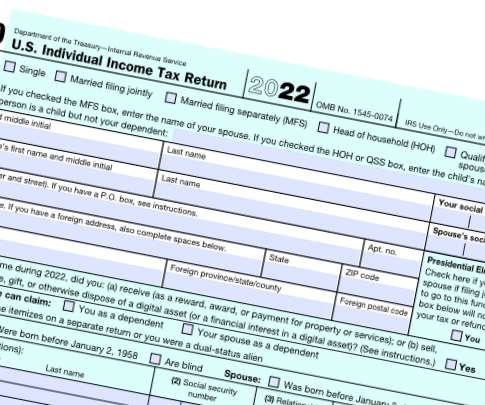

Issues to Consider After Your File Your Tax Return

RogerRossmeisl

MAY 23, 2022

The tax filing deadline for 2021 has passed. Now that your tax return has been successfully filed with the IRS, there may still be some issues to bear in mind. You can throw some tax records away now You should hang onto tax records related to your return for as long as the IRS can audit your return or assess additional taxes.

Let's personalize your content