Effective Marketing in Minutes: Essential Tips for the Time-Strapped CPA

CPA Practice

JANUARY 18, 2024

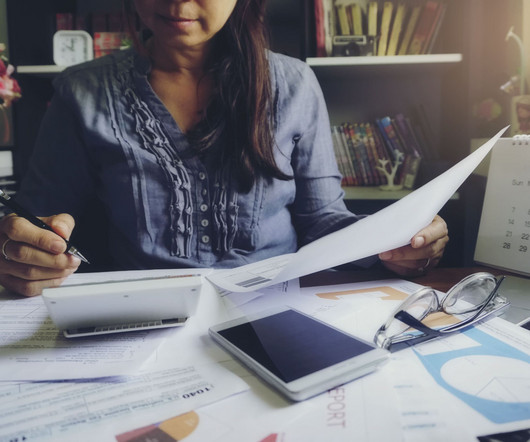

In today’s fast-paced world, you are constantly juggling between client needs, regulatory demands, and staying abreast of ever-changing tax laws. Amidst this, finding time for marketing can be a challenge. However, effective marketing doesn’t always require hours of effort. 10 Quick Tips Here are 10 quick tips to market your services efficiently, even when time is a luxury you don’t have.

Let's personalize your content