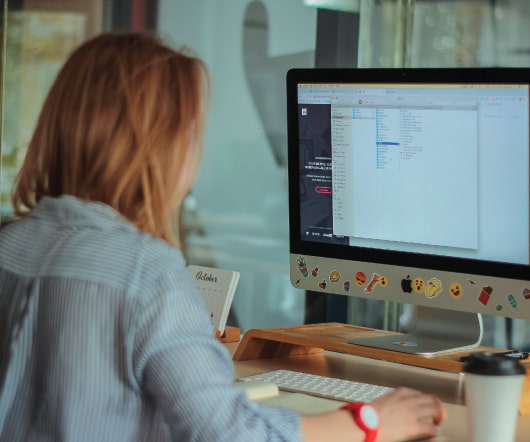

Types of Reports in QuickBooks: A Comprehensive Guide

AccountingDepartment

DECEMBER 19, 2023

Reports play a crucial role in managing a business effectively, and QuickBooks provides a wide range of reports that can help small and medium-sized businesses track their financial performance and make informed decisions. These reports provide valuable insights into various aspects of the business, such as income, expenses, sales, inventory, and payroll.

Let's personalize your content