Accounting by the numbers: September

Accounting Today

SEPTEMBER 18, 2024

Accountants weigh in on which groups are most affected by the economy, the importance of certifications, and other key metrics.

Accounting Today

SEPTEMBER 18, 2024

Accountants weigh in on which groups are most affected by the economy, the importance of certifications, and other key metrics.

CPA Practice

SEPTEMBER 18, 2024

The U.S. Federal Reserve announced on Wednesday that it will lower the federal funds rate by half a point. The rate is the amount it charges banks to borrow funds, which in turn affects the rates consumers and businesses see for loans, mortgages, credit cards and other finances, and can impact the economy as a whole. The Federal Reserve said the decrease will help decrease inflation, and was justified due to the economy achieving a better balance with employment levels.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

SEPTEMBER 18, 2024

Pruning your technology from time to time will make sure its better serving you and your clients.

CPA Practice

SEPTEMBER 18, 2024

More than half of C-suite and other executives (51.6%) expect an increase in the number and size of deepfake attacks targeting their organizations’ financial and accounting data – otherwise known as deepfake financial fraud – during the next 12 months, according to a new Deloitte poll. That increase could impact more than one-quarter of executives in the year ahead, as those polled report that their organizations experienced at least one (15.1%) or multiple (10.8%) deepfake financial fraud incid

Advertisement

Our 2025 Center Travel Survey is clear: as corporate travel increases, so does corporate credit cards distribution, and a rise in off-platform travel booking. This 61% rise causes various challenges: compliance, spend control, reporting problems, and a lack of visibility across organizations. To evolve with the ever-changing needs of travelers, decision-makers need a better solution.

Accounting Today

SEPTEMBER 18, 2024

The Federal Reserve lowered its benchmark interest rate by a half percentage point Wednesday, an aggressive shift aimed at bolstering the U.S. labor market.

Xero

SEPTEMBER 18, 2024

I was excited to sit down at Xerocon Nashville recently with Ashley Francis, a CPA with almost 25 years of experience, who has become an accounting expert on using artificial intelligence. Based in the US, Ashley is a well-known speaker, teacher and writer in the accounting industry on the value of incorporating generative AI (GenAI) and automation into practices.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

CPA Practice

SEPTEMBER 18, 2024

By Vanessa Piedrahita. Hispanic- and Latino-owned businesses are an economic powerhouse in the U.S., driving growth, innovation, and job creation. Nearly 5 million Hispanic-owned companies generate about $2.8 trillion in economic output and $800 billion in annual revenue, outpacing the overall growth of U.S. businesses. Understanding and addressing the unique needs of these businesses is crucial for advisory firms seeking to make a meaningful impact in this sector and foster growth.

Accounting Today

SEPTEMBER 18, 2024

Intuit announced the release of Intuit Enterprise Suite, an all-in-one solution that is meant for larger, more complex businesses.

GrowthForceBlog

SEPTEMBER 18, 2024

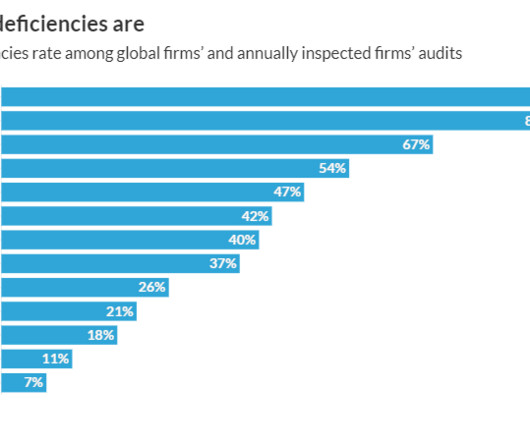

7 min read September 18th, 2024 The Association of Certified Fraud Examiners (ACFE) has released its latest internal business fraud findings in its Occupational Fraud 2024: A Report to the Nations study. It is the largest global study on occupational fraud and examines nearly 2,000 cases that resulted in more than $3.1 billion in monetary losses. Key Takeaways What Are Internal Controls: Internal controls are guidelines, policies, and procedures that are designed and implemented to protect a bus

Going Concern

SEPTEMBER 18, 2024

EY has issued a statement addressing the now-viral email written to EY India Chairman and Regional Managing Partner Rajiv Memani by a mother who tragically lost her daughter, an EY employee for just four months, in July. Anita Augustine’s scathing letter details how her 26 year old daughter Anna Sebastian Perayil “worked tirelessly at EY, ” giving in to unreasonable demands placed upon her day after day because she was new and wanted to impress. “However, the workload, ne

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, emails, and shared drives no longer need to slow you down. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

Accounting Today

SEPTEMBER 18, 2024

Prosperity Partners, a private equity-backed firm in Chicago, has completed the acquisition of Detroit-based Cendrowski Corporate Advisors.

Withum

SEPTEMBER 18, 2024

Implementing a new Enterprise Resource Planning (ERP) system is a transformative decision for your organization and marks a significant milestone in its growth trajectory. As with any major initiative, the journey begins with a strong foundation and strategic approach. This article provides a deep dive into the initiation and ERP implementation planning phases of your ERP implementation project, offering strategic steps to ensure your organization is set up for success from the very beginning.

Patriot Software

SEPTEMBER 18, 2024

You’re part business owner, part marketer, and part … payroll tax filing extraordinaire. And being a payroll tax filing extraordinaire requires that you know how to file employee taxes. Filing payroll taxes takes time and an understanding of the process. Read on to learn more about filing employee taxes.

Basis 365

SEPTEMBER 18, 2024

An income statement, also known as a profit and loss (P&L) statement, is a crucial financial document that provides a detailed summary of a company's revenues, expenses, and profits or losses over a specific period. While many business owners focus on revenue growth, an accurate income statement offers deeper insights into the financial health of a business.

Speaker: Susan Richards

Your past-due accounts are growing, cash flow is tightening, and the pressure is on. The big question: Do you handle the collections internally or outsource to experts? Both strategies come with advantages and risks - but which one delivers the best impact for your business? In this session we’ll dive deep into the in-house vs. outsourcing debate, examining cost-effectiveness, efficiency, compliance risks, and overall recovery success rates.

CPA Practice

SEPTEMBER 18, 2024

Ela Levi-Weinrib Globes, Tel Aviv, Israel (TNS) The Central Bottling Co. (Coca-Cola Israel), which exclusively markets Coca-Cola products in Israel, has been dealt a major blow and will have to pay hundreds of millions of shekels to the Israel Tax Authority. The Tel Aviv District Court has dismissed appeals filed by the company against the tax assessment issued by the Tax Authority on the Central Bottling Company’s tax liability for royalties it paid for using the intellectual property rights of

Canopy Accounting

SEPTEMBER 18, 2024

In this episode, Andrew Lassise, founder of Tech for Accountants, shares his career journey, from entering the financial planning world during the 2009 recession to transitioning into IT and tech consulting for accountants. He discusses the importance of leveraging technology in accounting firms, integrating AI, and building a robust tech stack that can scale with business growth.

Insightful Accountant

SEPTEMBER 18, 2024

Insightful Accountant wants your input on CRMs that you may use, refer to your clients, implement for your clients, or you are certified in. Please take 5 minutes to complete a very brief 3 question survey.

Ryan Lazanis

SEPTEMBER 18, 2024

Discover the 4 crucial elements to focus on for business growth. Nail these, and you'll likely become a super happy firm owner—find out how! The post You Only Need These 4 Things to Have a Great Firm appeared first on Future Firm.

Speaker: Danny Gassaway and Wayne Richards

Finance leaders are prioritizing efficiency and digital transformation, yet many hesitate to automate due to uncertainty. Without a clear understanding of its impact, organizations risk falling behind competitors who are leveraging automation to drive productivity and cost savings. Join Wayne Richards and Danny Gassaway from AvidXchange for a practical guide on bringing accounts payable (AP) automation to your organization.

Insightful Accountant

SEPTEMBER 18, 2024

The Tax Court's recent ruling in Soroban Capital Partners has significant implications for determining whether a limited partner's distributive share qualifies for the self-employment tax exception under Section 1402(a)(13).

Summit CPA

SEPTEMBER 18, 2024

How does an accidental agency owner attract prospects, convert them into clients, and then scale their business to a point that selling is a realistic possibility? What are the factors that separate an ordinary agency from one that thrives?

Insightful Accountant

SEPTEMBER 18, 2024

NetSuite has Introduced new AI-Powered Project Management Capabilities to bolster the 'suiteness' of SuiteProjects and anticipate risk, accelerate planning, and increase productivity.

CPA Practice

SEPTEMBER 18, 2024

Lauren Rosenblatt The Seattle Times (TNS) Amazon will require employees to work from the office five days a week, starting in January, the tech giant has announced. It’s a shift from the current three-day-a-week return to office mandate, which Amazon has had in place since May 2023. In a note to employees Monday, CEO Andy Jassy wrote that the company is going to return to being in the office the way we were before the onset of COVID.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Insightful Accountant

SEPTEMBER 18, 2024

In this episode of the Accounting Insiders Podcast, host Peter Leonard introduces MyWorks Software, an innovative tool designed to automate e-commerce bookkeeping for online businesses.

CPA Practice

SEPTEMBER 18, 2024

By Izzy Kharasch. Sometimes you tip at a restaurant, sometimes you give a gratuity and more and more you’re paying a service charge. What happens to that money? All of those may equal 20 percent, but how much goes to the server depends on which one you are paying. How Much of Your Tip Does the Server Get? My bill is $300 and I like to tip 20 percent, which means I am giving the server $60.

Wendy Tietz

SEPTEMBER 18, 2024

Ford Motor Company (NYSE: F) is moving ahead with a $1.5 billion expansion of its Ohio Assembly Plant in Avon Lake to start producing a new electric commercial van by 2026. This investment is part of Ford’s strategy to shift towards more electric and hybrid vehicles that are cost-efficient and offer better value to customers.

CPA Practice

SEPTEMBER 18, 2024

Top 200 accounting firm ATA has joined the private equity party, announcing this week that it’s receiving a minority investment from Boston-based Copley Equity Partners. ATA partners will maintain majority control of the firm, and its executive and leadership teams will stay intact, including managing partner John Whybrew, who has led Jackson, TN-based ATA since 2016.

Speaker: Jennifer Hill

Payroll compliance is a cornerstone of business success, yet for small and midsize businesses, it’s becoming increasingly challenging to navigate the ever-evolving landscape of federal, state, and local regulations. Mistakes can lead to costly penalties and operational disruptions, making it essential to adopt advanced solutions that ensure accuracy and efficiency.

Anders CPA

SEPTEMBER 18, 2024

The CannaBiz Success Show is excited to announce its new co-host, Brett Adams! For Brett’s first episode, he and Guillermo explore the New Jersey cannabis market with Brian Dowling, CEO of Sussex Cultivation, and Joe Bellantoni, CFO of Sussex Cultivation. Brian shares his transition from college athlete to cannabis entrepreneur, influenced by his family’s healthcare business.

Shay CPA

SEPTEMBER 18, 2024

Getting an audit notice from a tax authority is enough to stop most founders in their tracks. It doesn’t necessarily mean you’ve done anything wrong, though. While things like high deductions can definitely trigger an audit, it’s also possible to get chosen at random. The IRS, for example, uses computer screening to pick out companies to audit, and anything that deviates you from their statistical formula can land you in the audit pile.

Canopy Accounting

SEPTEMBER 18, 2024

In modern accounting, one thing remains constant: the need to provide real value to clients. However, in the quest to keep clients happy, many firms adopt a ‘yes to everything’ mentality. It seems harmless, even admirable, to accommodate every whim and demand, but in reality, it can lead to scope creep, unrealistic expectations, and ultimately, a strain on resources.

FraudFiles

SEPTEMBER 18, 2024

Are you more likely to be selected by the IRS for a tax audit if you file an extension for your income tax return?

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Let's personalize your content