Outsourced Client Accounting Services: Streamlining Financial Management

AccountingDepartment

DECEMBER 21, 2023

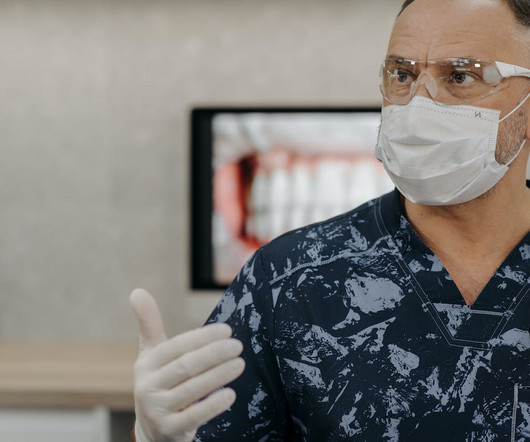

Outsourced client accounting services play a crucial role in helping businesses take control of their financials. These services involve outsourcing the accounting and bookkeeping tasks to a third-party service provider, allowing businesses to focus on their core operations. The role of outsourced client accounting services goes beyond basic bookkeeping; it includes managing accounts payable and receivable, payroll processing, financial reporting, and more.

Let's personalize your content