Emerging risks for accountants

Accounting Today

OCTOBER 16, 2023

Stephen Vono and John Raspante of McGowan Pro look at the new areas that are sparking claims against firms — and the tools they can use to protect themselves.

Accounting Today

OCTOBER 16, 2023

Stephen Vono and John Raspante of McGowan Pro look at the new areas that are sparking claims against firms — and the tools they can use to protect themselves.

MyIRSRelief

OCTOBER 16, 2023

When it comes to navigating the complex world of taxes, understanding deductions and credits is like having a secret treasure map to unlock potential savings. Tax deductions and credits are powerful tools that can help individuals and businesses reduce their tax liabilities, putting more money back in their pockets. In this comprehensive guide, we will explore a wide array of deductions and credits available to individual and business taxpayers, shedding light on the financial opportunities they

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

OCTOBER 16, 2023

The National Association of Enrolled Agents is asking the Internal Revenue Service to resume sending reminder notices immediately to non-filers and those with balances due of more than $10,000.

CPA Practice

OCTOBER 16, 2023

By Daniel F. Rahill, CPA/PFS, JD, LL.M., CGMA Since the beginning of the COVID-19 pandemic, median home prices in the United States have skyrocketed, increasing by 41.6% from March 2020 to July 2023 as inventories have declined, according to the National Association of Realtors. The pandemic-driven shift to remote work, increasing demand for suburban and rural homes, and formerly low interest rates combined to accelerate demand and home values.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Accounting Today

OCTOBER 16, 2023

The Internal Revenue Service is trying to leverage the extra funding to collect more taxes, but has spent surprisingly little so far.

Going Concern

OCTOBER 16, 2023

Videoconference tech company Owl Labs has released its 2023 State of Hybrid Work report and boy is there a lot to cover. When Fortune wrote it up a few days ago , one item they chose to highlight is how much it’s costing workers to be back in the office: the average is $51 a day, $71 a day for workers with pets. The total, says Owl Labs, breaks down as follows: $16 – Lunch $14 – Commuting costs $13 – Breakfast/coffee $8 – Parking ($20 – pet care) Employees who work a hybrid schedule, the c

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

CPA Practice

OCTOBER 16, 2023

By Nellie Akalp. Accountants are crucial for guiding clients through the various financial and administrative aspects of running a business. Tasks like meeting minutes might not be the most exciting part of running a business, but they are crucial for ensuring transparency, accountability, and legal compliance. As the year-end approaches, your business clients must ensure they have taken proper meeting minutes.

Accounting Today

OCTOBER 16, 2023

The Illinois governor's comments follow months of speculation over how Chicago Mayor Brandon Johnson plans to raise revenue to tackle the city's embattled finances.

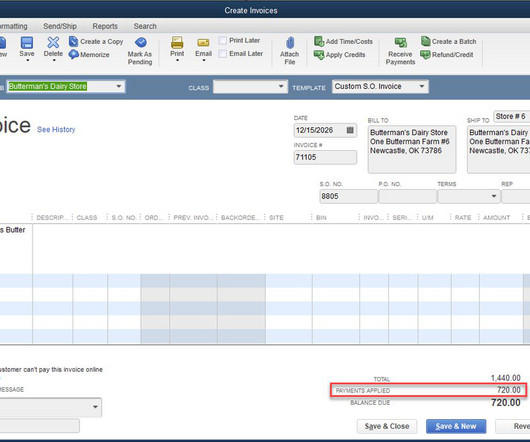

Insightful Accountant

OCTOBER 16, 2023

As the last piece in our QuickBooks Desktop 2024 series, Murph is giving us another of his favorite feature picks or, as he likes to call them, "his favorite newbies.

Withum

OCTOBER 16, 2023

The number of cyber incidents within the healthcare industry has continued to increase, ranging from isolated incidents to targeted attacks that have grown in their material impacts. Hospitals and medical practices that fall victim to cyber-attacks can be left figuring out how to operate without their daily information systems. This has led to patientsreceiving incorrect medicine dosages, delayed operations, and diverted healthcare, such as ambulances being rerouted to other facilities, threaten

Advertisement

Bleisure travel — where employees combine work and leisure — has been around since the advent of corporate travel and is here to stay. Successful bleisure policies strike a balance between employee preferences and company goals — workers report a 64% improvement in work-life balance, while companies benefit from reduced travel costs and increased workforce innovation.

CPA Practice

OCTOBER 16, 2023

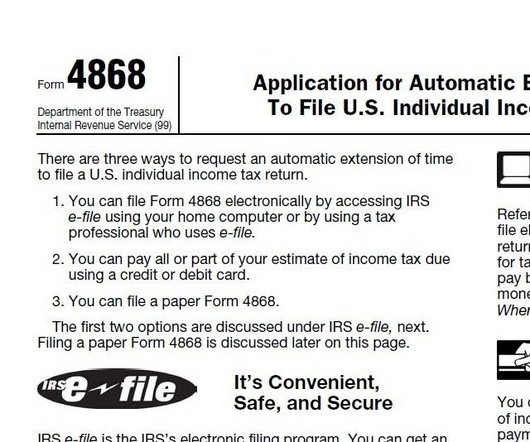

October 16 is this year’s deadline for taxpayers who requested additional time to file their taxes. Automatic extensions are available to virtually anyone who request it. This is often necessary for taxpayers who are still waiting on some documents before they can file their returns. However, taxes expected to be owed were required to be owed by the original April 18, 2023, deadline.

Insightful Accountant

OCTOBER 16, 2023

The new resource for business leaders helps accountants share this quarterly workforce report with their clients looking for actionable insights to improve business operations.

CPA Practice

OCTOBER 16, 2023

The projected gross tax gap—the difference between the total taxes owed to the federal government and how much is collected on time—increased to $688 billion for tax year 2021, the IRS said on Oct. 12. The new estimate reflects a rise of more than $192 billion from the prior estimates for tax years 2014 to 2016 and an increase of $138 billion from the revised projections for tax years 2017 to 2019.

Accounting Today

OCTOBER 16, 2023

Residents in 55 out of 58 counties have an extra month to file and pay.

Speaker: Ashley Harlan, MBA

What if your role as a fractional CFO went beyond operational support to actively shaping the future of your clients’ businesses? 💼 ✨ In this session, discover how fractional finance professionals can position themselves as architects of growth, guiding their clients toward sustainable success and preparing them for full-time financial leadership.

Withum

OCTOBER 16, 2023

The number of cyber incidents within the healthcare industry has continued to increase, ranging from isolated incidents to targeted attacks that have grown in their material impacts. Hospitals and medical practices that fall victim to cyber-attacks can be left figuring out how to operate without their daily information systems. This has led to patients receiving incorrect medicine dosages, delayed operations, and diverted healthcare, such as ambulances being rerouted to other facilities, threate

Reckon

OCTOBER 16, 2023

With the pandemic bringing forward the immense possibilities of working from home, Australia has been no slouch in adopting home businesses. With high-speed internet, tax incentives , ease of entry, and a wide range of possible start-up ideas, creating a home business has never been more accessible and plausible. All you have to do is get yourself an ABN, register as a Sole Trader and off you go!

GrowthForceBlog

OCTOBER 16, 2023

S ince 2000, the FDIC has recorded 565 bank failures in the United States. The number of bank failures peaked between 2009 and 2012 in the wake of the Great Recession.

CPA Practice

OCTOBER 16, 2023

From Kiplinger Consumer News Service (via TNS). Retirement is a milestone many look forward to, marking the end of our working lives and the beginning of a new chapter. However, turning your retirement savings into a stable and sustainable income can be challenging. As life expectancies increase and pension systems continue to shift away from traditional plans and move towards consumer-saving plans like 401(k)s and annuities, smart strategies can help make your hard-earned money last a lifetime.

Advertiser: Paycor

Use these handy calendar templates to stay on top of payroll in 2025! Download them today to share with your HR team or post for employees. Whether your company has biweekly, semi-monthly, or monthly pay periods, Paycor has you covered. Get your templates today!

inDinero Accounting

OCTOBER 16, 2023

Applying for an SBA loan can be a daunting task. The Small Business Administration (SBA) offers a variety of loan programs designed to help entrepreneurs get the financial support they need. Still, the information available makes it difficult to know whether or not an application is even likely to succeed. In this article, we’ll provide a snapshot of the minimum requirements for an SBA loan and a detailed overview of the documents you must submit to apply.

Accounting Today

OCTOBER 16, 2023

The ACCA, IFAC and the INTOSAI Development Initiative are teaming up on guidance on sustainability reporting and assurance for the public sector.

CPA Practice

OCTOBER 16, 2023

By Jeff Ostrowski, Bankrate.com (via TNS). Much to the chagrin of would-be homebuyers, property prices just keep rising. It seems nothing — not even the highest mortgage rates in nearly 23 years — can stop the continued climb of home prices. Prices increased once again in July, according to the latest S&P CoreLogic Case-Shiller home price index , with 19 out of 20 markets measured showing month-over-month gains.

Accounting Today

OCTOBER 16, 2023

The telecommunications company replaced Deloitte as its auditor with KPMG International. The decision was questioned by shareholders.

Speaker: Duke Heninger, Partner and Fractional CFO at Ampleo & Creator of CFO System

Are you ready to elevate your accounting processes for 2025? 🚀 Join us for an exclusive webinar led by Duke Heninger, a seasoned fractional CFO and CPA passionate about transforming back-office operations for finance teams. This session will cover critical best practices and process improvements tailored specifically for accounting professionals.

CPA Practice

OCTOBER 16, 2023

Tax season poses immense challenges for accounting firms. Capacity constraints force CPAs to work overtime to meet tight deadlines. Many firms turn to outsourcing as a solution. But, not all outsourcing is created equal. So how can firms ensure they implement outsourcing in a way that enhances, rather than hampers, operations? In this white paper, we explore how firms achieve faster turnarounds, improved workflows, and better client service through domestic outsourcing providers.

Accounting Today

OCTOBER 16, 2023

The AICPA's CEO of public accounting explains why the profession's future is much brighter than some would have you believe.

CPA Practice

OCTOBER 16, 2023

By Kelley R. Taylor, Kiplinger Consumer News Service (TNS) Many Californians thought their taxes were due today (Oct. 16), but the IRS has further postponed tax deadlines for people in 58 counties impacted by natural disasters last winter. As Kiplinger reported, the new postponement means that many California taxpayers and businesses now have until Nov. 16, 2023, to file their 2022 federal income tax returns and pay any tax due.

Accounting Today

OCTOBER 16, 2023

A lawyer questions whether expanded regulatory enforcement powers will lead to better-quality audits.

Speaker: Abdi Ali, Sr. Lease Accounting Consultant

Join this insightful webinar with industry expert Abdi Ali, who will discuss the challenges that can arise from managing lease accounting with spreadsheets! He will share real-world examples of errors, compliance issues, and risks that may be present within your spreadsheets. Learn how these tools, while useful, can sometimes lead to inefficiencies that affect your time, resources, and peace of mind.

Withum

OCTOBER 16, 2023

With hundreds of video games hosting professional competitions and tournaments for increasing prize pools and opportunities, it is easy to get lost in the rapidly growing market that is Esports. For many, it may be beneficial to look at one of the oldest and most profitable games in the industry to get a better sense of it all: Dota 2. Dota 2 (Defense of the Ancients) is a PC game officially released by Valve Corporation in 2013.

Accounting Insight

OCTOBER 16, 2023

How can manufacturers navigate the ever-evolving and increasingly complex world of value added tax (VAT)? There are several, key ways to evaluate your current and future approach to VAT, maintaining compliance the entire way. 1. Ensure alignment between IT and tax teams Far too often we have seen IT-centric processes miss (or at least misunderstand) key compliance needs and requirements, and tax-centric processes fail to consider the practicalities of automation.

Accounting Today

OCTOBER 16, 2023

Sustaining post-day two compliance requires a rigorous focus on optimizing processes for ongoing management of lease accounting data and entries.

VJM Global

OCTOBER 16, 2023

GST Council met for 52nd time on 7th October, 2023 under the chairmanship of Hon’ble Finance and Corporate affair minister. GST Council discussed various aspects such as Amnesty Scheme for filing of GST Appeal , Clarification on applicability of GST on Guarantee services provided by director and company, changes in GST rates etc. GST Council recommendations are categorized in following parts: Suggestions for facilitation of trade Changes in GST rates of goods and services ; Recommendations to is

Speaker: David Warren and Kevin O'Neill Stoll

Transitioning to a usage-based business model offers powerful growth opportunities but comes with unique challenges. How do you validate strategies, reduce risks, and ensure alignment with customer value? Join us for a deep dive into designing effective pilots that test the waters and drive success in usage-based revenue. Discover how to develop a pilot that captures real customer feedback, aligns internal teams with usage metrics, and rethinks sales incentives to prioritize lasting customer eng

Let's personalize your content