AI and the firm of the future

Accounting Today

APRIL 1, 2024

Wipfli's Kelly Fisher offers a practical look at artificial intelligence and how accounting firms should be thinking about it.

Accounting Today

APRIL 1, 2024

Wipfli's Kelly Fisher offers a practical look at artificial intelligence and how accounting firms should be thinking about it.

CPA Practice

APRIL 1, 2024

By Dr. Sangeeta Chhabra Here’s a sobering stat for accountants and business owners alike: 74% of data breaches occur due to human errors, encompassing mistakes, privilege misuse, stolen credentials, or social engineering. But there is hope—through proper training, your firm and ultimately your clients can significantly reduce the risk of a breach. Do staff follow data security policies?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

APRIL 1, 2024

The agency has indicted almost 800 people for COVID fraud, and has a 98.5% conviction rate.

CPA Practice

APRIL 1, 2024

Since 2021, the American Institute of CPAs (AICPA) has spoken out against unscrupulous third-party vendors promoting improper Employee Retention Credit (ERC) claims. The Internal Revenue Service has heeded the concerns of CPAs from across the country and taken steps to curb fraudulent ERC claims. As previously scheduled by the IRS, the voluntary disclosure program has come to an end.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

APRIL 1, 2024

This outrageous story about an accountant's client and his wife might not seem like it's real, but it is.

Going Concern

APRIL 1, 2024

Over the weekend, The Times published a bit of a scary article about how the consulting business is so slow over there in the UK McKinsey is now trying to force out some of its engagement managers and associate partners. But they aren’t laying them off right away. McKinsey is offering to pay hundreds of its senior employees to leave the firm and look for work elsewhere, the latest attempt by the consulting giant to reduce staff amid a sector-wide downturn.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Insightful Accountant

APRIL 1, 2024

AI is transforming the tax industry, yet professionals are wary of embracing it fully due to data security, ethics, and client relationships. Practice owners must navigate this shift for success.

Withum

APRIL 1, 2024

In this episode of Cryptonomix, Mark Eckerle and Anurag Sharma, Partner and Systems & Process Assurance Group Leader at Withum, break down SOC 1, 2, and 3 Reports and the differences between them.

Going Concern

APRIL 1, 2024

A belated Happy Easter to those who celebrate and an on-time Happy April Fools’ Day to all. We aren’t planning any shenanigans today so you won’t see any fake stories here today. TBH our brand is still recovering from the great Bitcoin debacle of April Fools’ Day 2014. Plus who can even tell what’s real and what’s fake on the internet these days?

Accounting Today

APRIL 1, 2024

From coast to coast, the cities and states where taxpayers procrastinate the most.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

CPA Practice

APRIL 1, 2024

It has now been more than four years since COVID-19 began ravaging the U.S., but the worst health crisis any of us have ever faced so far in our lifetime hasn’t stopped people from trying to financially take advantage of others. Over the last four years, the IRS Criminal Investigation unit has investigated 1,644 tax and money laundering cases related to COVID fraud totaling $8.9 billion, according to statistics released by the tax agency on March 28.

IgniteSpot

APRIL 1, 2024

In the world of entrepreneurship, especially among the do-it-yourself, blue-collar business community, the path to success is often paved with a series of trial and error, hard work, and a never-say-die attitude. Yet, there's an insidious logic trap that many fall into without even realizing it—circular reasoning. This logical fallacy can lead business owners down incorrect and illogical paths, significantly impacting their profits and growth.

Accounting Today

APRIL 1, 2024

City officials attribute the trend to the end of a tax-lien sales program that punishes delinquency.

Anders CPA

APRIL 1, 2024

Every industry goes through down cycles, transportation and logistics included: After the pandemic freight boom, we’ve seen gas prices rise, drivers quit, and operators go out of business. It’s a time when many business owners start to panic, making irrational decisions that can spiral out of control. An owner who sees too many trucks in the yard might accept work at a loss, because they haven’t taken the time to calculate and properly categorize overhead.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Accounting Today

APRIL 1, 2024

WithumSmith+Brown added a firm in Philadelphia that mainly serves nonprofit and government organizations.

Canopy Accounting

APRIL 1, 2024

What's new: We are thrilled to announce the launch of the Files Interface Redesign within Canopy's Document Management module. This update transforms the way Canopy users interact with the files section, providing a more intuitive and user-friendly experience.

Accounting Today

APRIL 1, 2024

If your practice is launching a CAS practice — or you're just in the initial planning and research stages — making sure you're well-prepared is essential.

CPA Practice

APRIL 1, 2024

Top 200 accounting firm Stambaugh Ness has acquired Left Brain Professionals, a Westerville, OH-based accounting and advisory firm serving government contractors, effective April 1. Financial terms of the deal weren’t disclosed. In conjunction with the acquisition, Stambaugh Ness has launched an Outsourced Accounting Services (OAS) for Government Contractors practice area.

Accounting Today

APRIL 1, 2024

Reporting requirements and asset location could loom large for clients seeking greater yield and diversification without thinking through payments to Uncle Sam.

CPA Practice

APRIL 1, 2024

Top 25 accounting firm Withum has merged in BBD, a Philadelphia-based boutique accounting, tax, and advisory firm that primarily serves nonprofit and government organizations, effective March 31. Financial terms of the deal weren’t disclosed. BBD’s five partners and 40 team members have been added to Withum’s roster. What makes this deal convenient for both firms is that they already share an office building, located at 1835 Market St. in downtown Philadelphia.

ThomsonReuters

APRIL 1, 2024

One of the most important considerations when building a comprehensive practice management solution is ensuring that your systems can communicate with one another. That allows you to gain 360-degree visibility and context into which operational practices aren’t running optimally. How Baker Newman Noyes automated their tax workflow Baker Newman Noyes (BNN), a U.S.

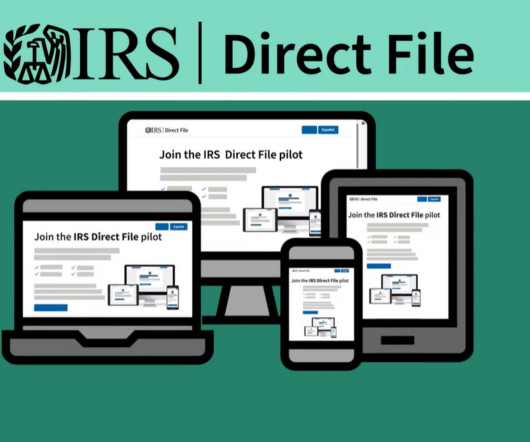

CPA Practice

APRIL 1, 2024

By Andrea Cristina Mercado, Miami Herald (TNS) Filing taxes in the United States is a challenging process. Each year, taxpayers grapple with a convoluted, inefficient and perplexing tax filing system. These challenges have an outsize impact on Latino taxpayers, particularly those from low-income, non-English speaking and immigrant households. While individuals of any background face the risk of being targeted by the predatory tax filing industry, Latinos may fall victim to unqualified service pr

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Dent Moses

APRIL 1, 2024

Expense reimbursement remains a significant challenge for many businesses in the accounting landscape. Manual processes often lead to errors, delays, and employee dissatisfaction. To address these issues, businesses are increasingly turning to software solutions that streamline the reimbursement process and enhance accuracy and efficiency. Expense reimbursement problems are commonly rooted in paper-based systems, which result in lost receipts, data entry errors, and delayed approvals.

CPA Practice

APRIL 1, 2024

April 1 is a big day at Crowe, as the Chicago-based top 15 accounting firm announced that 52 individuals have been promoted to either partner or principal. This year’s class topped last year’s when 44 professionals at Crowe received keys to the partnership. “On behalf of our management committee, our board, our partners, and the entire firm, I am very proud to congratulate each one of our new partners on this momentous career achievement,” Crowe CEO Mark Baer said in a statement.

Let's personalize your content