Becoming an Accounting Firm of the Future: The Benefits of Embracing New Technology

Insightful Accountant

DECEMBER 27, 2023

The Bonadio Group's Jennifer Wood takes a deep dive into the benefits of embracing new technology today.

Insightful Accountant

DECEMBER 27, 2023

The Bonadio Group's Jennifer Wood takes a deep dive into the benefits of embracing new technology today.

Accounting Today

DECEMBER 27, 2023

Technology developers who serve the accounting profession share the developments they have planned for 2024.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Going Concern

DECEMBER 27, 2023

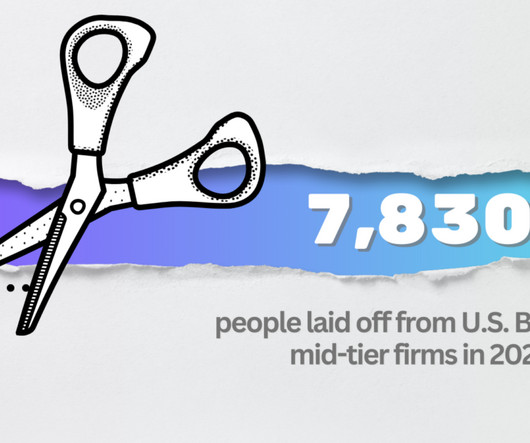

Today is December 27, assuming there is no accounting firm in the entire country shitty enough to lay people off just days before the end of the year (a generous assumption), we should be able to tally up how many people were shown the door in 2023. These are U.S. numbers for Big 4 and mid-tier firms only, if we missed some get in touch. Also, these layoff numbers include only layoffs that were A) confirmed and B) counted by the firm as layoffs, meaning this year’s aggressive PIP usage and

Accounting Today

DECEMBER 27, 2023

The Internal Revenue Service's Exempt Organizations and Government Entities unit has published two new technical guides aimed at nonprofits.

Speaker: Danny Gassaway and Wayne Richards

Finance leaders are prioritizing efficiency and digital transformation, yet many hesitate to automate due to uncertainty. Without a clear understanding of its impact, organizations risk falling behind competitors who are leveraging automation to drive productivity and cost savings. Join Wayne Richards and Danny Gassaway from AvidXchange for a practical guide on bringing accounts payable (AP) automation to your organization.

Insightful Accountant

DECEMBER 27, 2023

One less excuse for Desktop Users when it comes to migrating to QBO. There is now Balance Sheet Budgeting available in QBO Plus and QBO Advanced.

Accounting Today

DECEMBER 27, 2023

The Internal Revenue Service has updated its frequently asked questions to offer more guidance on what kinds of components can be used in electric vehicles to qualify for tax credits.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Accounting Today

DECEMBER 27, 2023

Here's how artificial will really impact accountants and what to do about it.

CPA Practice

DECEMBER 27, 2023

By Ali Donaldson, Inc. (TNS) The IRS is offering businesses a big present just in time for Christmas: a chance to avoid an audit or criminal investigation. The agency launched a new program to help businesses that applied for “questionable” employee retention credits (ERC) and received them, particularly companies that may have filed for the credits in error.

Accounting Today

DECEMBER 27, 2023

Recent data has found that accountants complete the most tasks on Tuesday, and the least on Friday.

CPA Practice

DECEMBER 27, 2023

Do you want to transfer wealth to other family members without dire tax consequences? One of the easiest ways to do it, and one of the most effective, is to simply give lifetime gifts to other family members. If you stay within the tax law boundaries, these lifetime gifts will qualify for the annual gift tax exclusion. And even if you exceed the limits, the remainder is usually covered by the unified estate and gift tax exemption.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Accounting Today

DECEMBER 27, 2023

The IRS-sponsored program relies on hundreds of dedicated accounting volunteers to ensure filers receive the crucial and necessary tax refunds they depend upon and ultimately help people fight poverty and food insecurity.

CPA Practice

DECEMBER 27, 2023

By Rachel Christian, Bankrate.com (via TNS). As the New Year approaches, many people are addressing financial resolutions. But a significant number of Americans feel like they’re behind on achieving their money goals. About 80% of Americans didn’t increase their emergency savings this year, according to a recent Bankrate survey. Nearly one-third of households (32%) have less emergency savings now than at the start of 2023.

Accounting Today

DECEMBER 27, 2023

The Internal Revenue Service has extended some of the deadlines for qualified intermediaries, withholding foreign partnerships and withholding foreign trusts.

CPA Practice

DECEMBER 27, 2023

The American Institute of CPAs recently submitted a comment letter to the U.S. Department of Labor related to RIN 1210-AC02, Retirement Security Rule: Definition of an Investment Advice Fiduciary. The letter states support for the proposed rule, particularly for fiduciary relationships acting in the public’s best interest with respect to any advice to the public.

Speaker: Jennifer Hill

Payroll compliance is a cornerstone of business success, yet for small and midsize businesses, it’s becoming increasingly challenging to navigate the ever-evolving landscape of federal, state, and local regulations. Mistakes can lead to costly penalties and operational disruptions, making it essential to adopt advanced solutions that ensure accuracy and efficiency.

Accounting Today

DECEMBER 27, 2023

CBIZ MHM's Latino-owned business service team has Southern California roots and national ambitions.

CPA Practice

DECEMBER 27, 2023

It’s that time of year again. The end of each year is the deadline to take required minimum distributions from funds held in individual retirement arrangements and other retirement plans. The IRS recently sent out a reminder, which applies to taxpayers aged 73 or older (born before 1951), and noted new requirements under the law beginning in 2023. Required minimum distributions , or RMDs, are amounts that many retirement plan and IRA account owners must withdraw each year.

Accounting Today

DECEMBER 27, 2023

Income equality; disclosing crypto; meetings are a waste of time; and other highlights from our favorite tax bloggers.

Withum

DECEMBER 27, 2023

We no longer have debtor’s prisons, but people deep in debt are prisoners of a sort. Whatever is owed is an encumbrance of your future earnings, and the work you do to acquire funds to repay your debt takes away some of your freedom. In effect, you are placed in a “prison” in that you are working to reduce debt acquired somewhere along the way. One way to avoid this is to not borrow or not take on debt.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Accounting Today

DECEMBER 27, 2023

The residential landlord with thousands of properties across Germany has been under intense public scrutiny since October 2021.

Insightful Accountant

DECEMBER 27, 2023

Stratafolio is an online software solution designed specifically for people who own or manage commercial real estate, use QuickBooks, and want to streamline their operations to save time, increase profits, and reduce manual work.

Accounting Today

DECEMBER 27, 2023

In the quest for enhanced corporate sustainability, the integration of innovative technologies is ushering in a new era of reporting capability and transparency.

Ryan Lazanis

DECEMBER 27, 2023

Using various marketing tactics and resources sometimes won't guarantee results. As such, you need to consider this strategy. The post Do This When Your Marketing Isn’t Working appeared first on Future Firm.

Speaker: Debra L. Robinson

CPAs know the drill: taxes, compliance, rinse, repeat. But what about the sneaky cash flow that’s quietly messing with your organization’s success? It’s time to step into the spotlight and expose the “dirty little secrets” of cash flow to fuel strategic growth. By upskilling your accounting practices and shifting focus from tax compliance to the strategic movement of money, you can transform your role from reactive accountant to proactive financial strategist.

CPA Practice

DECEMBER 27, 2023

The Treasury Department and Internal Revenue Service issued proposed regulations just before Christmas for the tax credit for the production of clean hydrogen. The Inflation Reduction Act (IRA) of 2022 provides a production credit for each kilogram of qualified clean hydrogen produced by a taxpayer at a qualified clean hydrogen production facility. The credit amount is dependent on the emissions intensity of the hydrogen production process and the taxpayer’s compliance with prevailing wage and a

Shay CPA

DECEMBER 27, 2023

If you’ve run out of runway and you’re out of options, it might be time to hang up your hat. Don’t fling it onto that hat rack just yet, though. Before you can shut down a tech company (or any company, for that matter), you need to take certain steps. Failing to follow the proper procedures can lead to headaches down the road. We’ve even seen founders have issues crop up years after they shuttered a company.

CPA Practice

DECEMBER 27, 2023

Retailers have been focused on efforts to mitigate returns, as total returns for the industry amounted to $743 billion in merchandise in 2023, according to a report released today by the National Retail Federation and Appriss Retail. As a percentage of sales, the total return rate for 2023 was 14.5%. According to the report, for every $1 billion in sales, the average retailer incurs $145 million in merchandise returns.

Accounting Today

DECEMBER 27, 2023

Under the draft proposal from the Treasury Department, hydrogen projects would need to adhere to strict environmental requirements.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

CPA Practice

DECEMBER 27, 2023

Christine Maurus Bloomberg News (TNS) Home prices in the U.S. rose for a ninth straight month, reaching a fresh record as buyers battled for a stubbornly tight supply of listings. A national gauge of prices rose 0.6% in October from September, according to seasonally adjusted data from S&P CoreLogic Case-Shiller. A seasonally adjusted measure of prices in 20 of the largest cities also rose 0.6%.

Let's personalize your content