Maximizing Financial Operations with Outsourced FP&A

AccountingDepartment

MARCH 21, 2024

This comprehensive guide illuminates the value proposition that outsourcing Financial Planning and Analysis can offer to small and medium-sized businesses.

AccountingDepartment

MARCH 21, 2024

This comprehensive guide illuminates the value proposition that outsourcing Financial Planning and Analysis can offer to small and medium-sized businesses.

TaxConnex

MARCH 21, 2024

There’s always something changing in the world of tax, especially sales tax. Here’s a review of some of the recent changes and updates. Amazon still liable. The Court of Appeals of South Carolina has affirmed a state Administrative Law Court (ALC) finding that the online retail giant remains liable for eight figures in unpaid sales tax on third-party sales from 2016, interest and penalties.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

MARCH 21, 2024

The Securities and Exchange Commission has charged two separate investment advisors for severely overstating their use of AI and machine learning for financial advice.

CPA Practice

MARCH 21, 2024

By Julie M. Bradlow. At the end of 2023, the U.S. Tax Court determined that the exception to net earnings from self-employment in Section 1402(a)(13) of the Internal Revenue Code of 1986, as amended, does not automatically apply to all limited partners in a state law limited partnership. While this sentence may be clear, the implications for accounting firms in knowing how to advise clients may be a bit blurry.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

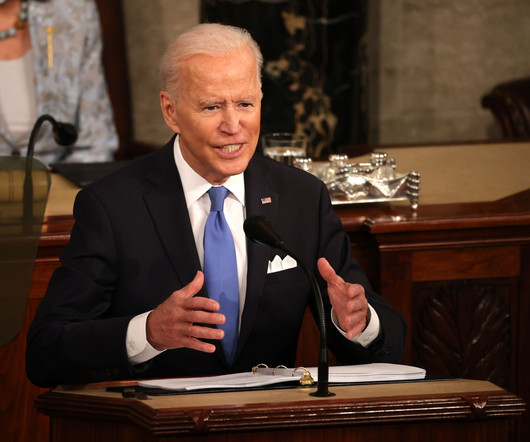

Accounting Today

MARCH 21, 2024

The Senate Finance Committee held a hearing to discuss the Biden administration's recently unveiled budget and tax proposals, as tax experts try to predict what will happen after the election.

CPA Practice

MARCH 21, 2024

By Carl Hoemke. Great literature is full of head-scratchers. Some questions are tough to answer: the Sphinx’s riddle in Oedipus Rex , the lead casket that contains Portia’s picture in The Merchant of Venice , Gollum’s brainteasers in The Hobbit. Property tax compliance can be just as puzzling, and getting it right in some states can be more complex than in others.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

CPA Practice

MARCH 21, 2024

The retail industry supported 55 million full-time and part-time jobs in 2022, accounting for 26% of total U.S. employment, according to a new report released today by the National Retail Federation. The figures are up from 52 million jobs and 25% of total U.S. employment in 2018. Conducted by PwC, The Economic Contribution of the U.S. Retail Industry examines the direct, indirect and induced contribution of the retail industry to the U.S. economy.

Accounting Today

MARCH 21, 2024

The Internal Revenue Service is urging businesses that have filed claims for the Employee Retention Credit to make sure they didn't incorrectly claim the credit and to come forward if they did.

Going Concern

MARCH 21, 2024

As reported first by Financial Times earlier this week, Deloitte is undertaking an ambitious change-up in its global operations that’s expected to take a year. The restructuring will see Deloitte trim its five main service lines down to four. The change was “a fairly divisive topic internally” according to one former partner who spoke to FT.

Insightful Accountant

MARCH 21, 2024

Contributing Author Katie Thomas, CPA shows you how you can not only make it through "the busy season' by help future-proof your firm by adopting AI and proactive strategies.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Going Concern

MARCH 21, 2024

An accounting firm you’ve never heard of made the local news in a Tennessee town you’ve also never heard of for the firm moving into 55,000 square feet in a 128,000-square-foot building where 2,000 Citi call center grunts used to work. According to earlier reporting, the property in Gray, TN (pop. 1,342) could have been turned into a school.

Insightful Accountant

MARCH 21, 2024

We've all heard of 'life coaches', but a CPA turned Life Coach who specializes in coaching CPAs to "bring a sense of calm to their lives" WOW!

CPA Practice

MARCH 21, 2024

By Dave Eisenstadter, masslive.com (TNS) A 17-year veteran of the IRS was arrested on Wednesday and charged with filing false personal tax returns for three years and underreporting about $90,000 worth of income, according to Acting U.S. Attorney Joshua Levy’s office. Ndeye Amy Thioub, 67, of Swampscott, MA, works as a revenue agent assigned to the Large Business and International Division of the IRS, conducting independent field examination and related investigations of complex income tax retu

Insightful Accountant

MARCH 21, 2024

Contributing Author Katie Thomas, CPA shows you how you can not only make it through "the busy season' by help future-proof your firm by adopting AI and proactive strategies.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Accounting Today

MARCH 21, 2024

The modern chief financial officer is increasingly tasked with risk management, including identifying and mitigating various risks such as cyberthreats and regulatory compliance issues.

CPA Practice

MARCH 21, 2024

Fyle , an expense management platform that works with customers’ existing credit cards, announced the launch of its Conversational AI platform, where employees can submit expense receipts and other details via text messages. This marks a paradigm shift in how accountants and professionals manage expenses, eliminating the need for traditional apps and making expense tracking significantly faster.

Accounting Today

MARCH 21, 2024

Businesses will get help determining whether profits interest and similar awards should be accounted for as share-based payment arrangements.

CPA Practice

MARCH 21, 2024

By Rachel Graf, Bloomberg News (TNS) Sam Bankman-Fried said U.S. prosecutors’ proposal to put him in prison for as long as 50 years “distorts reality” and paints him as a “depraved super-villain.” Prosecutors have argued that a sentence ranging from 40 to 50 years is necessary for the FTX co-founder’s “historic” crime involving more than 1 million victims and losses of more than $10 billion in the collapse of his crypto empire.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Accounting Today

MARCH 21, 2024

A former employee of U.K. tech mogul Mike Lynch's Autonomy Corp. told jurors at his U.S. criminal trial that she and one of her higher-ups were both fired after flagging concerns about accounting irregularities.

CPA Practice

MARCH 21, 2024

An Accounting Standards Update (ASU) issued by the Financial Accounting Standards Board (FASB) on March 21 provides illustrative guidance to help companies determine whether profits interest and similar awards should be accounted for as share-based payment arrangements within the scope of Topic 718, Compensation—Stock Compensation. The purpose of profits interest awards is generally to give employees the opportunity to participate in the upside of the entity — typically private companies — upon

Withum

MARCH 21, 2024

Did you know that ERP systems can be a game-changer for your tax teams, making tax-related activities a breeze and boosting overall efficiency? The tax applications within an ERP system can speed up tax-related activities, including tax calculation, reporting, compliance and optimization. This can lead to significant business benefits , such as streamlined processes, reduced risks and increased efficiency.

Summit CPA

MARCH 21, 2024

At any size and level of growth, long-term financial strategy and day-to-day financial monitoring are vital to the health of a business. Failure to conduct due diligence in finance and accounting most especially impacts the long-term performance of small businesses and start-ups. However, being able to afford a CFO or a Financial Controller, or both, is one of the largest factors preventing businesses from hiring these vital finance roles.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Insightful Accountant

MARCH 21, 2024

Gary Dehart discusses Drake Software products with John and Chris. John manages Drake Portals, Chris handles Drake Pay. Both focus on customer satisfaction and product improvement through feedback and tech team collaboration.

Canopy Accounting

MARCH 21, 2024

What's new: With the latest update, clients now have the flexibility to pay their invoices directly through a secure link, bypassing the need to log into the Client Portal. As a Canopy user, your process remains unchanged. Upon sending an invoice, your clients will receive the usual email notification, which now includes an additional "Pay now" option.

Withum

MARCH 21, 2024

Women within the Financial Services Industry share their perspectives on mentoring, support, and empowerment. The phrase that there is “strength in numbers” is very applicable when it comes to women in business today. Trailblazers in blazers in the 1990s and early 2000s paved the way, helping women shatter glass ceilings and earn their seats at male-dominated tables to showcase their value, strength, and ability.

Patriot Software

MARCH 21, 2024

Business expenses add up—fast. Fortunately, there are extensive tax deductions available for small business owners to offset the cost of running a business. Unfortunately, tax deductions can be complicated and confusing. Use our small business tax deductions checklist to simplify tax time, check out common FAQs relating to deductions, and get tips.

Speaker: Joe Wroblewski, Senior Sales Engineer

Is your tech stack working for you—or are you working for it ? 🤖 In today’s world of automation and AI, technology should simplify workflows—not add complexity. Seamless integration and interconnectivity are key to maximizing productivity, optimizing workflows, and improving collaboration. Join expert Joe Wroblewski for a practical and insightful session on how you can build a smarter, more connected tech stack that drives efficiency and long-term success!

CPA Practice

MARCH 21, 2024

Seller Ledger quietly launched in beta for eBay sellers last year in January, and officially came to market in March of 2023. Over the course of the past year the company has expanded to support Etsy, Poshmark, Mercari and Amazon sellers in addition to eBay with its automated bookkeeping and accounting solution. Seller Ledger was created by Kevin Reeth, the original founder of Outright.com which was purchased by GoDaddy and became GoDaddy Bookkeeping.

Dent Moses

MARCH 21, 2024

For the past five years, taxpayers have enjoyed historically high gift and estate tax exemptions, thanks to the Tax Cuts and Jobs Act of 2017. This legislation doubled the exemption from approximately $5.5 million to $13.61 million per person (adjusted for inflation) in 2024. The annual gift exemption also increased to $18,000 per donee in 2024. This substantial exemption has allowed individuals and families considerable flexibility in their estate planning.

CPA Practice

MARCH 21, 2024

The Financial Accounting Standards Board (FASB) on March 20 appointed a longtime veteran of Big Four firm EY to the role of director of technical activities. Jackson Day, who is currently a partner in professional practice at EY, will begin his new role at the FASB this July. Jackson Day “I am thrilled to have this opportunity to return to the FASB and be a part of its standard-setting team,” Day, a FASB practice fellow from 1997-99, said in a statement.

FraudFiles

MARCH 21, 2024

I did a divorce investigation several years ago that I like to call the Instagram Investigation. The husband was accused of marital waste (dissipation), as he was spending lots of money on his new girlfriend while his divorce was pending. The wife needed to quantify how much he was spending on the girlfriend, but it [.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

Let's personalize your content