IRS offers tax relief to Vermont flood victims

Accounting Today

JULY 13, 2023

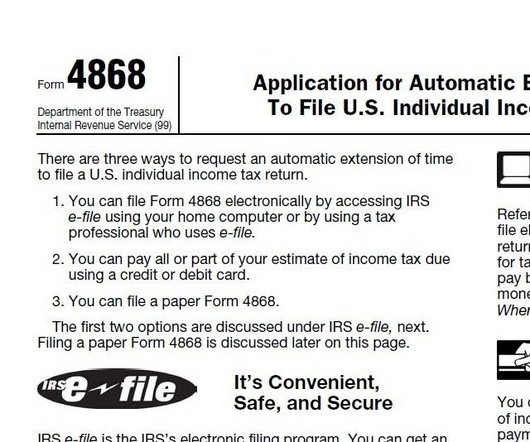

15, 2023, to file their individual and business tax returns and make tax payments, pushing back the Oct. Victims will now have until Nov. 16 deadline.

Accounting Today

JULY 13, 2023

15, 2023, to file their individual and business tax returns and make tax payments, pushing back the Oct. Victims will now have until Nov. 16 deadline.

CPA Practice

OCTOBER 2, 2023

Those affected by flooding in Vermont. 24, 2024, to file various individual and business tax returns. For 2023, however, many taxpayers who had received an extension to file, also later faced various forms of natural disasters for which the IRS has granted additional time to file. They have until Oct. 31, 2023, to file.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CPA Practice

OCTOBER 18, 2023

One crucial factor to consider when selecting your business location is the tax environment. Business taxes can significantly impact your bottom line and overall profitability. The importance of business taxes As an entrepreneur, you face countless decisions when starting a business.

CPA Practice

OCTOBER 16, 2023

Those affected by flooding in Vermont. 24, 2024, to file various individual and business tax returns. For 2023, however, many taxpayers who had received an extension to file, also later faced various forms of natural disasters for which the IRS has granted additional time to file. They have until Oct. 31, 2023, to file.

ThomsonReuters

JANUARY 30, 2023

Vermont ( House Bill 66 ) Virginia ( House Bill 2035 ) West Virginia ( Senate Bill 197 ) – pilot program for Parental Paid leave States that already have PFMLI programs on the books are eyeing some changes. Tax credits State legislators are looking to offer businesses tax incentives for certain benefits to employees.

ThomsonReuters

JUNE 10, 2021

Employers must use one of the special payment methods if their average tax liability was $25,000 or more per month during the previous calendar year for business taxes, which includes withholding tax (wage withholding tax and non-wage withholding tax). Remote worker guidance.

CPA Practice

AUGUST 2, 2024

The bill would revive a trio of business tax breaks, including the full upfront deduction of research and development expenses, and expand the child tax credit to make it more generous to low-income families. Manchin has cited issues with the child tax credit, as well as concerns about adding to the deficit.

Let's personalize your content