Art of Accounting: How to succeed with changes

Accounting Today

AUGUST 26, 2024

Innovation and changes are hot topics, but many who talk about it or wish for it never seem to move forward or make changes.

Accounting Today

AUGUST 26, 2024

Innovation and changes are hot topics, but many who talk about it or wish for it never seem to move forward or make changes.

CPA Practice

AUGUST 26, 2024

By Richard Corn. It can be difficult at times to achieve a proper work-life balance: we have to juggle our careers, families, friends, and other important responsibilities. When life gets busy, what often gets left behind are our hobbies. This can be frustrating, but even more so in the summer, when there are more family trips and activities we want to spend time on — and not spending time completing repetitive accounting tasks.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

AUGUST 26, 2024

Millionaires only accounted for 0.22% of total returns filed this year for the 2023 tax season.

CPA Practice

AUGUST 26, 2024

It might be time for me to move to Ohio. The Buckeye State is conveniently located for folks, like me, with ties to both coasts. It’s home to world-class medical facilities and the Rock & Roll Hall of Fame. And I’d save money on takeout if I lived there: While Ohio sales tax generally applies to food sold for consumption in a restaurant, takeout food is sales tax exempt.

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Accounting Today

AUGUST 26, 2024

AICPA chair Carla McCall talks about how accounting firms need to work together so they can all thrive separately.

CPA Practice

AUGUST 26, 2024

Forvis Mazars, LLP, ranked among the largest public accounting and consulting firms in the United States, is expanding its Public Sector Advisory Services practice by launching a new line of Government Outsourced Accounting Services (GOAS) for clients. These services are designed to help state and local governments bridge the growing gap created by a shortage of public sector finance professionals across the country.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Canopy Accounting

AUGUST 26, 2024

Profile Accountability Services is a forward-thinking accounting firm located in Seattle, Washington and Boulder Valley, Colorado. The firm, co-owned by Lera Kooper, Dave Fischer and Ernie Villany, emphasizes a modern approach to accounting that prioritizes work-life balance, scalability, and a client-centric focus. The firm provides tax, accounting, and advisory services, primarily catering to business owners with an entrepreneurial mindset.

Accounting Today

AUGUST 26, 2024

New rules for IRA beneficiaries, the expiration of the Tax Cuts and Jobs Act and guidelines for qualified stock make these strategies especially relevant.

Anders CPA

AUGUST 26, 2024

“We have a budget. Why do we need a forecast?” Budgets and forecasts are important pieces of a strong financial toolkit, but many people think if they have one, they don’t need the other. That couldn’t be further from the truth: You’ll get the most mileage out of a budget if you also have a forecast to guide you. Here’s a look at their key differences and how they can work together to strengthen your firm’s financial planning.

Accounting Today

AUGUST 26, 2024

Moss Adams announced the launch of two new AI consulting teams, focused on machine learning and generative AI, who will work with clients on implementing AI solutions.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

CPA Practice

AUGUST 26, 2024

Top 15 accounting firm Moss Adams announced on Monday that it’s now providing artificial intelligence consulting services, with two new offerings for businesses looking to effectively utilize the technology. One service offering focuses on generative AI, while the other is centered around machine learning. Through the firm’s generative AI services, businesses can create a central knowledge center that empowers employees to search, access, and leverage organizational data quickly and safely.

Accounting Today

AUGUST 26, 2024

The Internal Revenue Service continues to expand the things business taxpayers can do with BTA.

VJM Global

AUGUST 26, 2024

CBIC has received a request from the GST authority to issue clarification in the following matters: Whether recovery proceedings should be initiated in the matter where the first appellate authority has confirmed the demand created by the adjudicating authority, whether fully or partially, and where an appeal against such order could not be filed due to non-constitution of Appellate Tribunal.

Accounting Today

AUGUST 26, 2024

The Top 100 firm announced it has partnered with Audax Private Equity, making it the latest in a string of large accounting firms to score PE money.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Insightful Accountant

AUGUST 26, 2024

Murph looks at a couple of the 'sub-categories' used by Insightful Accountant for both the 'Niche' and 'CAAS' Award categories. This week's Part 2 cover 'Tax' as a specialty or CAAS service.

Accounting Today

AUGUST 26, 2024

Kevan Parekh will take on the CFO role from Luca Maestri at the end of the year, as part of a planned succession.

Insightful Accountant

AUGUST 26, 2024

A federal judge in Dallas has blocked the U.S. Federal Trade Commission's (FTC) near-total ban on noncompete agreements, which was set to take effect next month.

CPA Practice

AUGUST 26, 2024

For too long, accountants and their clients have been operating out of alignment. Do you want more time for the deeper advisory work that matters to you and to your clients but aren’t sure how to get there? Collaborative Accounting is the path, and this eBook will start you on your journey. In it, you’ll learn: What it means to be a Collaborative Accountant How this new methodology can revolutionize your practice How to implement a collaborative workflow with clients Plus, actionable steps to ge

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Insightful Accountant

AUGUST 26, 2024

Join Gary DeHart and HR expert Michelle LeBlanc as they dive into crucial HR strategies for small businesses!

Cherry Bekaert

AUGUST 26, 2024

We’ll cover the basics of indirect costs, including calculation, and process of negotiating with the federal cognizant agency. We’ll focus on the multiple ways that indirect costs can be leveraged to maximize grant funding. We will also delve into how to secure and preserve unobligated ARPA funding before claw backs occur after the 12/31/24 obligation deadline.

Insightful Accountant

AUGUST 26, 2024

Get a jump on transitioning to the new 'Modern View' Reports that Intuit is starting to roll out into QuickBooks Online by attending Insightful Accountant's QB Talks on April 24, 2024 at 2:00 Eastern Daylight Saving Time.

Cherry Bekaert

AUGUST 26, 2024

In this session, we’ll discuss an integrated approach to the development of risk based cybersecurity programs. Specifically, we will discuss specific areas of cybersecurity risks that public sector organizations face, and the types of cybersecurity risk mitigation that may need to be improved. Furthermore, we shall discuss risk-based approaches for reducing the vulnerability to cybersecurity threats, which requires a multidisciplinary approach.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Insightful Accountant

AUGUST 26, 2024

In QB Talks on March 20, 2024, Alicia Katz Pollock demonstrated QBO Advanced’s latest feature, Revenue Recognition. Accrual-based companies will love the ability to automatically schedule Deferred Revenue transactions.

VJM Global

AUGUST 26, 2024

CBIC has received a request from the GST authority to issue clarification in the following matters: Whether recovery proceedings should be initiated in the matter where the first appellate authority has confirmed the demand created by the adjudicating authority, whether fully or partially, and where an appeal against such order could not be filed due to non-constitution of Appellate Tribunal.

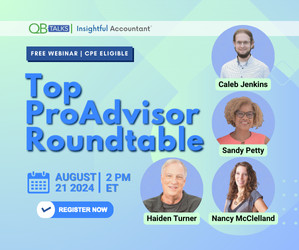

Insightful Accountant

AUGUST 26, 2024

Join Murph, Gary and others to learn what it takes to be an Insightful Accountant "Top ProAdvisor" in the August QB Talks session.

Cherry Bekaert

AUGUST 26, 2024

A Five-Part Series The global COVID-19 pandemic drove dramatic changes, placing a spotlight on key business outcomes and accelerating digital transformation efforts in law firms. Each of these outcomes, coupled with how people and processes can be empowered digitally through the application of technologies, will be explored in this five-part series for firms.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Insightful Accountant

AUGUST 26, 2024

Check out this special edition of QB Talks, where Alicia Katz Pollock and special guest Ted Callahan dive into the subject of assisted bookkeeping.

Going Concern

AUGUST 26, 2024

This has to be at least the third or fourth article I’ve seen about Grant Thornton UK being courted by multiple private equity suitors. Sounds to me like they’re having trouble getting one of them to commit, not that they’ve got their pick of dates. Several private equity firms are considering offers for a stake in Grant Thornton’s UK business, in a competitive bidding process aimed at securing a valuation of up to £1.5bn for the mid-tier accountant.

Insightful Accountant

AUGUST 26, 2024

Check out this special edition of QB Talks, where Alicia Katz Pollock dives into converting from QuickBooks Desktop to QuickBooks Online.

Let's personalize your content