Corporate Tax Leaders’ Views on GenAI Have Flipped, EY Survey Finds

CPA Practice

OCTOBER 14, 2024

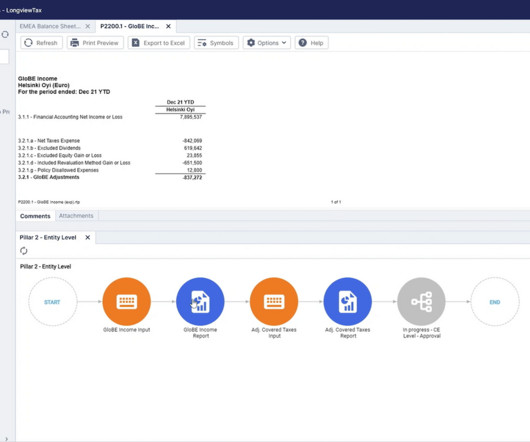

A new survey from Big Four firm EY reveals that CFOs’ and corporate tax leaders’ stances on generative artificial intelligence have shifted over the past year—from mostly negative to mostly positive. Tax departments are expected to be the leaders for most organizations as they move quickly along the GenAI maturity curve.

Let's personalize your content