Automation's place in sales tax compliance

TaxConnex

JANUARY 30, 2025

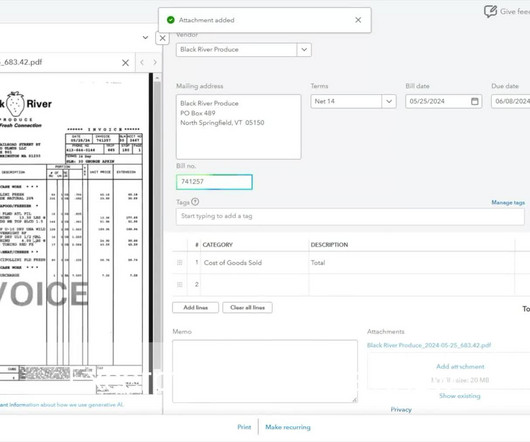

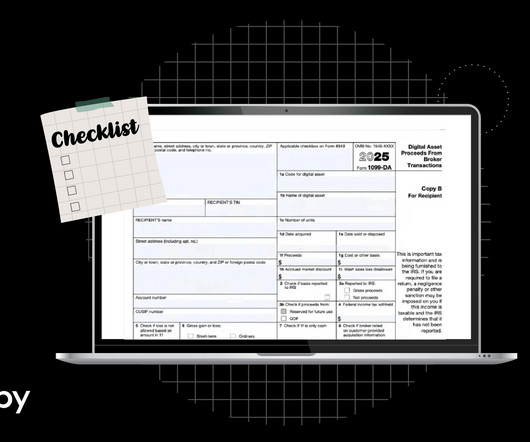

AI and automation are all the rage, but does it have a place in your sales tax compliance process? If so, where? For many businesses, software and automation can serve an important purpose in the compliance process. Businesses need a way to calculate the correct sales tax to charge in states where they have a sales tax obligation, and for this, automation can be a great solution.

Let's personalize your content