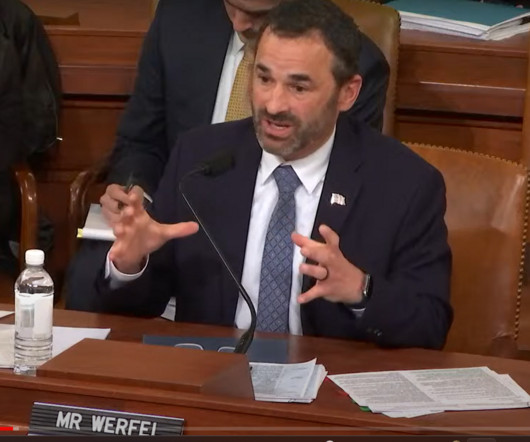

IRS-CI Chief Jim Lee Will Call It a Career in April

CPA Practice

FEBRUARY 16, 2024

Happy trails to IRS Criminal Investigation unit chief Jim Lee who is retiring on April 6. His successor has not yet been named, the IRS said earlier this week. Lee has led IRS-CI since October 2020. During that three-year period, he has overseen a staff of more than 3,200 CI employees, including 2,200 special agents, who have investigated thousands of financial crimes involving tax violations, money laundering, public corruption, cybercrime, identity theft, narcotics trafficking, human trafficki

Let's personalize your content