Filing trends to watch during the 2025 tax season

Accounting Today

FEBRUARY 13, 2025

As the new year's tax season begins, a look back at lessons from the 2024 filing season.

Accounting Today

FEBRUARY 13, 2025

As the new year's tax season begins, a look back at lessons from the 2024 filing season.

TaxConnex

FEBRUARY 13, 2025

Online businesses looking to do business on Native American tribal lands in the U.S. should know that sales tax obligations for these sovereign nations and territories resemble those obligations in other areas of the U.S. but can differ in important ways. Areas such as the Navajo Nation have tribal sovereignty; for tax purposes, this means their sales tax laws are separate from the states within which they reside.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Going Concern

FEBRUARY 13, 2025

Although we haven’t fully decided whether accountants are knowledge workers or manual laborers so long as accountants’ output is predominantly measured in billable hours, this recent paper as reported in 404 Media seems relevant to the sector nonetheless. Emanuel Maiberg writes : A new paper from researchers at Microsoft and Carnegie Mellon University finds that as humans increasingly rely on generative AI in their work, they use less critical thinking, which can result in the deteri

Withum

FEBRUARY 13, 2025

New York plans to align with the federal centralized partnership audit regime as part of Governor Kathy Hochuls fiscal year 2026 budget. The 2026 budget proposal would amend various tax law provisions and introduce a new section, 659-a, detailing how partnerships must report federal changes and pay any resulting tax on behalf of their partners.The proposal aims to clarify New York state reporting requirements since the IRS started its partnership audit initiative in 2018.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

SkagitCountyTaxServices

FEBRUARY 13, 2025

Saving money isnt a good priority in your business. I know, a shocking statement by any means, but especially in our current inflationary reality. But, heres what I mean If were speaking strictly in terms of getting your costs down, it’s understandable why youd prioritize anything that gets you savings. When prices go up, you have to adjust for that.

CPA Practice

FEBRUARY 13, 2025

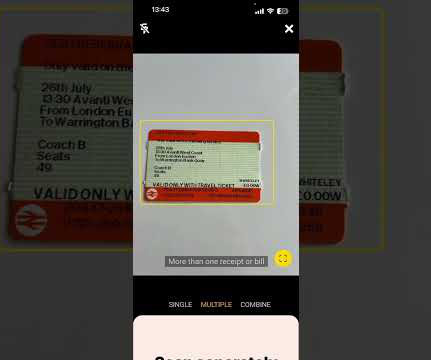

With cryptocurrency's increase in popularity, the IRS has introduced some complicated reporting requirements to ensure compliance with U.S. tax laws.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Accounting Today

FEBRUARY 13, 2025

Expect rates to rise and audits to increase as cash-strapped states and localities feel the crunch.

Accounting Insight

FEBRUARY 13, 2025

GAAPweb, the UKs leading finance and accountancy job board, has launched their 2025 Salary Survey. Building on the success and invaluable insights garnered from previous surveys, GAAPweb are reaching out for audience contributions. 2024 was a year characterised by resilience in both employers and employees alike. Responses from finance and accountancy professionals allow GAAPweb to garner crucial insights into finance employment, highlighting the current trends and challenges the finance sector

CPA Practice

FEBRUARY 13, 2025

The software consolidates globally applicable accounting principles into a central repository of knowledge, serving as a pivotal platform for the collection and analysis of crucial financial data.

Accounting Insight

FEBRUARY 13, 2025

Ca seware confirms security of client confidential information and response reliability with independent assessment of its AI digital assistant Caseware , a global leader in cloud-enabled audit, financial reporting and data analytics solutions, has today announced that Holistic AI, makers of the leading AI governance platform for the enterprise, has been chosen as a strategic foundation of Casewares AI strategy to provide ongoing assurance and visibility of Casewares rigorous safety standards fo

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Withum

FEBRUARY 13, 2025

This is the 1,162 nd blog I have posted in the last thirteen years without missing a week. I posted twice a week for the first eight and a half years and then once a week. I posted my first blog on February 7, 2012, and while I think everything will last forever, most things do not. Things, people and circumstances change. However, my blog’s focus and topics haven’t changed – much.

Accounting Insight

FEBRUARY 13, 2025

New collaboration will drive practice efficiency, ahead of the MTD for Income Tax mandate TaxAssist Accountants is pleased to announce a new strategic alliance with Intuit QuickBooks , which recognises TaxAssist as an important growth ally. Intuit QuickBooks became a preferred supplier of TaxAssist in 2013 and its software already dominates the network.

Accounting Today

FEBRUARY 13, 2025

Careless; the PTIN shuffle; time for Time; and other highlights of recent tax cases.

CPA Practice

FEBRUARY 13, 2025

Here are a few key items that CFOs need to answer as they health check their ESG oversight capabilities and seek to make sure that their organizations can meet these challenges in 2025 and for years to come.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Accounting Today

FEBRUARY 13, 2025

The economy is the No. 1 risk cited by a group of business leaders, according to a new survey from Protiviti and North Carolina State University.

Going Concern

FEBRUARY 13, 2025

Are you having trouble finding remote accountants, CAS experts, auditors, or tax professionals for your firm or internal team? Accountingfly can assist you! With our Always-On Recruiting service, you can access a pool of top remote accounting candidates without any upfront costs. Sign up now to view the complete candidate list and connect with potential hires.

CPA Practice

FEBRUARY 13, 2025

The Public Company Accounting Oversight Board has posted a new series of knowledge checksdesigned to help auditors gauge their understanding of important aspects of the regulator's new quality control standard, QC 1000,A Firms System of Quality Control.

Accounting Today

FEBRUARY 13, 2025

Accounting and ERP solutions provider Sage announced new AI-driven improvements to its Sage Intacct product, particularly its generative AI Sage Copilot feature.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

CPA Practice

FEBRUARY 13, 2025

Many businesses have team members across state lines, and you may have clients with remote employees in other states. Payroll can get confusing and tricky in these situations.

Withum

FEBRUARY 13, 2025

Ever since Meta, formerly known as Facebook, announced it would be discontinuing its enterprise communication platform, Workplace, organizations have been searching for ways to fill the gap. With the news of Meta Workplace shutting down, many teams are actively exploring Meta Workplace alternatives to ensure their communication and collaboration needs are met.

CPA Practice

FEBRUARY 13, 2025

Miami-based KSDT CPA is merging with Colbert & Boue, an accounting firm based in Coral Gables, FL, a move that strengthens the top 200 firm's presence in Miami-Dade County and marks the opening of its fourth South Florida office.

Accounting Today

FEBRUARY 13, 2025

Help clients create the ideal life for themselves first and then work backward to help them get there financially.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

CPA Practice

FEBRUARY 13, 2025

Despite ongoing economic and geopolitical disruption, CFOs are planning significant technology budget increases, viewing digital investments as crucial for growth and efficiency, according to Gartner, Inc.

Insightful Accountant

FEBRUARY 13, 2025

Xero has announced two leadership changes in the areas of 'People' and 'Finance'.

CPA Practice

FEBRUARY 13, 2025

These latest enhancements help finance teams save time, get trusted insights faster, and focus on growth by simplifying compliance, enhancing decision-making, and improving operational efficiency.

Insightful Accountant

FEBRUARY 13, 2025

Sage Future is formerly replacing Sage Transform as the new Sage conference. Registration has just opened for the event being held June 3-5, 2025 at Atlanta's Georgia World Congress Center.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

CPA Practice

FEBRUARY 13, 2025

The integration will offer energy companies an automated, more accurate, and scalable tax compliance solution, enabling real-time tax calculation, reducing reliance on manual processes, and minimizing errors.

Insightful Accountant

FEBRUARY 13, 2025

Murph wants to make you aware of 'report suite' designed to address data visibility gaps for manufacturers and wholesalers who are trying to operate with QuickBooks Enterprise.

CPA Practice

FEBRUARY 13, 2025

The top 30 accounting firm is planning to merge with Scottsdale, AZ-based boutique business law firm Radix Law this spring to form the Arizona law firm Aprio Legal, a move that could set off a wave of other CPA firms entering an industry that was once considered off limits.

Ryan Lazanis

FEBRUARY 13, 2025

Building an accounting tech stack? Learn why it matters, must-have tools, and pro tips to fully streamline your firm's operations. The post How to Build an Accounting Tech Stack for Your Firm appeared first on Future Firm.

Speaker: Joe Wroblewski, Senior Sales Engineer

Is your tech stack working for you—or are you working for it ? 🤖 In today’s world of automation and AI, technology should simplify workflows—not add complexity. Seamless integration and interconnectivity are key to maximizing productivity, optimizing workflows, and improving collaboration. Join expert Joe Wroblewski for a practical and insightful session on how you can build a smarter, more connected tech stack that drives efficiency and long-term success!

Let's personalize your content