Treasury and IRS Issue Guidance on the Qualified Alternative Fuel Vehicle Refueling Property Credit

RogerRossmeisl

JANUARY 21, 2024

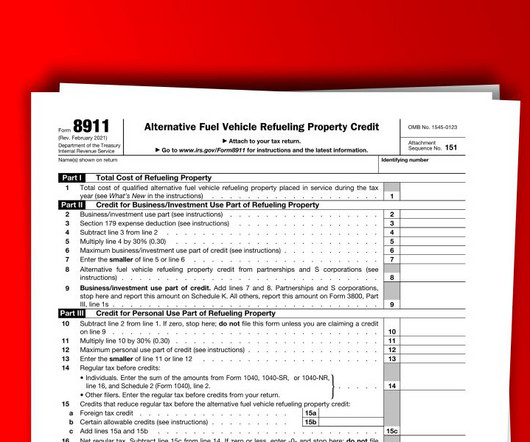

As reported via IR-2024-16 on 1/19/2024 The Internal Revenue Service and the Department of the Treasury today issued Notice 2024-20 to provide guidance on eligible census tracts for the qualified alternative fuel vehicle refueling property credit (the tax credit applicable to the installation of EV chargers) and to announce the intent to propose regulations for the credit.

Let's personalize your content