Pathways to Growth: Optimizing opportunistic growth

Accounting Today

OCTOBER 3, 2024

Fish are literally jumping into the boat these days, and accounting firms need to ensure that they get the best possible catch.

Accounting Today

OCTOBER 3, 2024

Fish are literally jumping into the boat these days, and accounting firms need to ensure that they get the best possible catch.

TaxConnex

OCTOBER 3, 2024

Navigating sales tax compliance in complex organizations can be a challenge, influenced by various factors. Industries like telecommunications, hospitality, healthcare, manufacturing, and technology face unique complexities when it comes to sales and use tax compliance. In this blog we discuss some of the reasons why these particular industries can be a bit more challenging than others.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Withum

OCTOBER 3, 2024

The IRS issued a news release providing tax relief for taxpayers affected by Hurricane Helene. This includes the entire states of Alabama, Georgia, North Carolina, and South Carolina, 41 counties in Florida, eight counties in Tennessee, and six counties and one city in Virginia. Key Hurricane Helene Tax Relief Information Who qualifies for this relief?

Accounting Today

OCTOBER 3, 2024

Let me pay that; W-2-timer; the early bird gets a cell; and other highlights of recent tax cases.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

CPA Practice

OCTOBER 3, 2024

Avalara, Inc. , a provider of tax compliance automation software for businesses of all sizes, has announced the launch of Automated Tariff Code Classification , a AI-based system that uses a pioneering combination of proprietary, advanced AI, machine learning, and natural language processing methods and technologies to classify large product catalogs quickly and efficiently to Harmonized System (HS) or Tariff Codes.

Accounting Today

OCTOBER 3, 2024

More than 500 Internal Revenue Service staff are manning FEMA phone lines, and others are deploying to help with search and rescue efforts.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Accounting Today

OCTOBER 3, 2024

Those affected by the storm now have until Feb. 3 to file and pay their taxes.

CPA Practice

OCTOBER 3, 2024

By Tanasia Kenney Merced Sun-Star (Merced, Calif.) (TNS) To tip or not to tip? It’s the question many Americans are faced with when paying for a product or service, and many say the pressure is beginning to be too much, according to a new Upgraded Points study. A whopping 90 percent of respondents feel tipping expectations have gotten out of control, the report found, leaving some customers reeling from so-called “tipflation.

Withum

OCTOBER 3, 2024

Withum is proud to share Caroline Weirich , Supervisor, was nominated at the Maryland Association of Certified Public Accountants (MACPA) 2024 Women to Watch Awards in the Emerging Leader category. The MACPA Foundation’s annual Women to Watch awards celebrates women in the accounting profession who demonstrate leadership and contribute to the profession through service and implementation of impactful initiatives.

Going Concern

OCTOBER 3, 2024

Are you having trouble finding remote accountants, CAS experts, auditors, or tax professionals for your firm or internal team? Accountingfly can assist you! With our Always-On Recruiting service, you can access a pool of top remote accounting candidates without any upfront costs. Sign up now to view the complete candidate list and connect with potential hires.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

CPA Practice

OCTOBER 3, 2024

Hosts Brian Tankersley, CPA, and Randy Johnston discuss how changes in software licensing and delivery models can affect client data and privacy policies. View the video at: [link] Or use the below podcast player to listen: Transcript (Note: There may be typos due to automated transcription errors.) Brian F. Tankersley, CPA.CITP, CGMA 00:00 Welcome to the accounting Technology Lab sponsored by CPA practice advisor.

Going Concern

OCTOBER 3, 2024

It’s been a while since we checked in on former Deloitte CEO Cathy Engelbert, the woman who will forever hold the title of first female CEO of a US Big 4 firm. Apologies to any WNBA fans out there, it’s not really a priority on our editorial calendar (we’re too busy with more important things ). When she left the Green Dot at the end of FY19, Engelbert made the transition to commissioner of the WNBA where she remains to this day, taking flak from fans for being too businesslike

CPA Practice

OCTOBER 3, 2024

Top 10 accounting firm Baker Tilly is expanding its advanced technology capabilities by acquiring Alirrium, a company that specializes in robotic process automation (RPA) advisory and implementation services, effective Nov. 1. Financial terms of the deal weren’t disclosed. Baker Tilly said the move strengthens its capabilities in RPA, artificial intelligence, and machine learning to better support businesses in modernizing and improving their operations.

Summit CPA

OCTOBER 3, 2024

What is the difference between a budget and a forecast? How do both financial tools help you increase cash flow and profitability?

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

CPA Practice

OCTOBER 3, 2024

Private sector employment increased by 143,000 jobs in September and annual pay was up 4.7 percent year-over-year, according to the September ADP National Employment Report produced by ADP Research in collaboration with the Stanford Digital Economy Lab. The ADP National Employment Report is an independent measure and high-frequency view of the private-sector labor market based on actual, anonymized payroll data of more than 25 million U.S. employees.

Insightful Accountant

OCTOBER 3, 2024

The IRS reports a 30% increase in tax extensions over the past five years, with 19 million taxpayers filing for automatic extensions this year. This trend is reshaping our profession (and driving us all nuts).

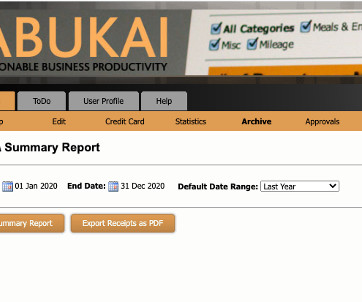

CPA Practice

OCTOBER 3, 2024

ABUKAI, a provider of innovative expense management solutions, has announced that its business application is now available for Apple Vision Pro devices. The Apple Vision Pro is an exciting new device with spatial computing capabilities. The ABUKAI application for the Apple Vision Pro allows users to add receipts and create expense reports directly from the Apple Vision Pro.

Accounting Today

OCTOBER 3, 2024

The free filing program will be available in 24 states, and reach potentially 30 million taxpayers.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

AccountingDepartment

OCTOBER 3, 2024

To kick off this year's series of Entrepreneurs' Organization (EO) events, ADC Business Development Representative, Shawn Marcum, attended EO Alchemy in Denver, CO last week.

Patriot Software

OCTOBER 3, 2024

When you start a company, there are several business structures. Two popular types of business structures are an S corporation and LLC. Are you choosing between these structures? Find out the key differences between S Corp vs. LLC and learn which is best for you. S Corp vs.

Nancy McClelland, LLC

OCTOBER 3, 2024

There’s been a ton of confusion lately among QuickBooks Online users due to a series of emails from Intuit about the importance of PCI compliance (that part’s true, it is important), which they follow up with a plug to encourage you work with their “partner,” SecurityMetrics. Problem is, they are surprisingly quiet about the fact that QB Payments… is already PCI compliant.

Accounting Today

OCTOBER 3, 2024

A costly provision of the Tax Cuts and Jobs Act of 2017 is in limbo as policy wonks call for either big changes or outright elimination of the policy.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

CPA Practice

OCTOBER 3, 2024

Pending home sales in August rose 0.6%, according to the National Association of REALTORS®. The Midwest, South and West posted monthly gains in transactions, while the Northeast recorded a loss. Year-over-year, the West registered growth, but the Northeast, Midwest and South declined. The Pending Home Sales Index (PHSI) – a forward-looking indicator of home sales based on contract signings – increased to 70.6 in August.

SkagitCountyTaxServices

OCTOBER 3, 2024

I’m watching in disbelief, like you, as I see the photos of the hurricane devastation keep rolling in. It’s hard to believe so much infrastructure can be swept away that quickly. Our hearts are grieving for those who lost loved ones and homes and businesses from Helene. I’ll keep you updated on any deadline extensions that the IRS makes available in the coming days – they usually do in situations like these.

CPA Practice

OCTOBER 3, 2024

This webinar will be held on Thursday, November 14, 2024 at 2:00pm ET Sponsor: IRIS Payroll Duration: 1 Hour Register Now Gustavo Fernandez, President of Payroll Service Pros, will share real-world examples to demonstrate the differences and the choices you make play out in practice. Key Takeaways: Features and Functionality: Selecting the right payroll software platform or payroll service can make or break your payroll business.

Accounting Today

OCTOBER 3, 2024

Accounting solutions provider FreshBooks will be laying off 140 employees across all teams, and at all levels around the world, more than 20% of its staff of roughly 500.

Speaker: Joe Wroblewski, Senior Sales Engineer

Is your tech stack working for you—or are you working for it ? 🤖 In today’s world of automation and AI, technology should simplify workflows—not add complexity. Seamless integration and interconnectivity are key to maximizing productivity, optimizing workflows, and improving collaboration. Join expert Joe Wroblewski for a practical and insightful session on how you can build a smarter, more connected tech stack that drives efficiency and long-term success!

Going Concern

OCTOBER 3, 2024

INSIDE Public Accounting #437 firm The Pun Group of Santa Ana, CA (revenue $8,856,915) put out a press release about their new website today and imagine our disappointment when we read all 661 words of it to find nary a pun in the bunch. The Pun Group, LLP, a leading accounting firm specializing in comprehensive audit, tax, and advisory services, announced today that it has relaunched its website to highlight its longstanding industry success and the workplace solutions it offers its wide array

Accounting Today

OCTOBER 3, 2024

Crowe announced a major expansion of its Artificial Intelligence Center of Excellence, effectively doubling its size through the addition of three newly established teams fully dedicated to AI pursuits.

Withum

OCTOBER 3, 2024

In the dynamic landscape of global business, innovation is not just a buzzword but a fundamental necessity for growth and competitiveness. As U.S. companies push the frontiers of research and development (R&D), maximizing the value of these investments is crucial. Australia’s Research and Development Tax Incentive Program (RDTIP) offers significant benefits to qualifying businesses.

Accounting Today

OCTOBER 3, 2024

Accounting ERP provider Acumatica announced its 2024 R2 launch, with hundreds of new features and capacities, many of which center around automation, integrations and enhanced accuracy.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

Let's personalize your content