The biggest decisions young accountants have to make

Accounting Today

MARCH 28, 2024

Experts share what young accountants should look for in a firm and how to approach their careers.

Accounting Today

MARCH 28, 2024

Experts share what young accountants should look for in a firm and how to approach their careers.

AccountingDepartment

MARCH 28, 2024

Efficient financial processes are essential for the success and growth of any business. However, managing tasks like invoicing, payroll management, and financial reporting can be time-consuming and complex, diverting valuable resources from core operations. This is where client accounting services come into play. In this blog post, we will explore how client accounting services (CAS) streamline financial processes for businesses, highlighting the benefits of outsourcing accounting functions to i

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

MARCH 28, 2024

Farming it out; short circuited; California dreamin'; and other highlights of recent tax cases.

Going Concern

MARCH 28, 2024

The IRS has announced via press release that Criminal Investigation (CI) has been busy investigating what could end up being almost $9 billion of fraud related to various COVID measures introduced four years ago. The announcement comes days after the IRS ended the Voluntary Disclosure Program that allowed ineligible businesses to repay claimed Employee Retention Credit (ERC) without penalty as long as the business reveals who pushed them to claim ERC in the first place.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

MARCH 28, 2024

New SEC cybersecurity disclosure rules are now in effect. Here's what CFOs should be doing to comply with the new requirements.

CPA Practice

MARCH 28, 2024

Suppose you’re in the midst of divorce proceedings and trying to divvy up assets in a reasonable manner. Some are easily divided, but others can cause more complications. For instance, how does one spouse gain access to the vested benefits in the other spouse’s 401(k) plan? In this case, a qualified domestic relations order, QDRO for short, may do the trick.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

CPA Practice

MARCH 28, 2024

U.S. business executives worry about potential risks from the widening use of generative artificial intelligence programs such as ChatGPT and Microsoft Copilot, but more than a quarter of them say that hasn’t stopped their organizations from experimenting with the game-changing technology in many core business functions, a recent survey by AICPA & CIMA found.

Accounting Today

MARCH 28, 2024

NetSuite, during its SuiteConnect event in New York City today, announced that it is expanding its generative AI-driven Text Enhance feature with over 200 new places it can be applied.

CPA Practice

MARCH 28, 2024

Donald Scholl, who provided management consulting and training services to hundreds of public accounting firms during the course of his more than 40-year career and created many development programs for CPAs, including the popular Management for Results, has passed away. He was 88 years old. Scholl’s son, Jonathan, posted the news on Facebook (below) this morning, saying his dad died the morning of March 27 in his sleep at home.

Accounting Today

MARCH 28, 2024

The Public Company Accounting Oversight Board sanctioned PricewaterhouseCoopers' member firms in the U.S. and Australia over auditing quality control violations, imposing a $2.75 million and $600,000 penalty.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

LSLCPAs

MARCH 28, 2024

It’s that time of year when we remind you to make any final contributions to your prior year IRA, Roth, or HSA accounts. These contributions are due by the first due date of personal tax returns, so April 15th for most of the country. IRA and Roth Contributions The allowable 2023 contribution amount is $6500. The post Time Sensitive Opportunities Regarding IRAs: 2023 IRA and HSA Contribution Deadlines appeared first on LSL CPAs.

Accounting Today

MARCH 28, 2024

BookSmarts Accounting CEO Jenny Groberg managed to survive a traumatic brain injury and build a firm that empowers women accountants.

Cherry Bekaert

MARCH 28, 2024

How Did the IRA Change Elective and Direct Pay? The Inflation Reduction Act of 2022 (IRA) created the ability for certain tax-exempt and other governmental entities to receive a payment for investments into property that would otherwise qualify for a credit against federal tax liability. These tax credits are specifically available for qualified clean energy investments as specified under the IRA, which includes properties like solar panels, battery storage systems, electric vehicles and electri

Accounting Today

MARCH 28, 2024

The Top 25 Firm is adding a tax, assurance, advisory and real estate consulting firm in Birmingham, Alabama.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Patriot Software

MARCH 28, 2024

Do you have a valid PTIN? Getting or renewing a Preparer Tax Identification Number (PTIN) is required for preparing or assisting in preparing a return or refund claim. This article provides a step-by-step guide on how to get a PTIN, including the application process, fees, and renewal requirements.

CPA Practice

MARCH 28, 2024

In a deal expected to close in May, top 20 accounting firm EisnerAmper is merging in top 200 firm Tidwell Group, based in Birmingham, AL. Founded in 1997, Tidwell is a tax, assurance and advisory, and real estate consulting firm with 40 partners and a staff of more than 200 professionals. The firm has six offices across Alabama, Georgia, Texas, and Ohio.

Cherry Bekaert

MARCH 28, 2024

The Internal Revenue Service (IRS) released a notice of proposed regulations, REG-108761-22 , to identify certain transactions involving charitable remainder annuity trusts (CRAT) and substantially similar transactions as listed transactions. The IRS highlighted these CRAT transactions on their 2023 Dirty Dozen list of potentially abusive arrangements.

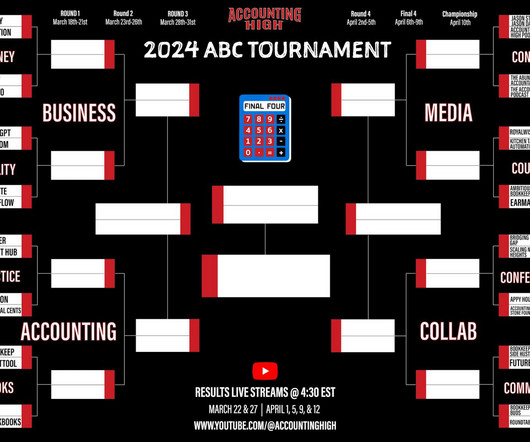

CPA Practice

MARCH 28, 2024

The field of 64 has shrunk to 16 in the quest to win the 2024 Accountant Bracket Challenge, presented by Accounting High, as voting for the third-round matchups starts on Thursday. You have through the Easter weekend to cast your votes on the third-round action to determine who advances to the Elite Eight, which begins on April 2. Only two of the four No. 1 seeds remain, as Relay was defeated in the second round by No. 8 seed Ignition in the Money Bracket and Bridging the Gap was bested by No. 8

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Summit CPA

MARCH 28, 2024

Once your business exceeds around $2 million in revenue, a Chief Financial Officer, or CFO, becomes increasingly necessary. Multiple factors come into play that make the financial side of your business more complicated: banking, taxes, revenue recognition, forecasting, and budgeting, to name a few. The joy of generating more revenue often morphs into frustration when basic bookkeeping and traditional CPA services aren’t enough to level up your business.

CPA Practice

MARCH 28, 2024

By Molly Crane-Newman, New York Daily News (via TNS) Fallen FTX founder Sam Bankman-Fried was sentenced to 25 years in prison on Thursday for stealing more than $10 billion from customers of his global cryptocurrency exchange. Manhattan federal court Judge Lewis Kaplan handed down the steep prison term in a packed courtroom just before noon after hearing from one of more than 200 victims who contacted him ahead of sentencing.

CPA Practice

MARCH 28, 2024

By Augusta Saraiva, Bloomberg News (via TNS) The government’s two main measures of U.S. economic activity posted strong advances at the end of last year, pointing to an economy that’s still expanding at a healthy clip. Gross domestic product rose at an upwardly revised 3.4% annualized pace in the fourth quarter on the back of stronger household demand and business investment, according to the third estimate of the figures from the Bureau of Economic Analysis out Thursday.

Let's personalize your content