Turning up the temperature on auditors

Accounting Today

MARCH 4, 2024

A roundup of the flood of sanctions, fines and penalties issued over the past year or so by the PCAOB.

Accounting Today

MARCH 4, 2024

A roundup of the flood of sanctions, fines and penalties issued over the past year or so by the PCAOB.

CPA Practice

MARCH 4, 2024

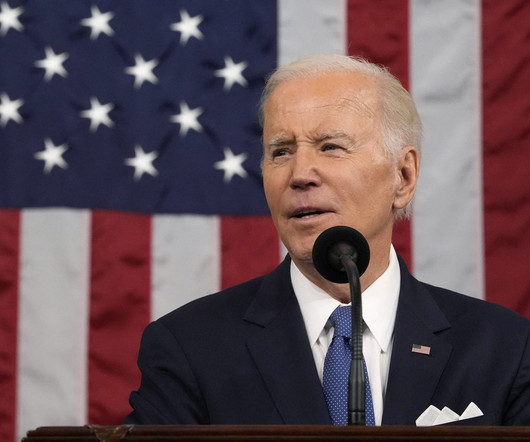

By Justin Sink, Bloomberg News (TNS) President Joe Biden will advocate plans to increase taxes on the wealthy and corporations as well as to lower prescription drug prices in his State of the Union address this week, in what aides describe as an effort to lay out second term proposals for protecting and implementing his economic agenda. Biden, who will speak before both houses of Congress on Thursday night, is seeking to convince voters that his administration’s achievements merit another four y

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

MARCH 4, 2024

KPMG and its partner Adrian Wilcox failed to audit the advertising agency with sufficient professional skepticism, according to the Financial Reporting Council.

CPA Practice

MARCH 4, 2024

By Venus Wu and Crystal Li. In October 2023, California became the first state to pass regulations for reporting greenhouse gas emissions (GHGs). The regulations are outlined in two bills, the Climate Corporate Data Accountability Act (SB-253) and the Climate-Related Financial Risk Act (SB-261). These laws apply for both private and public U.S. companies that do business in California (not just those with a physical presence in California).

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

MARCH 4, 2024

When someone leaves, they need to be replaced and with that comes orientation, training, introduction to your systems and procedures and to your culture.

Insightful Accountant

MARCH 4, 2024

We are excited to announce the members of Insightful Accountant’s inaugural Advisor Panel. The primary purpose of the panel is to help us stay “in touch” with the audience we serve and to continue to provide the content you, our audience, want.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Going Concern

MARCH 4, 2024

In an unusually humble press release that doesn’t use the words “leading accounting and advisory firm” in the first sentence like every other firm does, Crowe announced announced the hiring of Mike Edwards as the next managing principal of Consulting. When he assumes the role on April 1, he’ll be leading a practice that consists of 150 partners and 2,000 professionals.

Accounting Today

MARCH 4, 2024

The regulatory environment around accounting is getting stricter, as the IRS, the SEC and the PCAOB crack down.

Withum

MARCH 4, 2024

Withum is excited to share that Michael George , Partner, has joined the Healthcare Services Team as a strategic leader. Formerly an audit partner at a Big Four firm, Michael has deep technical and industry expertise, including having previously led Healthcare-centered practices. He has a reputation for excellent client service, working to deliver transformative audit and consulting services.

Accounting Today

MARCH 4, 2024

There's a growing sense of unease among asset managers that companies with conspicuously small tax bills pose a financial liability too big to ignore.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Insightful Accountant

MARCH 4, 2024

Gary and Val take a deep dive into the Zoho products, why accounting professionals may want to consider it for their practice and/or their clients (here's a hint - low cost, high value, and a broad range of products.) Take a look at this episode!

Accounting Today

MARCH 4, 2024

The development comes as Trump is appealing his loss at the non-jury trial, which resulted in a $454 million judgment against him and his company for inflating the value of his assets by billions of dollars a year for more than a decade.

Insightful Accountant

MARCH 4, 2024

Last week our calendars all marked a unique day that only comes about once every four years. Leap Day, February 29th, this day intends to sync the calendar with the solar year. It still has its affects tax planning, so discuss with clients.

Accounting Today

MARCH 4, 2024

What goes into the recipe for accounting firm success? Randy Crabtree goes over the ingredients, and how best to combine them.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

ThomsonReuters

MARCH 4, 2024

Preparers have the following perfection periods to correct and retransmit tax returns or extensions that were filed on time but were rejected by the filing deadline. The IRS considers returns that are resubmitted electronically during the applicable timeframe as timely-filed returns. What is the e-file rejection grace period for federal tax returns?

Xero

MARCH 4, 2024

The latest Xero Small Business Insights (XSBI) data shows just how challenging conditions became for small businesses, and their customers, towards the end of 2023. We’ve summarised the major trends and also have some tips for you on how to navigate the current headwinds. Despite improvements over the past year, inflation (or cost-of-living) pressures remained in late 2023.

Cherry Bekaert

MARCH 4, 2024

On December 28, 2023, the Internal Revenue Service (IRS) released proposed regulations to IRC Section 166 to provide guidance on when debts could be conclusively presumed to be wholly or partially worthless. The proposed regulations will provide an option for regulated financial companies and members of regulated financial groups to use a new method of accounting for federal tax purposes that will align the allowable bad debt deductions to GAAP (book) charge-offs.

IgniteSpot

MARCH 4, 2024

In the entrepreneurial journey, finding innovative avenues to build wealth and enhance business profitability is paramount. Amidst various strategies, one often overlooked is the power of starting a podcast. Beyond being a medium for sharing stories or industry insights, podcasting holds significant financial benefits for businesses, especially for those led by entrepreneurs striving for growth and profitability.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

CPA Practice

MARCH 4, 2024

By Jo Constantz, Bloomberg News (TNS) Mistakes continued to pile up this earnings season in the wake of Lyft Inc.’s market-roiling typo : Planet Fitness Inc., Mister Car Wash Inc. and Rivian Automotive Inc. all had to correct their quarterly earnings statements. These types of errors shake investor confidence and in extreme cases can result in heavy fines from the U.S.

Accounting Today

MARCH 4, 2024

Jackson Thornton acquired MST CPAs & Advisors; and HHM CPAs merged in Bizzell, Neff & Galloway.

CPA Practice

MARCH 4, 2024

By Richard J. Jackson. Auditors, like so many others today, are seizing the opportunity to transform how they work by adopting artificial intelligence. This powerful tool can drill down into millions of lines of data, flagging potential anomalies in minutes for auditors to examine instead of relying on the manual selection and review of data samples ― expending significantly more time looking for the proverbial “needle in a haystack.

Accounting Today

MARCH 4, 2024

The Top 100 Firm also announced the first three member firms of the network, which will focus on food and agriculture clients.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

CPA Practice

MARCH 4, 2024

By Matt Kanas. In the accounting world, the ground beneath our feet is shifting faster than ever, thanks to the whirlwind of advancements in technology such as AI, automation, blockchain, and more. Accountants and firms face daunting challenges around operational approaches, client relationships, and staff retention. But with the right tools and a mindset shift, the changes in our profession can open doors to unprecedented efficiency and insight.

Accounting Today

MARCH 4, 2024

The Chicago-based agricultural commodity trader said the issue with internal controls relates to the way it reports sales between segments.

CPA Practice

MARCH 4, 2024

Breaking news: Accountants aren’t robots—they’re human beings and sometimes they make mistakes at work. But a new survey from research and consulting firm Gartner finds that capacity constraints are the leading factor to more errors being made than usual in accounting and finance departments. The survey of 497 professionals working in the controllership function, conducted last July, revealed that 18% of accountants said they make financial errors at least daily, with a third making at least a f

Anders CPA

MARCH 4, 2024

Contingent fee attorneys often feel like law firm forecasting is out of reach. There are so many question marks: How much are their cases worth? How much money is coming in this month – and how much needs to be coming in? Contingent firms face unique challenges. They often don’t know the value of the universe of their cases. Because they can’t forecast cash, they have to finance their own cases.

Speaker: Joe Wroblewski, Senior Sales Engineer

Is your tech stack working for you—or are you working for it ? 🤖 In today’s world of automation and AI, technology should simplify workflows—not add complexity. Seamless integration and interconnectivity are key to maximizing productivity, optimizing workflows, and improving collaboration. Join expert Joe Wroblewski for a practical and insightful session on how you can build a smarter, more connected tech stack that drives efficiency and long-term success!

Going Concern

MARCH 4, 2024

Hi! It’s Monday which means it’s my job to go round up some headlines for you to start the week. Did anyone get anything for Employee Appreciation Day? Let me know. Let’s See What You Got For Employee Appreciation Day The IRS has a new chief counsel who enjoys boomeranging back and forth to EY : Former EY principal Marjorie Rollinson spent a quarter-century at EY, rising to principal, before joining the IRS in 2013.

CPA Practice

MARCH 4, 2024

As of Feb. 24, 943,000 taxpayers had filed returns this tax season through Free File , a 9.7% increase from last year’s comparable period when 860,000 tax returns were filed, the IRS reported on Friday. The increase in Free File usage comes as the IRS released new data on how the 2024 filing season is progressing. Through Feb. 24 , the IRS had delivered more than 28.9 million refunds to taxpayers worth $92.9 billion.

Accounting Insight

MARCH 4, 2024

Continuing its global rollout, the award-winning CCH iFirm is set to transform British tax and accounting practices by improving their efficiency and productivity Wolters Kluwer Tax & Accounting (TAA) has launched CCH iFirm ®, its award-winning cloud-based practice management and compliance software platform, in the U.K. The integrated and scalable platform is designed to help make tax and accountancy practices more efficient and productive.

Withum

MARCH 4, 2024

In this on-demand webinar, Withum’s Tech Advisory Team examine the most common control failures they come across in SOC 2 examinations. They will discuss the 10 most common control failures seen in SOC 2 reports and how to avoid them. Already Registered? Click Here View On-Demand Webinar This on-demand webinar is perfect for tech startups and companies who want to learn more about SOC 2 reports as well as companies that undergo annual SOC 2 reports and are looking for areas of improvement.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

Let's personalize your content