IRS offers tax relief to Vermont flood victims

Accounting Today

JULY 13, 2023

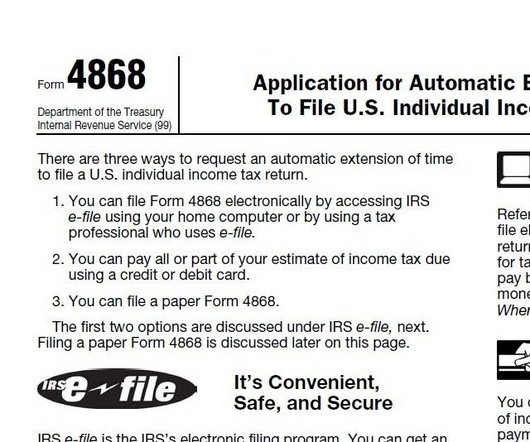

15, 2023, to file their individual and business tax returns and make tax payments, pushing back the Oct. Victims will now have until Nov. 16 deadline.

Accounting Today

JULY 13, 2023

15, 2023, to file their individual and business tax returns and make tax payments, pushing back the Oct. Victims will now have until Nov. 16 deadline.

CPA Practice

OCTOBER 2, 2023

October 16 is this year’s deadline for taxpayers who requested additional time to file their taxes. However, taxes expected to be owed were required to be owed by the original April 18, 2023, deadline. Those affected by flooding in Vermont. 24, 2024, to file various individual and business tax returns.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CPA Practice

OCTOBER 18, 2023

One crucial factor to consider when selecting your business location is the tax environment. Business taxes can significantly impact your bottom line and overall profitability. The importance of business taxes As an entrepreneur, you face countless decisions when starting a business.

CPA Practice

OCTOBER 16, 2023

October 16 is this year’s deadline for taxpayers who requested additional time to file their taxes. However, taxes expected to be owed were required to be owed by the original April 18, 2023, deadline. Those affected by flooding in Vermont. 24, 2024, to file various individual and business tax returns. 16 due date.

ThomsonReuters

JANUARY 30, 2023

Table of contents: Minimum wage Paid leave Tax credits Unemployment Earned wage access Pay transparency Tipped workers Worker classification State-run retirement plans Work scheduling 1. Tax credits State legislators are looking to offer businesses tax incentives for certain benefits to employees.

ThomsonReuters

JUNE 10, 2021

Summertime Tax Tips. Let’s go over a few summertime tax tips for payroll professionals this season: 1) Interns. Biden Administration issues tax proposals “Green Book.” The Department of the Treasury has issued detailed information about the Biden Administration’s tax proposals for fiscal year 2022 in its “ Green Book.”

CPA Practice

AUGUST 2, 2024

Caitlin Reilly CQ-Roll Call (TNS) WASHINGTON — The Senate fell short as expected Thursday of the 60 votes needed to start debate on a $79 billion tax bill that would deliver financial relief to businesses and low-income families, amid opposition from most Republicans and some on the majority side of the aisle as well.

Let's personalize your content