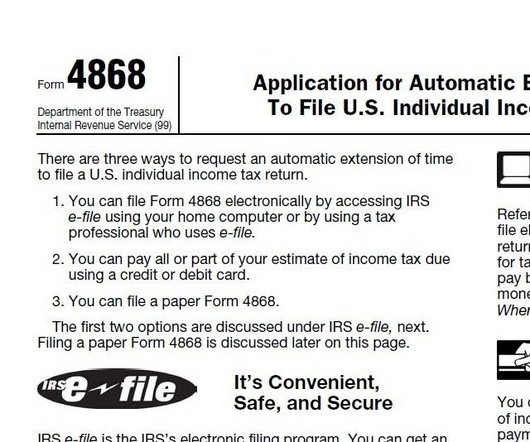

This article will guide you through the process of correcting errors on your tax return, provide instructions on filing amended returns , highlight common mistakes to avoid, and explain how our tax firm can professionally assist you. Get tax help today by calling us at 1-877-788-2937. Corporation Income Tax Return.

Let's personalize your content