Auditors play important role in responding to fraud risk

Accounting Today

OCTOBER 7, 2024

The Center for Audit Quality and the Anti-Fraud Collaboration released a new publication on the role of the auditor in assessing and responding to fraud risk.

Accounting Today

OCTOBER 7, 2024

The Center for Audit Quality and the Anti-Fraud Collaboration released a new publication on the role of the auditor in assessing and responding to fraud risk.

CPA Practice

OCTOBER 7, 2024

The Department of the Treasury and the Internal Revenue Service today issued final regulations identifying certain syndicated conservation easement transactions as “listed transactions” – abusive tax transactions that must be reported to the IRS. Syndicated conservation easements have been included in the IRS’ annual list of Dirty Dozen tax schemes for many years.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

OCTOBER 7, 2024

Companies increasingly expect their audit firms to leverage artificial intelligence to aid the audit process, according to a new survey from BDO.

Withum

OCTOBER 7, 2024

Explore Other Episodes #CivicWarriors #WithumImpact The post Advocacy and Achievement With Blinded Veterans Association appeared first on Withum.

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Accounting Today

OCTOBER 7, 2024

The new rules require that certain syndicated conservation easements must be reported to the IRS.

Going Concern

OCTOBER 7, 2024

What’s this? Not Financial Times reporting that EY partners will have about two percent of their annual compensation “taken to help the firm manage cash flow” after the firm’s wallet took a hit for FY24! *distant sound of small violins begins to crescendo* US partners at EY have been told the firm will hold back some of their pay for 2024 after a tough financial year that has left the accounting firm’s leaders facing criticism from their rank and file.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Xero

OCTOBER 7, 2024

This month’s Xero product updates include exciting new features and enhancements to streamline your workflows and boost productivity. From rolling out new tools for our accountants and bookkeepers, to improvements to the Xero Accounting app, and tools for managing inventory, Xero’s October updates offer valuable enhancements for both small businesses and advisors alike.

CPA Practice

OCTOBER 7, 2024

By Tammy Ayer Yakima Herald-Republic, Wash. (TNS) Oct. 4—Federal officials have announced tax relief for people and businesses in the Yakama Nation affected by summer wildfires that began June 22. Taxpayers now have until Feb. 3, 2025, to file various federal individual and business tax returns and make tax payments, according to a news release from the IRS.

Accounting Today

OCTOBER 7, 2024

Too many accounting firms are relying on outdated or inappropriate data to measure their success, says Sarah Dobek.

Withum

OCTOBER 7, 2024

It is common for business owners and employers to reimburse employees for out-of-pocket expenses incurred when performing their job functions. However, not all expenses are reimbursed. Prior to the Tax Cuts and Jobs Act of 2017 (“TCJA”), unreimbursed out-of-pocket expenses paid by employees were treated as a miscellaneous itemized deduction on an employee’s personal tax return to the extent these out-of-pocket expenses exceeded 2% of the employee’s adjusted gross income.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Accounting Today

OCTOBER 7, 2024

Private sector employment increased by 143,000 jobs in September, while annual pay rose 4.7% year-over-year, payroll giant ADP reported.

CPA Practice

OCTOBER 7, 2024

A new survey finds that in one in 5 workers aren’t following their company’s RTO policy. The survey was commissioned by ResumeBuilder.com , a resource for resume templates and career advice.Employees on a hybrid schedule show higher rates of non-compliance. To get around the mandate, workers are leaving early or even enlisting the help of a co-worker to swipe or sign them in.

Accounting Today

OCTOBER 7, 2024

The IRS has pushed back filing and payment deadlines for those impacted by the fires that began last June 22.

VJM Global

OCTOBER 7, 2024

The Customs (Import of Goods at Concessional Rate of Duty) Rules, 2017 provides for the procedure to be followed for importing goods at a concessional rate of duty. Earlier, the importers were required to file all the forms under Customs IGCR Rules manually with customs authorities. The process of claiming the benefit of the concessional rate of duty has been made automatic from 1st March 2022 onwards.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

OCTOBER 7, 2024

Bloomberg Tax and Accounting announced the launch of its Innovation Studio, which offers select customers access to solution still in development. Its latest offering is a new AI Assistant feature.

VJM Global

OCTOBER 7, 2024

The CBIC has received various representations to clarify the place of supply for “Data Hosting Service” provided by a supplier located in India to a “Cloud Computing Service Provider” located outside India. As per representations received, some of the field formations are of the view that the place of supply of such service shall be the location of the service provider, i.e., India, and therefore, the benefit of export of services shall not be available on such supply of service.

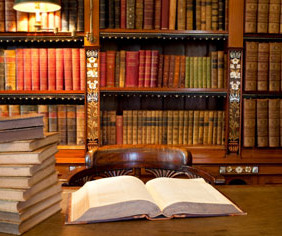

Accounting Today

OCTOBER 7, 2024

Bookcases full of accounting and tax reference materials were useful at one time, but not so much anymore.

VJM Global

OCTOBER 7, 2024

In the 54th GST Council meeting , the GST Council recommended introducing an Invoice Management System (IMS) on the GST Portal. At the time of the introduction of GST, it was planned to make GST on the two-way communication model between the supplier and the recipient, i.e., the recipient could take action on the invoices furnished by the supplier in his GST return.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Insightful Accountant

OCTOBER 7, 2024

As far as the International ProAdvisor Awards are concerned, the ‘more, the better.’ Murph explains how the Top 50 International Awards are ‘weighted’ on a hemispheric basis.

CPA Practice

OCTOBER 7, 2024

CPA Practice Advisor wants to highlight those in the accounting and tax communities who have begun or are in the process of mobilizing efforts to help those impacted by Hurricane Helene. Whether it’s providing important news and resources on your website or volunteering to help residents or businesses in your community, we want to share what you or your organization is doing.

Anders CPA

OCTOBER 7, 2024

There’s no doubt that the cannabis business is like no other: taxes , banking, financing , regulations, licenses, referendums. The landscape varies so widely, not just by state but even by town. Competition comes in all forms: the illegal market, hemp-derived products, other operators. But at the end of the day, when it comes to dollars and cents, it’s still a business.

ThomsonReuters

OCTOBER 7, 2024

Unlocking simplicity in tax research Navigating the complex world of tax research can be daunting. Tax professionals often grapple with an ever-evolving landscape of new regulations , intricate tax codes, and the need for precise and timely information. Furthermore, advisory opportunities introduce new and diverse demands that can increase the complication of responsibilities.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Insightful Accountant

OCTOBER 7, 2024

Alicia Katz Pollock provides insight into Intuit's new Enterprise Suite prior to our QB Talks October session on October 23rd at 2pm EST.

VJM Global

OCTOBER 7, 2024

The Customs (Import of Goods at Concessional Rate of Duty) Rules, 2017 provides for the procedure to be followed for importing goods at a concessional rate of duty. Earlier, the importers were required to file all the forms under Customs IGCR Rules manually with customs authorities. The process of claiming the benefit of the concessional rate of duty has been made automatic from 1st March 2022 onwards.

Shay CPA

OCTOBER 7, 2024

For tech startups operating in Manhattan, especially those that have recently raised Seed or Series A rounds, the Commercial Rent Tax (CRT) can be an unexpected expense. If you’re leasing office space in Manhattan south of 96th Street and your annual rent exceeds $250,000, you may be liable for this tax. Without the right internal finance processes in place, missing or skipping these filings can result in late penalties, cutting into your newly raised capital.

VJM Global

OCTOBER 7, 2024

The CBIC has received various representations to clarify the place of supply for “Data Hosting Service” provided by a supplier located in India to a “Cloud Computing Service Provider” located outside India. As per representations received, some of the field formations are of the view that the place of supply of such service shall be the location of the service provider, i.e., India, and therefore, the benefit of export of services shall not be available on such supply of service.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Menzies

OCTOBER 7, 2024

Menzies LLP - A leading chartered accountancy firm. Please note that the following is all subject to agreement and so is an outline of the current proposed trading landscape for Northern Ireland. Update to the movement of goods, in parcels or large letters, between Great Britain and Northern Ireland The following summary of HMRC guidance applies to the Royal Mail Group, being the UK’s designated Universal Postal Union provider and express carriers, being companies that deliver parcels within a s

VJM Global

OCTOBER 7, 2024

In the 54th GST Council meeting , the GST Council recommended introducing an Invoice Management System (IMS) on the GST Portal. At the time of the introduction of GST, it was planned to make GST on the two-way communication model between the supplier and the recipient, i.e., the recipient could take action on the invoices furnished by the supplier in his GST return.

Menzies

OCTOBER 7, 2024

Menzies LLP - A leading chartered accountancy firm. Please note that the following is all subject to agreement and so is an outline of the current proposed trading landscape for Northern Ireland. Update to the movement of goods, in parcels or large letters, between Great Britain and Northern Ireland The following summary of HMRC guidance applies to the Royal Mail Group, being the UK’s designated Universal Postal Union provider and express carriers, being companies that deliver parcels within a s

Withum

OCTOBER 7, 2024

After many years of proposed legislation and revisions, the Biden Administration passed the Fair Labor Standards Act (FLSA), effective July 1, 2024. This new regulation increases the minimum salary amount that employers must pay to be considered for exemption from the overtime pay requirements. The FLSA adjusted the threshold for overtime pay to be applicable for those employees who make less than $43,888 on July 1, 2024, and $58,656 on January 1, 2025.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content