The past and future of accounting data

Accounting Today

JUNE 28, 2024

There has been a revolution in data accessibility over the past 40 years, and it's creating major opportunities for accountants.

Accounting Today

JUNE 28, 2024

There has been a revolution in data accessibility over the past 40 years, and it's creating major opportunities for accountants.

MyIRSRelief

JUNE 28, 2024

Tax audits can be a daunting experience for any taxpayer. The California Franchise Tax Board (FTB) conducts audits to ensure compliance with state tax laws and to verify the accuracy of tax returns. Understanding the audit process and knowing your rights can significantly ease the stress associated with an audit. One of the most effective ways to navigate a tax audit is by enlisting the help of an enrolled agent (EA).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JUNE 28, 2024

Due to extensive interest, Accounting Today is extending the deadline for submissions for its annual Managing Partner Elite list to the end of the day on Monday, July 8.

CPA Practice

JUNE 28, 2024

Hosts Randy Johnston and Brian Tankersley, CPA, discuss several changes coming to QuickBooks in 2024, including in pricing and strategic changes in the organization. Use the video player below to watch, or the podcast player below to listen to the podcast. Or use the below podcast player to listen: Transcript (Note: There may be typos due to automated transcription errors.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Withum

JUNE 28, 2024

Withum is proud to announce its 2024 New Partner Class. It’s my privilege to introduce Withum’s 2024 New Partner Class. We are celebrating these individuals for reaching a career milestone they have worked tirelessly toward. Each person on this list has exhibited a strong entrepreneurial spirit, dedication to their profession, and long-lasting grit that I am sure will propel them and our firm through many years of success.

CPA Practice

JUNE 28, 2024

The Department of the Treasury and the Internal Revenue Service have issued final regulations that provide taxpayers and tax professionals with guidance on how to report and pay the 1 percent excise tax owed on corporate stock repurchases. The Inflation Reduction Act imposed a new excise tax on stock repurchases equal to 1 percent of the aggregate fair market value of stock repurchased by certain corporations during the taxable year, subject to adjustments.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

CPA Practice

JUNE 28, 2024

Increased tech skills, the use of artificial intelligence (AI), and surviving the economy dominated the results of the 2024 Intuit QuickBooks Accountant Technology Survey of 700 U.S. accountants. While the survey showed the profession has felt the shockwaves of changing economic conditions, failure to keep pace with technological advancements is the greatest risk to the industry, ahead of higher interest rates, the rising cost of goods, and widespread hiring challenges (Exhibit 1).

AccountingDepartment

JUNE 28, 2024

We are thrilled to announce that our season 1 finale, Episode 24, of our podcast, Beyond the Books , is now live and ready for your listening pleasure.

Accounting Today

JUNE 28, 2024

The Treasury and the Internal Revenue Service issued final regulations on reporting by brokers on dispositions of digital assets such as cryptocurrency for customers in certain sale or exchange transactions.

Randal DeHart

JUNE 28, 2024

Running a small construction business comes with unique challenges, and dealing with toxic employees is undoubtedly one of the trickiest. A single troublesome team member can disrupt productivity, affect team morale, and ultimately harm your business's success. These individuals can create a hostile work environment, lower morale, and reduce productivity.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

JUNE 28, 2024

The 6-3 decision could reduce the commission's leverage to extract high-dollar settlements.

GrowthForceBlog

JUNE 28, 2024

9 min read June 28th, 2024 Every year, business leaders in the construction industry fight a constant battle to beat out the competition and win work to cover their costs, stay operational, keep their crews working, and turn a profit. For many construction business owners, winning the battle means submitting as many bids as possible and hoping, fingers crossed, to win enough projects to survive another year.

Accounting Today

JUNE 28, 2024

A divided U.S. Supreme Court threw out a decades-old legal doctrine that empowered federal regulators to interpret unclear laws, issuing a blockbuster ruling that will constrain environmental, consumer and financial-watchdog agencies.

Going Concern

JUNE 28, 2024

Poor Andy Baldwin, he’s gonna hate this news. As former cheerleaders of Project Everest make their hasty exits , Carmine Di Sibio’s successor made a strong statement to EY people yesterday that a split of audit and consulting practices is not on the menu. Her comments sound a lot like what was said by Deloitte Global CEO Joe Ucuzoglu about his firm’s superior “multidisciplinary private partnership model” when the Green Dot and P-Dubs were busy rebuking the EY split

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Accounting Today

JUNE 28, 2024

The need for a revolutionary approach in fraud prevention is clear.

Cherry Bekaert

JUNE 28, 2024

Contributors: Priyanka Munipalle, Senior Manager, Information Assurance & Cybersecurity Services Third-Party Risk Management (TPRM) is critical for organizations to effectively manage risk. The challenge is that effective TPRM requires coordination of executive leadership, legal, compliance and risk management teams across the organization. Teams often find themselves allocating time and effort to certain aspects of TPRM, potentially overlooking more impactful strategies for managing vendor

Accounting Today

JUNE 28, 2024

Plus, Solix Technologies touts enterprise-grade document management on a budget; and other accounting technology news.

Canopy Accounting

JUNE 28, 2024

What qualifications are necessary to become an enrolled agent? An enrolled agent is a federally certified tax practitioner who can represent taxpayers before all administrative levels of the Internal Revenue Service. Enrolled agents help individuals, corporations, and trusts when audited by the IRS. Enrolled agents specialize in tax resolution. The status of an enrolled agent is the highest credential given by the IRS.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

ThomsonReuters

JUNE 28, 2024

Jump to: A look at the tax research landscape Understanding the benefits of AI for tax and accounting professionals A deeper look at how AI can transform tax research How AI can enhance client service Are you ready to harness the power of AI? In recent years, AI has become a transformative force across various industries — and the tax and accounting profession is no exception.

Withum

JUNE 28, 2024

Many people need a professional to help with their personal financial planning. Following is a checklist of what to bring to your first meeting. The better prepared you are, the better the meeting will be. Financial Planning Checklist A personal financial statement if you have one. Many of the following items provide the backup of your net worth. If you do not have a financial statement the planner should be able to prepare one from the information you provide, but that will delay the start of t

Randal DeHart

JUNE 28, 2024

Running a small construction business comes with unique challenges, and dealing with toxic employees is undoubtedly one of the trickiest. A single troublesome team member can disrupt productivity, affect team morale, and ultimately harm your business's success. These individuals can create a hostile work environment, lower morale, and reduce productivity.

Cherry Bekaert

JUNE 28, 2024

Contributors: Carole Sorensen, Senior Manager, Risk & Accounting Advisory Services In the aftermath of the Enron scandal and other widespread fraud and failures, the Sarbanes-Oxley (SOX) Act was enacted to improve corporate transparency and accountability in financial reporting and to prevent corporate fraud from occurring. Although SOX compliance is now a requirement for all publicly traded companies in the U.S., the necessary SOX audit process can be a time-consuming and costly undertaking

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

CPA Practice

JUNE 28, 2024

By Gail Cole. June 21, 2024, marked the sixth anniversary of South Dakota v. Wayfair, Inc., the pivotal United States Supreme Court decision that enabled states to tax remote sales. Some states and businesses are still grappling with the outcome of the ruling, even six years on. Keep reading for a recap of the Wayfair decision , how Wayfair affected sales tax , and a summary of some of the most contentious ramifications stemming from remote sales tax requirements.

Cherry Bekaert

JUNE 28, 2024

Podcast host Danny Martinez, Managing Director and Government & Public Sector Accounting Advisory Lead, is joined by Lauren Strope, Partner, and Jack McKee, Advisory Senior Manager to recap and reflect on their time at the 118th Government Finance Officers Association (GFOA) National Conference. Held in Orlando, FL, the conference had over 7,000 attendees, with 50 states represented and chances for continuing professional education (CPE), networking and learning.

Menzies

JUNE 28, 2024

Menzies LLP - A leading chartered accountancy firm. Life is unpredictable but we can protect our loved ones by securing their future with life insurance. What is Life Insurance Life insurance provides you with a lump sum benefit in the event of your death or sometimes terminal illness. Protecting loved ones Life insurance ensures your loved ones are financially protected in the event of your death.

Cherry Bekaert

JUNE 28, 2024

Processes That Can Transform Your Back Office and Beyond In the modern business landscape, accounting and finance transformation has emerged as a pivotal strategy fueled by the emphasis on automation, standardization, scale, efficiency and cost reduction. The term “transformation” in today’s world has largely been defined as the optimization of the organization’s use of talent, technology and process.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Menzies

JUNE 28, 2024

Menzies LLP - A leading chartered accountancy firm. The general election is a crucial point in the UK’s transition to Net Zero. When the UK wrote it into Law, it was a step ahead of all other major economies at the time. However, it feels as though not a huge amount of progress has been made since then. Rishi Sunak rolled back on certain policies and supported oil & gas expansion despite advice from the Climate Change Committee.

Going Concern

JUNE 28, 2024

Footnotes is a collection of stories from around the accounting profession curated by actual humans and published every Friday at 5pm Eastern. While you’re here, subscribe to our newsletter to get the week’s top stories in your inbox every Tuesday and Friday. Comments are closed on Friday Footnotes and the Monday Morning Accounting News Brief by default.

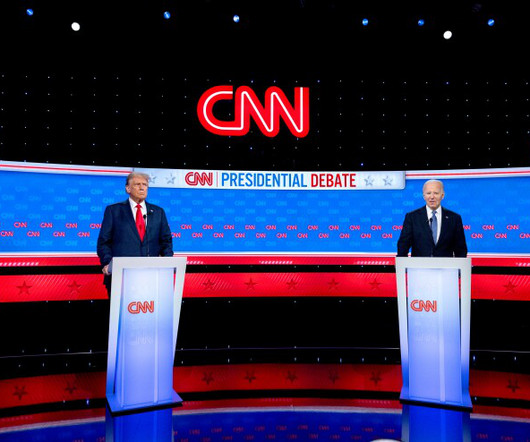

Accounting Today

JUNE 28, 2024

The contentious debate Thursday evening between President Joe Biden and former President Donald Trump included some discussion on tax policy, but Biden's unsteady delivery left many Democrats worried about his ability to continue his campaign.

CPA Practice

JUNE 28, 2024

By David G. Savage, Los Angeles Times (TNS) In a major victory for business, the Supreme Court Friday gave judges more power to block new regulations if they are not clearly authorized by federal law. The court’s conservative majority overturned a 40-year-old rule that said judges should defer to agencies and their regulations if the law is not clear.

Speaker: Joe Wroblewski, Senior Sales Engineer

Is your tech stack working for you—or are you working for it ? 🤖 In today’s world of automation and AI, technology should simplify workflows—not add complexity. Seamless integration and interconnectivity are key to maximizing productivity, optimizing workflows, and improving collaboration. Join expert Joe Wroblewski for a practical and insightful session on how you can build a smarter, more connected tech stack that drives efficiency and long-term success!

Let's personalize your content