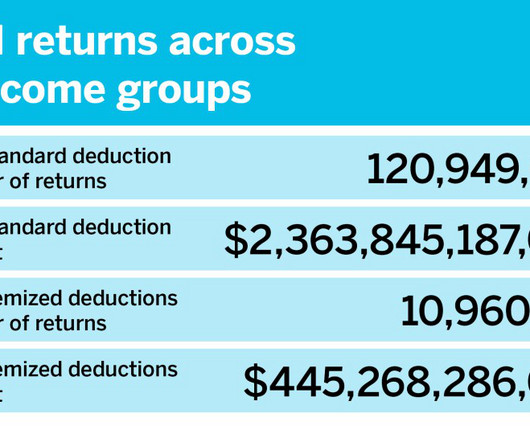

Standard vs. itemized: Who deducts what?

Accounting Today

SEPTEMBER 16, 2024

Taxpayers earning more are more likely to choose to itemize their deductions, while taxpayers earning less tend to favor the standard deduction.

Accounting Today

SEPTEMBER 16, 2024

Taxpayers earning more are more likely to choose to itemize their deductions, while taxpayers earning less tend to favor the standard deduction.

Withum

SEPTEMBER 16, 2024

As a plan sponsor, staying informed about the latest regulations and industry trends is crucial to the success of your employee benefit plan as we navigate through employee benefit plan filing season. Adhering to regulatory requirements and ensuring compliance to avoid potential penalties are priorities for plan sponsors with employee benefit plan audits.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

SEPTEMBER 16, 2024

The Treasury Inspector General for Tax Administration, in two reports, critiqued the IRS on cybersecurity for both its data warehouse and its cloud infrastructure.

CPA Practice

SEPTEMBER 16, 2024

Hosts Randy Johnston and Brian Tankersley, CPA, review Supervizor , a continuous quality assurance system that helps accounting firm’s error-proof their client’s bookkeeping and curb fraud. Use the video player below to watch, or the podcast player below to listen to the podcast. Or use the below podcast player to listen: Transcript (Note: There may be typos due to automated transcription errors.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

SEPTEMBER 16, 2024

Find out what the client needs and then figure out how to fill that need.

CPA Practice

SEPTEMBER 16, 2024

Payroll solutions provider Gusto has announced a new artificial intelligence-powered assistant called “Gus,” aimed at helping small business owners save time, get personalized insights, and make smarter decisions about their businesses. Gus can provide business owners with quick answers to their most frequently asked questions, such as their compliance requirements or what they need to do to file their taxes.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

CPA Practice

SEPTEMBER 16, 2024

Many professionals across various industries have gone to sites like LinkedIn and Reddit over the past week or so to discuss—and to criticize, by some—a recent plan by PwC to monitor where its 26,000 employees in the United Kingdom do their work from starting in January, as the Big Four accounting firm tightens the screws on its hybrid work policy. This move reflects a broader trend of employers rolling back hybrid working arrangements that became popular during the COVID-19 pandemic.

Going Concern

SEPTEMBER 16, 2024

Monday already? Guess we should see what’s going on in the world. Can someone help me come up with a Vault-Tec joke for this story? Because I know it’s right there. "As it stands today, Deloitte is not known as a shipbuilder, nor is it clear it could meaningfully contribute to the construction of submarines." [link] — Going Concern (@going_concern) September 14, 2024 Speaking of Deloitte, the UK business is finally entering the modern age and extending equal family leav

CPA Practice

SEPTEMBER 16, 2024

The Department of the Treasury and the Internal Revenue Service have issued proposed regulations PDF for Tribal General Welfare Benefits. Section 139E of the Internal Revenue Code was enacted by the Tribal General Welfare Exclusion Act of 2014 and excludes from gross income the value of any Tribal General Welfare Benefit. As described in the Consultation and Federal Feedback summary PDF , the proposed regulations are the result of long-term efforts by Treasury, IRS, the Treasury Tribal Advisory

Insightful Accountant

SEPTEMBER 16, 2024

As Congress reconvenes this month, tax practitioners find themselves navigating an uncertain legislative landscape with the looming threat of a government shutdown and its potential impact on year-end tax legislation.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

CPA Practice

SEPTEMBER 16, 2024

Michael E. Kanell The Atlanta Journal-Constitution (TNS) Will they or won’t they? The interest rate-setting committee of the Federal Reserve will meet starting Tuesday to discuss the economy and a potential cut to the central bank’s benchmark rate — a decision that will affect the pricing of home, auto and business loans, credit card rates, the rates for savers and so on.

Withum

SEPTEMBER 16, 2024

A common challenge when completing a business valuation for SBA 7(a) purposes is how much reliance should be given to the seller’s interim financial statements. Generally, an SBA lender will provide an appraiser with three years of business tax returns and interim financial statements as of the current calendar year. This is where certain trends may be observed from the interim financial statements on an annualized basis that have large divergences from the business tax returns.

CPA Practice

SEPTEMBER 16, 2024

insightsoftware (lowercase intentional), a provider of solutions for CFOs, has released its 2024 Finance Team Trends Report. The report analyzes data integration challenges, the rise of artificial intelligence (AI), essential shifts in cloud computing, and the ongoing impact of staffing and skills challenges across the finance and accounting sectors.

Accounting Today

SEPTEMBER 16, 2024

Wolters Kluwer announced major enhancements to CCH Axcess Audit, which works with numerous other modules in the suite to produce more detailed insights and workflow integration.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Anders CPA

SEPTEMBER 16, 2024

It’s that time of year, when we start to get our financial ducks in a row. The end of Q3 is the perfect time to look back at the past year and ahead to the future. This period provides a critical opportunity to assess performance, identify areas for improvement, and set strategic goals. The transportation industry has endured a lot in these past few years, but a wise colleague of mine once said, “Prepare to endure, endure.

Accounting Today

SEPTEMBER 16, 2024

John Napolitano of Napier Financial takes a long look at the host of unusual investment opportunities available to your wealthier clients.

Going Concern

SEPTEMBER 16, 2024

Deloitte has reported its global revenue numbers and while it’s another record-smasher for the Big D, it’s also got to be a bit disappointing for the firm that enjoys self-jerking it to their greatness more than any other. Growth is in the low single digits for the first time since 2020 when they clocked in at 3.9% growth (in US currency).

Accounting Today

SEPTEMBER 16, 2024

In the latest example of accounting firms taking on outside investments, the internationally focused firm has sold a minority stake to an Indian billionaire.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Insightful Accountant

SEPTEMBER 16, 2024

You still have plenty of time to apply for the International ProAdvisor Awards, but why wait. you can start your application and come and go as you complete new training, earn certifications and use/learn new Apps.

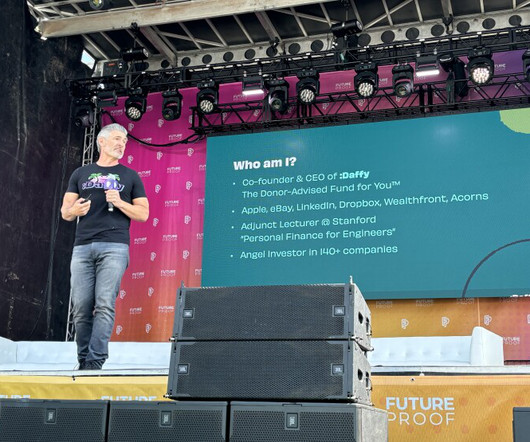

Accounting Today

SEPTEMBER 16, 2024

The accounts are expected to grow by another trillion dollars over the next decade because of their tax and flexibility advantages, Daffy CEO Adam Nash said.

Insightful Accountant

SEPTEMBER 16, 2024

Murph will host Dawn Brolin, Kelly Gonsalves, and Jeff Siegel to review the Top 100 ProAdvisors' Top 10 most popular eCommerce Connector Apps today, September 17 at 2 PM Eastern.

Accounting Today

SEPTEMBER 16, 2024

The IRS has postponed payment and filing deadlines for those affected by the storm.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

LSLCPAs

SEPTEMBER 16, 2024

As a business owner, your primary focus is on growing and managing your business. However, while navigating the financial landscape can be complex and time-consuming, prioritizing regular meetings with your Certified Public Accountant (CPA) is crucial to your business’s success. So you don’t get overwhelmed, remember that you don’t have to cover every item on.

Accounting Today

SEPTEMBER 16, 2024

Hong Kong's Accounting and Financial Reporting Council said its review of PwC's local practice, which is separate from China's probe, is still "in progress.

CPA Practice

SEPTEMBER 16, 2024

Wolters Kluwer Tax & Accounting unveiled on Sept. 16 a huge expansion of its CCH Axcess Audit solution, which integrates with other key CCH Axcess modules for faster, more precise engagements across firms of all sizes. According to Wolters Kluwer, the new technological advancements reduce manual data entry, minimize errors, and sync data in real time, adding a layer of agility and cohesion to every project.

Menzies

SEPTEMBER 16, 2024

Menzies LLP - A leading chartered accountancy firm. In anticipation of this year’s Autumn Budget, Menzies’ Retail Sector Team have compiled a Wishlist for the sector, covering key areas such as VAT, business rates, the national living wage, and the employer national insurance allowance, highlighting the measures businesses should focus on.

Speaker: Joe Wroblewski, Senior Sales Engineer

Is your tech stack working for you—or are you working for it ? 🤖 In today’s world of automation and AI, technology should simplify workflows—not add complexity. Seamless integration and interconnectivity are key to maximizing productivity, optimizing workflows, and improving collaboration. Join expert Joe Wroblewski for a practical and insightful session on how you can build a smarter, more connected tech stack that drives efficiency and long-term success!

FraudFiles

SEPTEMBER 16, 2024

In the early stages of divorce, clients are required to complete financial affidavits, financial declarations, or other similarly titled disclosures. The importance of an accurate disclosure of assets, liabilities, and income is obvious. Yet many clients are unable to accurately prepare this financial information. Particularly in high net worth divorces, it may be difficult for [.

Accounting Today

SEPTEMBER 16, 2024

Former President Donald Trump's agenda of higher tariffs on U.S. imports would help offset his expanding tax-cut proposals if he's reelected in November, according to his running mate, Ohio Senator JD Vance.

CPA Practice

SEPTEMBER 16, 2024

A tax briefing on the proposed tax policies of the major presidential candidates, Vice President Kamala Harris and former President Donald Trump, was recently released by Wolters Kluwer Tax and Accounting. The analysis aims to clearly distinguish their tax priorities and propose how their policies could potentially affect individual taxpayers, businesses, and the wider economy, Wolters Kluwer said.

CPA Practice

SEPTEMBER 16, 2024

By Tony Czuczka Bloomberg News (TNS) Former President Donald Trump’s agenda of higher tariffs on U.S. imports would help offset his expanding tax-cut proposals if he’s reelected in November, according to his running mate, Ohio Senator JD Vance. “If we actually balance this out by penalizing some of these companies for manufacturing overseas, I do think that we can get this to balance out in the right way, where we’re not blowing a hole in the deficit, we’re giving workers more of their money,” V

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

Let's personalize your content