Are accountants ready for Making Tax Digital? New survey reveals gap in preparedness

Accounting Insight

JANUARY 31, 2025

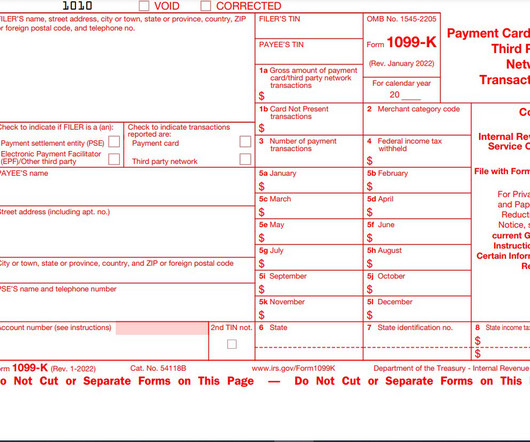

A new survey conducted by IRIS Software Group (IRIS) found that more than two in five accountants (42%) are not yet prepared for the upcoming Making Tax Digital (MTD) requirements set to take effect in April 2026. IRIS findings come despite the governments push to digitalise and streamline tax reporting. According to IRIS survey, 44% of respondents said they felt somewhat prepared for the forthcoming MTD requirements, while only 10% considered themselves very prepared.

Let's personalize your content