How the enhanced CTC could impact tax season

Accounting Today

MARCH 11, 2024

The fate of the Child Tax Credit is in the hands of the Senate, but the IRS is ready to implement changes rapidly if the bill is passed.

Accounting Today

MARCH 11, 2024

The fate of the Child Tax Credit is in the hands of the Senate, but the IRS is ready to implement changes rapidly if the bill is passed.

Going Concern

MARCH 11, 2024

The 96th annual Academy Awards went off seemingly without a hitch last night but we’re not here to talk about that because this isn’t a movie blog and I haven’t seen Oppenheimer. We’re here to rehash what happened seven years ago because this website specializes in the beating of dead horses and reminding Big 4 accounting firms of the dumb things they’ve done over the years.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

MARCH 11, 2024

With a wealth of ways to move forward and build their practices, accounting firms need to figure of which to take, and which to pass up.

CPA Practice

MARCH 11, 2024

By Dave Eisenstadter, masslive.com (TNS) Did you end up unexpectedly owing money on your taxes this year? Statistics from the IRS ending on March 1 indicate you’re not alone. Compared with a similar point in the tax season the previous year, there have been nearly 6 million fewer refunds, IRS records show. By March 3, 2023, 42,040,000 refunds had been issued compared with 36,288,000 by March 1 of this year, a difference of 5.75 million or nearly 14%.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

MARCH 11, 2024

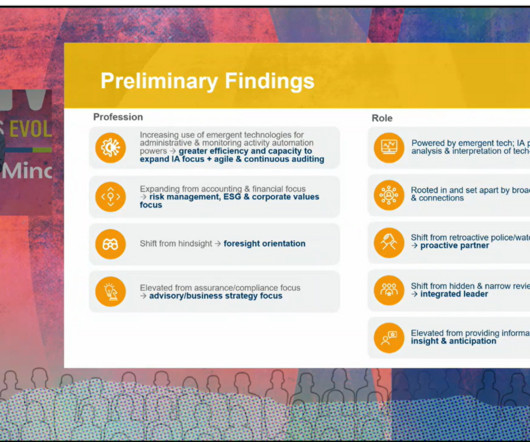

The internal audit function is gaining more people and funding, according to a new survey released Monday during an Institute of Internal Auditors conference in Las Vegas.

Insightful Accountant

MARCH 11, 2024

A judge ruled the Corporate Transparency Act's ownership reporting unconstitutional for NSBA and its 60,000+ members by March 1, 2024. This may trigger similar cases nationwide, impacting BOI reporting. Practitioners need to plan their response.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Insightful Accountant

MARCH 11, 2024

The Bonadio Group climbs to 41st on 2024 Accounting Today Top 100 Firms List, named Top Firm in Mid-Atlantic. Revenue grows over 14% post mergers.

Accounting Today

MARCH 11, 2024

President Joe Biden's budget proposal — which calls for sweeping tax increases on corporations and the wealthy — is the opening round of a looming tax fight set to consume Washington next year.

CPA Practice

MARCH 11, 2024

By Poonkulali Thangavelu. Bankrate.com (via TNS) On March 5, the Consumer Financial Protection Bureau (CFPB) finalized a rule capping credit card late payment fees at $8 for the biggest card issuers after inviting public comment on the matter last year. According to the consumer protection agency, the move is an effort to rein in “excessive” credit card late fees.

Accounting Today

MARCH 11, 2024

The perception that companies are scaling back their diversity efforts is wrong, according to the AICPA's Crystal Cooke.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

KROST

MARCH 11, 2024

LOS ANGELES, CA – For the fourth year in a row, the Los Angeles Business Journal has named KROST’s Principal, Keith Hamasaki, CPA, a Leader of Influence: Minority CPA. The recognition is dedicated to the works and accomplishments of knowledgeable and skilled accountants in the Los Angeles area. We are extremely fortunate to be in Read the full article.

Withum

MARCH 11, 2024

Intuit recently announced the QuickBooks Desktop discontinuation, halting new subscriptions for several QuickBooks (QB) Desktop products after July 31, 2024. This presents an opportunity for the millions of small businesses currently using QB Desktop to upgrade to another, more modern software solution. What We Know About the QuickBooks Desktop Discontinuation Intuit will no longer sell new subscriptions for some of its products: QB Desktop Pro Plus, QB Desktop Premier Plus, QB Desktop Mac Plus

Canopy Accounting

MARCH 11, 2024

Have questions about accounting practice management software? We cover it all here. Learn what it is, how to use it, and much more!

CPA Practice

MARCH 11, 2024

The results of The 2024 North American Pulse of Internal Audit Survey , from the Internal Audit Foundation, finds a growing profession, with Chief Audit Executives (CAEs) more than twice as likely to have increased staff (26%) than to have decreased staff (9%). Additionally, after sharp cuts due to the COVID pandemic in 2020 and 2021, significantly more internal audit functions are now increasing their budgets (36%) than are decreasing them (13%), according to the new survey of senior internal a

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Accounting Today

MARCH 11, 2024

The Creating Hospitality Economic Enhancement for Restaurants and Servers would provide a tax deduction for bars, restaurants and entertainment venues with draft beer systems.

CPA Practice

MARCH 11, 2024

The American Institute of CPAs has sent a letter to the Internal Revenue Service requesting guidance on section 461(l), also known as the limitation on excess business losses (EBLs) of noncorporate taxpayers, enacted under the Tax Cuts and Jobs Act (TCJA). The letter also provides recommendations to help the IRS deliver practical guidance that would be helpful to both taxpayers and tax practitioners.

Accounting Today

MARCH 11, 2024

A recent podcast included a discussion of time sheets, practice management and the future of the profession.

Going Concern

MARCH 11, 2024

Hiya! It’s pretty dead out there today. So feel free to review Friday’s Footnotes for a news fix because this one is going to be dry. You can also check out the weekend discussion, this week it was “ Is Everybody Dumb Now? ” Getting right into it… Morale is down at EY UK after a few rounds of layoffs: Staff in EY’s UK deals business have hit out at the company’s management for the way recent job cuts were handled, saying “trust is broken” and that employees feel “de

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Accounting Today

MARCH 11, 2024

AuditBoard announced new artificial intelligence, analytics and annotation capabilities.

Summit CPA

MARCH 11, 2024

Creative Agency Success Show Podcast Episode 118 In this episode of the Creative Agency Success Show, Jamie and Jody welcome Jack Skeels, CEO of Agency Agile and author of Unmanaged. Jack shares his deep expertise in agency management, offering nuggets on how to unmanage your agency and why layer cakes make a healthy organization. They discuss the complexities of marketing agency management within growing service-based agencies.

Accounting Today

MARCH 11, 2024

The Financial Reporting Council is considering either Canary Wharf or Stratford for its new main office.

Withum

MARCH 11, 2024

Accounting Standards Update (“ASU”) 2022-04 Liabilities – Supplier Finance Programs (Subtopic 405-50): Disclosure of Supplier Finance Programs is effective for fiscal years ending on or after December 15, 2022, which means it is effective beginning with fiscal years ending on December 31, 2023. The purpose of this ASU is to provide information in the form of note disclosures sufficient to enable users of financial statements to understand the nature, activity during the period, changes from pe

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

LSLCPAs

MARCH 11, 2024

The month-end close process is a critical aspect of financial management for organizations of all sizes. It involves reconciling key financial accounts, verifying transactions are captured and in the correct account, and preparing monthly financial statements to provide an accurate snapshot of a organization’s financial health throughout the year.

Cherry Bekaert

MARCH 11, 2024

Contributor: Gabriela Payne, CPA On March 6, 2024, the U.S. Security Exchange Commission (SEC) released final rules on new climate disclosure requirements for public companies. The rules require registrants to provide climate-related information in their registration statements and annual reports. The new climate disclosure rules aim to improve and standardize disclosures about climate issues.

Anders CPA

MARCH 11, 2024

Cannabis entrepreneurs face major challenges when it comes to business financing. Even as recreational use becomes more common throughout the United States, funding options for cannabis businesses will face limited funding options until legalization — or at least rescheduling — occurs at the federal level. Why are banking services limited for cannabis-related business?

Accounting Today

MARCH 11, 2024

With two fields increasingly working together, wealth management and accounting firms are rolling out tools. Are financial advisors ready to work with the robots?

Speaker: Joe Wroblewski, Senior Sales Engineer

Is your tech stack working for you—or are you working for it ? 🤖 In today’s world of automation and AI, technology should simplify workflows—not add complexity. Seamless integration and interconnectivity are key to maximizing productivity, optimizing workflows, and improving collaboration. Join expert Joe Wroblewski for a practical and insightful session on how you can build a smarter, more connected tech stack that drives efficiency and long-term success!

Withum

MARCH 11, 2024

In this on-demand webinar, learn to navigate the warranty submission process! Already Registered? Click Here View On-Demand Webinar Withum and fellow industry experts, Bass Sox Mercer and The Niello Company participated in a panel event where they discussed the latest trends in warranty reimbursement, tactics of the manufacturer and how dealerships could and should capitalize on warranty rate increases.

VJM Global

MARCH 11, 2024

Held by Hon’ble High Court of Allahabad In the matter of Associated Switch Gears and Projects Ltd. Vs State of U.P. (Writ Tax No. 276 0f 2020 ) The Petitioner received an order for imposition of penalty. Show Cause notice was issued on the ground that the vehicle was traveling to a destination not mentioned in the invoice. However, while issuing the order, the appellate authority has imposed a penalty on a different ground.Hon’ble High Court held that “Show Cause Notice” serves as a vital checkp

Withum

MARCH 11, 2024

This month, as a part of Withum’s mission to instill volunteerism and philanthropy in emerging professionals, winter interns took to their communities to participate in give-back efforts for a variety of organizations. In East Brunswick, New Jersey, a small group of interns and staff members went to the Ronald McDonald House (RMH) to prepare special gluten-free meals for families of children in Robert Wood Johnson University Hospital.

Menzies

MARCH 11, 2024

Menzies LLP - A leading chartered accountancy firm. The chancellor failed to address any major areas impacting the sector, which is likely to leave retailers continuing to struggle for the rest of 2024. Whilst the government confirmed in the Autumn statement 2023 that a Business Rates discount of 75% for qualifying retailers would continue into the 2024/25 tax year, we had hoped that the government would switch from using the September 2023 CPI to the April 2024 projected CPI, which could save r

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

Let's personalize your content