Congressional leaders agree on tax extenders deal

Accounting Today

JANUARY 16, 2024

The chairs of Congress's two main tax committees announced a deal to extend a number of expired tax credits and tax breaks, including the expanded Child Tax Credit.

Accounting Today

JANUARY 16, 2024

The chairs of Congress's two main tax committees announced a deal to extend a number of expired tax credits and tax breaks, including the expanded Child Tax Credit.

TaxConnex

JANUARY 16, 2024

Do you sell software-as-a-service (SaaS)? Then you already have one of the most complicated situations in sales tax. Your tax obligation and liability begin with where you have nexus , the connection between your company and a taxing authority or jurisdiction. Sales tax nexus was once defined only as a substantial physical presence, but for nearly six years – ever since the Supreme Court’s Wayfair ruling in 2018 – sales tax nexus can also be defined as an economic presence by just selling enough

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JANUARY 16, 2024

The Internal Revenue Service and the Treasury Department told businesses they won't have to report on the digital assets they receive until regulations are issued.

Withum

JANUARY 16, 2024

We are excited to announce that Ways and Means Chairman Jason Smith (R-MO) and Senate Finance Committee Chairman Ron Wyden (D-OR) released a bipartisan tax framework that promotes Main Street businesses, while also providing more financial security to families in need. The agreement is between the two Chairs, but respective ranking members and leadership support is still needed to pass the bill.

Speaker: Amanda Adams, Fractional CFO, CPA

Are you ready to elevate your accounting processes for 2025? 🚀 Join us for an exclusive webinar led by Amanda Adams, a seasoned fractional CFO and CPA passionate about transforming back-office operations for finance teams. This session will cover critical best practices and process improvements tailored specifically for accounting professionals.

Going Concern

JANUARY 16, 2024

It’s possible this is just clickbait and thinly veiled advertising for remote recruiters (*sweats nervously*) but according to CNBC Make It , “accountant” is “the number one in-demand remote job companies are hiring for.” Adds their headline, “it can pay over $100,000 a year.” Insert sitcom laugh track here.

Anders CPA

JANUARY 16, 2024

The looming sunset of the expanded lifetime estate and gift tax exemption will arrive on January 1, 2026. If you are anticipating a transition of ownership of your business to your heirs in the years ahead, now may be the best time in a generation to take advantage of the increased thresholds before they expire. Gifting minority interests in the business over the next two years can help you maximize the potential tax benefit of the increased gifting thresholds.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Accounting Today

JANUARY 16, 2024

The Korean company is seeking to keep its cars competitive with automakers qualifying for tax credits under the Inflation Reduction Act.

CPA Practice

JANUARY 16, 2024

By Roger Vincent, Los Angeles Times (via TNS). In the uneasy tug of war between bosses and workers about how much time should be spent in the office, new evidence reveals that many employees think they should come in more often than they do. Office workers recently surveyed by an international architecture firm reported that they typically come into the office about half the time, but said they ideally needed to be there two-thirds of a typical workweek for their best productivity.

CTP

JANUARY 16, 2024

In the rush to finish last year strong, small business owners may now find themselves caught off guard by the legal requirements awaiting them in 2024. This is where you can provide additional value to your tax clients, just by familiarizing them with the new beneficial ownership information requirement. This comes as part of the Corporate Transparency Act, which seeks to crack down on illicit business activities using small businesses as a screen.

CPA Practice

JANUARY 16, 2024

By Claire Withycombe, The Seattle Times (TNS) The U.S. Supreme Court said Tuesday it would not review Quinn v. Washington , the lawsuit challenging Washington’s capital gains tax. The Legislature passed the tax in 2021 and payments first came due in April 2023. It’s a 7% tax on profits gained from the sale or exchange of stocks, bonds and other investments or tangible assets above $250,000.

Speaker: Abdi Ali, Sr. Lease Accounting Consultant

Join this insightful webinar with industry expert Abdi Ali, who will discuss the challenges that can arise from managing lease accounting with spreadsheets! He will share real-world examples of errors, compliance issues, and risks that may be present within your spreadsheets. Learn how these tools, while useful, can sometimes lead to inefficiencies that affect your time, resources, and peace of mind.

CTP

JANUARY 16, 2024

As 2024 kicks off, so do new legal requirements for small businesses. The Corporate Transparency Act took effect on January 1st, which means that many businesses will need to submit a Beneficial Ownership Information Report to the Financial Crimes Enforcement Network (FinCEN). These new regulations are intended to help the U.S. government identify small businesses that are actually a front for illicit business operations, such as money laundering.

CPA Practice

JANUARY 16, 2024

[ State CPA Societies in Action is a series of articles spotlighting the varied educational, advocacy, networking and professional activities of the state CPA societies across the U.S.] The Alabama Society of CPAs was formed in 1919 and adopted its recent bylaws on June 25, 1975, with the last revision completed on March 1, 2018. The purpose of the organization as stated in the bylaws, is “To unite the profession of accountancy in the State of Alabama; to promote and maintain high professional,

Accounting Today

JANUARY 16, 2024

Businesses eager for a tax deal announced by two powerful U.S. lawmakers can't yet bank on the corporate breaks.

CPA Practice

JANUARY 16, 2024

By Lizzy McLellan Ravitch, The Philadelphia Inquirer (via TNS). In a lawsuit filed last month, Crystal Kemp, a Jehovah’s Witness, alleged that her employer, SEPTA, the regional transit authority based in Philadelphia, refused to adjust her schedule so she could attend religious meetings on Sunday mornings and Tuesday evenings. She alleges she was ultimately terminated for refusing to work during those times.

Advertisement

Join us in this webinar, where we share best practices on how to think about the reconciliation work each month, when best to do reconciliations, how they should be prepared, and some common pitfalls to avoid. Learning Objectives: This course objective is to understand how to properly prepare and review balance sheet reconciliations and its impact on the financial statements.

Insightful Accountant

JANUARY 16, 2024

Recent filing instructions include a domestic filing exception, potentially exempting domestic passthrough entities if they meet the criteria.

Accounting Today

JANUARY 16, 2024

Retirement plan sponsors and their financial advisors receive guidance from the IRS on how the Secure 2.0 Act opened the door for "de minimis financial incentives.

GrowthForceBlog

JANUARY 16, 2024

8 min read Running a business is a complex endeavor, and most business leaders are experts in their own fields - not in finance.

Accounting Today

JANUARY 16, 2024

Hundreds of sub-postmasters in the U.K. were wrongfully prosecuted for theft and false accounting after computer glitches led to shortfalls in their accounts.

Speaker: David Warren and Kevin O’Neill Stoll

Transitioning to a usage-based business model offers powerful growth opportunities but comes with unique challenges. How do you validate strategies, reduce risks, and ensure alignment with customer value? Join us for a deep dive into designing effective pilots that test the waters and drive success in usage-based revenue. Discover how to develop a pilot that captures real customer feedback, aligns internal teams with usage metrics, and rethinks sales incentives to prioritize lasting customer eng

ThomsonReuters

JANUARY 16, 2024

Jump to: What are the benefits of remote 1040 client collaboration? How mobile apps meet client expectations Streamlining your 1040 source document collection According to a recent survey by Protiviti and The Institute of Internal Auditors (IIA) , almost 75% of respondents, including 82% of technology audit leaders, view cybersecurity as a high-risk area, and with good reason.

Accounting Today

JANUARY 16, 2024

The Connecticut-based financial advisory firm has added a CPA firm and a registered investment advisory firm.

Withum

JANUARY 16, 2024

Massachusetts Companies The Massachusetts Life Sciences Center Tax Incentive Program application window is now open and is offering lucrative tax savings to eligible companies. Companies that apply and are accepted into this program can benefit from various tax benefits, such as: Life Sciences Investment Tax Credit (pursuant to M.G.L c. 62, §6(m) and c. 63, §38U) Extension of Net Operating Losses (NOLs) from 5 to 15 years (pursuant to M.G.L. c. 63, §30(17)) Designation as R&D Company for Sal

Accounting Today

JANUARY 16, 2024

Kevin Ellis is adamant that younger staff in particular should avoid the temptation of working from home.

Advertisement

The first Market Momentum Index: AI and Unstructured Data Management, conducted by Deep Analysis with support from AIIM and M-Files, surveyed 500 enterprises across various industries to assess their readiness to employ AI. The results reveal that AI is already far more embedded into organizations' operations than previously realized. These findings and more insights have been brought to you in the "Market Momentum Index: AI and Unstructured Data Management.

Insightful Accountant

JANUARY 16, 2024

Murph is inviting you to a ProAdvisor Meet-up for an "open microphone' edition of QB Talks. He wants your thoughts on Awards, ProAdvisor Program changes and QuickBooks Desktop Pro/Premier and Payroll changes.

Accounting Today

JANUARY 16, 2024

The New York-based Top 20 Firm has acquired a firm headquartered in Farmington, Connecticut.

Nancy McClelland, LLC

JANUARY 16, 2024

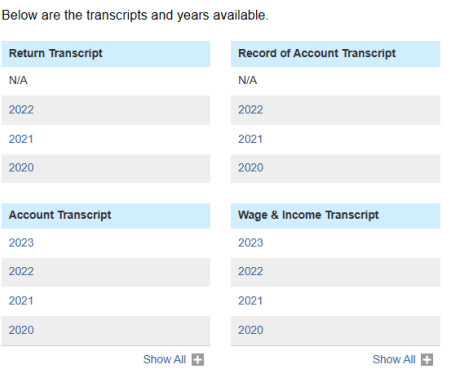

Photo by Thomas Lefebvre “What is an IRS Account Transcript and Why Do I Need One?” During the pandemic, we began requiring all clients to submit a copy of their IRS Account Transcript along with their Tax Organizer and other annual tax prep documentation. Initially, this was to confirm the amounts of stimulus payments and child tax credit payments.

Accounting Today

JANUARY 16, 2024

A set of surveys has found that businesses are highly optimistic about the ability for generative AI to drive profits, but they're highly pessimistic about the wider social effects.

Speaker: Mark Stovel

When it comes to automating, many firms focus on finding the latest tech, believing that efficiency is something achieved through new tools. Yet true efficiency is achieved by delivering real value to clients, not merely by upgraded systems. Without a clear approach, no level of automation can overcome the complexities of serving every client’s needs.

ThomsonReuters

JANUARY 16, 2024

Jump to: What is wellness? Why is overall accountant wellness important? Making occupational wellness a priority Tax and accounting professionals are known for working hard, especially during tax season. But this can take a toll on their well-being and lead to burnout. Many talented junior staff quit their jobs and shift careers because they can’t cope with the stress and the lack of work-life balance.

Accounting Today

JANUARY 16, 2024

Investors must account for the impact of transition risks on existing investments, including potential costs to remediate or decommission assets that would otherwise remain productive.

ThomsonReuters

JANUARY 16, 2024

Jump to: What are the benefits of remote 1040 client collaboration? How mobile apps meet client expectations Streamlining your 1040 source document collection Ensuring your remote 1040 client collaboration process is secure How to manage client resistance to new tech Choosing the right digital solutions for your 1040 process As a tax professional, you can probably think of several ways that digitization has made your job easier.

CPA Practice

JANUARY 16, 2024

By Sabah Meddings and Katherine Griffiths, Bloomberg News (TNS) Junior staff should spend more time in the office to get quicker promotions, the U.K. boss of accounting giant PricewaterhouseCoopers said, as AI is poised to take on routine tasks traditionally given to younger workers. Generative AI is removing “tasks that in the past our more junior staff trained and cut their teeth on,” Kevin Ellis, the chair of PwC UK, said during an interview at the World Economic Forum in Davos, Switzerland.

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

Let's personalize your content