Tax season kicks off with non-tax issues center stage

Accounting Today

JANUARY 28, 2025

With relatively fewer tax changes to worry about, BOI and tariffs are top of mind for some experts.

Accounting Today

JANUARY 28, 2025

With relatively fewer tax changes to worry about, BOI and tariffs are top of mind for some experts.

Acterys

JANUARY 28, 2025

Financial modeling is an essential tool in corporate finance and business decision-making. By creating structured representations of a companys financial data, financial modeling enables stakeholders to forecast future cash flows, evaluate investment opportunities, and strategize for revenue growth. In this guide, we’ll explore what financial modeling is, the types of financial models, the benefits they provide, and how to create effective financial models.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

BurklandAssociates

JANUARY 28, 2025

Think your startup doesnt qualify for R&D tax credits? Think again. You could unlock $500,000 or more in annual savings. The post R&D Tax Credit Misconceptions Could Cost Your Startup Six Figures appeared first on Burkland.

CPA Practice

JANUARY 28, 2025

Scammers impersonating the IRS are texting taxpayers leading them to believe they're going to receive an economic impact payment, also known as a recovery rebate credit, but it's a scheme to steal their personal data, TIGTA said on Jan. 28.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

ThomsonReuters

JANUARY 28, 2025

Blog home The buzz around generative AI (GenAI) is hard to ignore. But with headlines declaring it has the potential to revolutionize industries, what does the use of GenAI mean for the audit profession ? Amidst the noise, lets separate the hype from reality and explore how GenAI can genuinely enhance an auditors daily life and work. Jump to What is GenAI and what is its potential impact for audit professionals?

Accounting Today

JANUARY 28, 2025

Tax solutions provider TaxDome said it experienced a data breach last week, though said no sensitive personal information was revealed.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Accounting Today

JANUARY 28, 2025

Financial executives are eyeing economic uncertainty and market volatility as they look ahead this year, according to a new report.

Insightful Accountant

JANUARY 28, 2025

You asked for it, it was the 3rd most popular request from ProAdvisors. compare backup apps for QuickBooks Online. good thing too, while there is only one listed in the QBO App store, there really are six, plus a brand new one for MSPs.

Accounting Today

JANUARY 28, 2025

The Public Company Accounting Oversight Board launched an online resource page with content tailored for smaller firms.

Insightful Accountant

JANUARY 28, 2025

New platform creates a combined QuickBooks and Mailchimp platform experience to help businesses accelerate productivity and profitability.

Speaker: Joe Wroblewski, Senior Sales Engineer

Is your tech stack working for you—or are you working for it ? 🤖 In today’s world of automation and AI, technology should simplify workflows—not add complexity. Seamless integration and interconnectivity are key to maximizing productivity, optimizing workflows, and improving collaboration. Join expert Joe Wroblewski for a practical and insightful session on how you can build a smarter, more connected tech stack that drives efficiency and long-term success!

Accounting Today

JANUARY 28, 2025

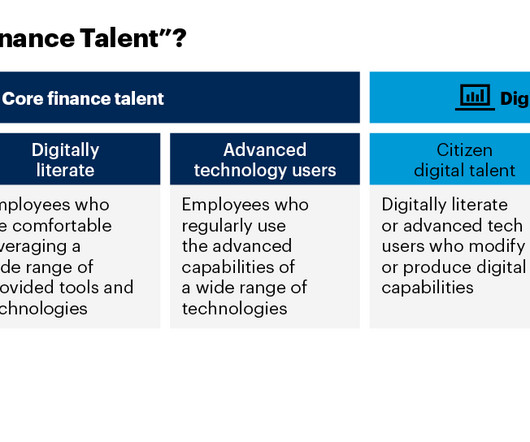

How do you redesign traditional finance roles as digital finance roles?

Insightful Accountant

JANUARY 28, 2025

The 2025 ProAdvisor Award Application Form is back to working, so get your application completed by February 11, 2025.

Accounting Today

JANUARY 28, 2025

Avantax acquired Sweeney Kovar, and Marsico Financial Group bought Care Accounting.

CPA Practice

JANUARY 28, 2025

Employee engagement in the U.S. fell to its lowest level since 2014, with only 31% of employees reporting being engaged at work in 2024, Gallup says. And the percentage of actively disengaged employees, at 17%, also reflects 2014 levels.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

Accounting for Good

JANUARY 28, 2025

NFP organisations with a turnover under 750K will find high-level accounting services cost-prohibitive.

Canopy Accounting

JANUARY 28, 2025

Practitioners with permission can create engagement templates and then use them to quickly and repeatedly create new engagements for any clients. Like any engagement, a template contains services, pricing, acceptance tasks, terms, and more.

Accounting Today

JANUARY 28, 2025

The limits of DOGE; big pharma and the TCJA; soda tax misaimed; and other highlights from our favorite tax bloggers.

CPA Practice

JANUARY 28, 2025

As an official partner within the Prophix network, UHY can offer clients advisory and implementation services that leverage Prophix One, a financial performance platform for finance and accounting professionals.

Speaker: Yohan Lobo

In the accounting world, staying ahead means embracing the tools that allow you to work smarter, not harder. Outdated processes and disconnected systems can hold your organization back, but the right technologies can help you streamline operations, boost productivity, and improve client delivery. Dive into the strategies and innovations transforming accounting practices.

Accounting Today

JANUARY 28, 2025

Ignition, a practice management solutions company, appointed Greg Strickland as CEO and Amy Foo as CEO, with former CEO and co-founder Guy Pearson taking the role of executive chairman.

CPA Practice

JANUARY 28, 2025

Plano, TX-based accounting firm SS Accounting and Auditing Inc.and partner Saima Sayani were disciplined for committing several failures on the audits of China Green Agriculture Inc. and for violating PCAOB quality control standards.

Insightful Accountant

JANUARY 28, 2025

Live from Las Vegas its Day Two of the Acumatica Summit and they introduce Acumatica Labs, AI Studio and Industry-Specific Functionality.

CPA Practice

JANUARY 28, 2025

The new online resource page,Information for Smaller Firms, features PCAOB content tailored for smaller audit firms, including publications, videos, and other resources.

Advertisement

Our 2025 Center Travel Survey is clear: as corporate travel increases, so does corporate credit cards distribution, and a rise in off-platform travel booking. This 61% rise causes various challenges: compliance, spend control, reporting problems, and a lack of visibility across organizations. To evolve with the ever-changing needs of travelers, decision-makers need a better solution.

FraudFiles

JANUARY 28, 2025

One of the last places youd expect to find fraud is in a law practice. Like accounting, the practice of law is a profession in which ethics are of utmost importance. Accountants and lawyers are often too trusting of their fellow professionals, and therefore leave themselves open to the risks of fraud. The issue of [.

CPA Practice

JANUARY 28, 2025

The collaboration enables accounting firms to safely access all their Wolters Kluwer apps remotely and securely in Rightworks OneSpace.

TaxConnex

JANUARY 28, 2025

In our first blog, we looked at how complicated sales tax can be for construction professionals, including how the form of the contract and location of the work can make even the simplest job complex for compliance. In short, what works for sales tax in one state in this industry often doesnt work in another. Here are a few more key points from our recent webinar on construction and sales tax.

ThomsonReuters

JANUARY 28, 2025

Blog home Auditors know theres never been a more challenging time to monitor and meet evolving regulatory and professional standards changes. How their jobs are performed now requires more than accounting and audit knowledge and skills. In fact, the accounting and audit professions have gradually been drawn into the world of automation and automated technology.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, emails, and shared drives no longer need to slow you down. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

Basis 365

JANUARY 28, 2025

Have you ever tried to analyze data only to realize it was inaccurate and your efforts were a complete waste of time? Building a strong business starts with a solid accounting foundation. Just like a sturdy building needs a well-constructed base to withstand external forces, a thriving business requires an accurate and reliable accounting foundation to support growth and stability.

ThomsonReuters

JANUARY 28, 2025

Blog home The Consumer Financial Protection Bureau (CFPB) issued a new advisory opinion rescinding its November 2020 guidance on earned wage access (EWA) products. This previous guidance had exempted certain EWA products from being classified as “credit” under the Truth in Lending Act (TILA) and Regulation Z. Jump to EWA products and 2020 advisory opinion Rescinding the opinion and industry response New rule proposal continues debate More comments express concerns EWA products and

Accounting Today

JANUARY 28, 2025

The administration fired an opening shot in an upcoming constitutional fight over his ability to unilaterally halt spending approved by Congress.

Going Concern

JANUARY 28, 2025

On January 23 Bloomberg Tax published a surprising headline: “ KPMG Slated to Post Best Audit Inspection Report in 15 Years.” Surprising because we’ve been recycling the “KPMG Still Rocks at Having the Worst PCAOB Inspection Report Among the Big 4” headline for YEARS. Here’s what BT had to say about the news: KPMG LLP may have finally cracked the code on delivering better audits to investors: Giving its staff more time to do their work and ensure they increasi

Speaker: Susan Richards

Your past-due accounts are growing, cash flow is tightening, and the pressure is on. The big question: Do you handle the collections internally or outsource to experts? Both strategies come with advantages and risks - but which one delivers the best impact for your business? In this session we’ll dive deep into the in-house vs. outsourcing debate, examining cost-effectiveness, efficiency, compliance risks, and overall recovery success rates.

Let's personalize your content