AICPA and NATP Respond to TurboTax Ad

CPA Practice

OCTOBER 17, 2024

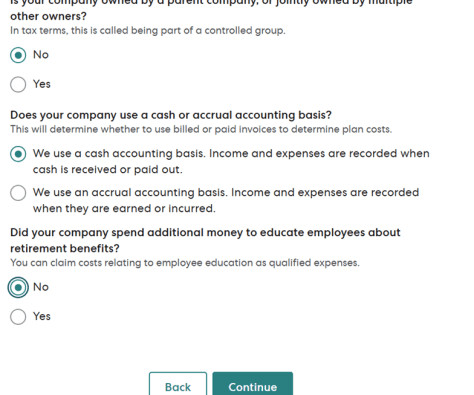

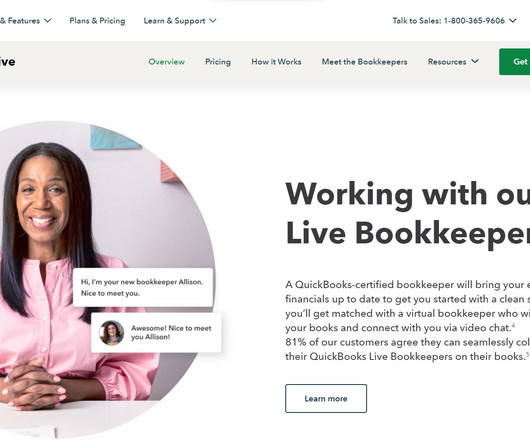

TurboTax, the most widely-used do-it-yourself tax preparation in the U.S., is out with a new advertisement in which it is telling Americans that maybe they should save money and have a “tax break up” with their professional preparer by using one of TurboTax’s live experts.

Let's personalize your content