AI in accounting: Who are the humans in the loop?

Accounting Today

JULY 16, 2024

Accounting firms and vendors alike have stressed the importance of having a "human in the loop" to oversee AI. Just who are these humans and what do they do?

Accounting Today

JULY 16, 2024

Accounting firms and vendors alike have stressed the importance of having a "human in the loop" to oversee AI. Just who are these humans and what do they do?

TaxConnex

JULY 16, 2024

Knowing when and where you have sales tax obligations is a key part of compliance. And understanding your taxability – especially if you don’t sell just tangible personal property (TPP) – is key to getting the right sales tax rates on transactions. Tax mapping helps you determine how items are taxed in a jurisdiction. Anything not tagged to a tax code in mapping is taxed as TTP, which may not be the best or correct sales tax rate.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

BurklandAssociates

JULY 16, 2024

Investing in employee retention makes financial sense and builds a foundation for sustained success and growth. The post Employee Retention Strategies for Startups: Keeping Your Best Talent Engaged appeared first on Burkland.

CPA Practice

JULY 16, 2024

Chicago-based RSM US brought in $4 billion in revenue during the firm’s most recent fiscal year, with consulting driving business growth, according to its FY 2024 Impact Report. The firm reached the $4 billion mark after a nearly 8% increase in revenue in FY 2024, up from $3.7 billion in FY 2023. “We have made significant progress during the last year in our journey to become an even more compelling, digital and global organization committed to leading the middle market into the future,” Brian B

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

JULY 16, 2024

Accounting is an industry wedded to traditional techniques, so leveraging new technology will require a cultural shift within the organization.

CPA Practice

JULY 16, 2024

By Davis Bell. In business, as in life, change is the only true constant. From mitigating unprecedented business disruptors to adapting to new operational paradigms, professionals in all industries find themselves dealing with major changes — many of them driven by emerging technologies. [Go to Part II of this two-part series.] Accounting is no exception.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

CPA Practice

JULY 16, 2024

The American Institute of CPAs and the National Association of State Boards of Accountancy have expanded international testing availability of the U.S. CPA Exam to the Republic of the Philippines. Passing the Uniform CPA Examination is a prerequisite to becoming a licensed Certified Public Accountant (CPA) in the United States. With the increasing globalization of business, many people who live abroad are interested in obtaining the U.S. professional designation.

Accounting Today

JULY 16, 2024

A roundup of the most important court cases, regulations and more in tax for the first six months of the year.

CPA Practice

JULY 16, 2024

The American Institute of CPAs has submitted a request to the Department of the Treasury and the Internal Revenue Service (IRS) to clarify the instructions of Form 4626, Alternative Minimum Tax—Corporations , to allow corporations already identified as “applicable corporations” to skip Part V of the form. The current filing requirement to complete Part V represents a substantial compliance and administrative burden for taxpayers, and the information included in Part V does not appear to provide

Accounting Today

JULY 16, 2024

The role of the internal auditor is expected to change drastically in the decade to come, according to a new report by the Institute of Internal Auditors.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Going Concern

JULY 16, 2024

I’d like the record to reflect that this is not my idea. Comment left on “ What’s your hot take for the next 5 years in the field of Accounting? “ I wasn’t able to find any information on the average cost of those extra 30 units, probably because it varies so much so instead let me drop two relevant links. You all are welcome to tell us how much you paid for your 30 units in the comments (or by email ).

CPA Practice

JULY 16, 2024

This webinar will be held on Tuesday, August 6, 2024 at 1:00pm ET Sponsor: Canopy Software Duration: 1 Hour Register Now This webinar, featuring Darren Root and John Mitchell, long-time accounting profession leaders, will give easy-to-implement guidance around how to build your accounting firm to support the life you want to live.In this webinar, you’ll learn: How to remove friction from your processes How to simplify your firm to focus on the areas that are most profitable and that you enjoy

AccountingDepartment

JULY 16, 2024

Growing a business is a multifaceted challenge that requires careful financial management. For many business owners, juggling daily operations while keeping track of finances is daunting. Enter Client Accounting Services (CAS), a crucial element for business growth that improves financial accuracy, reduces costs, and offers expert financial guidance.

CPA Practice

JULY 16, 2024

Professionals on the Move is a round-up of recent staffing and promotion announcements from around the profession. CLA Appoints New Chief Data Officer and Chief Financial Officer CLA (CliftonLarsonAllen LLP), the eighth-largest accounting firm in the United States, announced that Ray Price, Jr. has joined the firm as its Chief Financial Officer (CFO) and that Spencer Lourens has advanced to the newly created Chief Data Officer (CDO) role.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Insightful Accountant

JULY 16, 2024

The potential expiration of key provisions of the Tax Cuts and Jobs Act (TCJA) at the end of 2025 is a critical issue that requires careful attention and proactive planning, and Section 199A is no exception.

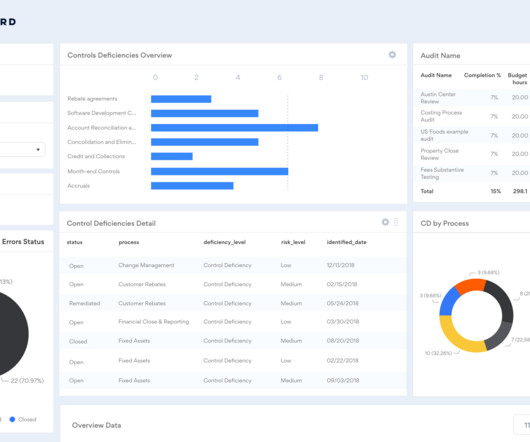

CPA Practice

JULY 16, 2024

AuditBoard , a cloud-based platform transforming audit, risk, compliance, and ESG management, has launched new of out-of-the-box, self-assessment tools that enable internal auditors to easily assess and streamline conformance with the new Institute of Internal Auditors (IIA) Global Internal Audit Standards that go into effect January 9th, 2025. These new capabilities are immediately available within AuditBoard’s top-rated Audit Management Solution, which benefits from the powerful and proprieta

CTP

JULY 16, 2024

As tax planner, you have frequent conversations with clients about possible tax strategies and strive to provide reliable advice in response to their questions. At what point do you begin to document that advice in writing? If the answer is “never,” we have trouble brewing. If the answer is more like “as soon as I get to it,” you may still be opening yourself up to more risk than you realize.

CPA Practice

JULY 16, 2024

Grant Thornton, one of America’s largest brands for audit, assurance, tax, and advisory services, has named Money Magnets Club to its Purple Paladin program. Through the program, Grant Thornton helps emerging nonprofit organizations move from “start-up to unstoppable” and provides funding, business advice and volunteer support, while also helping nonprofits raise awareness of their work and mission.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Accounting Today

JULY 16, 2024

AuditBoard has released an out-of-the-box assessment tool feature for internal auditors to assess conformance with new IIA global standards.

CPA Practice

JULY 16, 2024

Data released by the U.S. Census Bureau shows modest retail sales gains in June despite an uneven pace of spending in recent months, National Retail Federation Chief Economist Jack Kleinhenz said. “The path of household spending remains difficult to read,” Kleinhenz said. “Spending has been uneven but remains in good condition notwithstanding the slower pace of payrolls, subdued consumer confidence and price deflation for retail goods.

Going Concern

JULY 16, 2024

In an exclusive, Reuters is reporting this morning that PwC China might cut as much as half of its 2,000-person financial services audit group. “The move follows Chinese regulators’ scrutiny of PwC this year for its role as the auditor of troubled property giant China Evergrande Group which, in turn, triggered the exit of some clients,” wrote Julie Zhu.

Cherry Bekaert

JULY 16, 2024

In the second episode of Cherry Bekaert’s Operational Effectiveness podcast series, Eric Poppe , a Managing Director in Cherry Bekaert’s Government Contracting Industry practice, is joined by Todd Angioli, a Director in the Firm’s Government Contracting practice with 20+ years of financial operations experience. Together, Eric and Todd discuss mid-year considerations when budgeting and forecasting.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Anders CPA

JULY 16, 2024

Keeping your not-for-profit on mission depends on your organization’s ability to overcome the riskier areas in compliance: donor restrictions and board-designated net assets, Form 990, and governance policies including gift acceptance policies. Failure to adhere to these policies and best practices can result in consequences such as damage to your organization’s reputation, increased scrutiny from regulatory bodies and possibly even legal worries.

Accounting Today

JULY 16, 2024

BOI guidance; IRS accessibility; home on the road; and other highlights from our favorite tax bloggers.

Summit CPA

JULY 16, 2024

In VCFO Deep Dive, Jody and Jamie take a deep dive into “Beyond HGTV Success Featuring Traci Barrett,” which aired on The Root of All Success.

Insightful Accountant

JULY 16, 2024

Intuit is hiking the cost of its QuickBooks Payments processing as of August 15, 2024. This price change only impacts Intuit customers processing 'payment card' transactions using QuickBooks Payments.

Speaker: Joe Wroblewski, Senior Sales Engineer

Is your tech stack working for you—or are you working for it ? 🤖 In today’s world of automation and AI, technology should simplify workflows—not add complexity. Seamless integration and interconnectivity are key to maximizing productivity, optimizing workflows, and improving collaboration. Join expert Joe Wroblewski for a practical and insightful session on how you can build a smarter, more connected tech stack that drives efficiency and long-term success!

CPA Practice

JULY 16, 2024

Almost half (47%) of U.S. organizations report that their salary budgets for the 2024 cycle are lower than the previous year, as the overall median pay raise for 2024 fell to 4.1%, compared with 4.5% in 2023. That’s according to the latest Salary Budget Planning Report by WTW, a leading global advisory, broking and solutions company. The report found employers are being more conservative with their salary budgets as they anticipate lower demand resulting in longer-term stability in their employe

Insightful Accountant

JULY 16, 2024

Docyt AI has announced a new AI-based bookkeeping tool called "Gary.

CPA Practice

JULY 16, 2024

By Davis Bell. In Part I of this series , I defined what the term pivot strategy means in the context of an accounting practice: “A pivot is the action that is at the center of any “change management” initiative. I also noted that while the accounting profession has embraced the concept of change management, strategies for successfully using a pivot strategy to accomplish them are less widely seen.

ThomsonReuters

JULY 16, 2024

Jump to: What are the hidden costs of inefficient data collection? 3 practical steps to improve data collection processes What are the benefits of streamlined data collection? Tips for training staff Are you ready to stop chasing client data? If you’re an accountant, you know that time is money. However, many accounting firms find themselves caught in a continuous chase for client data.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

Let's personalize your content