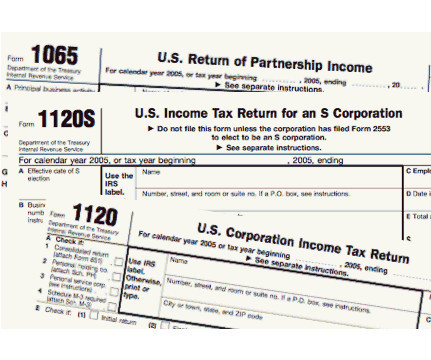

Three Complex Tax Issues Businesses are Facing Now

CPA Practice

OCTOBER 2, 2023

Tax-exempt entities can also benefit from the 179D Tax Deduction through a design rebate received from the project’s designer. The reason clients continue to partner with us is because their results are reflected in our values.” Established in 1999 with offices across the U.S.,

Let's personalize your content