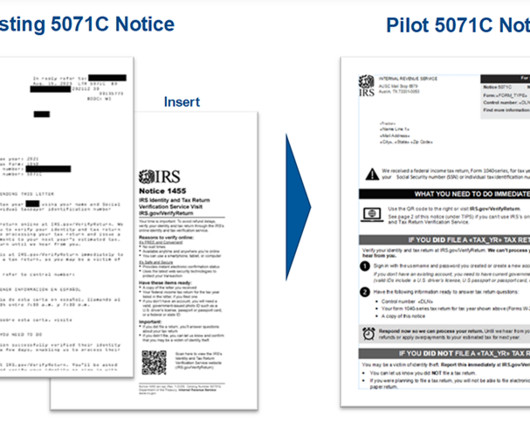

IRS Redesigning Taxpayer Notices to Make Them Easier to Understand

CPA Practice

JANUARY 23, 2024

The Internal Revenue Service says it is working on the Simple Notice Initiative, a sweeping effort to simplify and clarify about 170 million letters sent annually to taxpayers. Part of the larger transformation work taking place at the IRS with Inflation Reduction Act funding, the Simple Notice Initiative will build off redesigned notice efforts in place for the 2024 tax season and expand on a recent successful pilot involving identity theft letters.

Let's personalize your content