Tips for Managing Capacity During Tax Season

Canopy Accounting

NOVEMBER 13, 2023

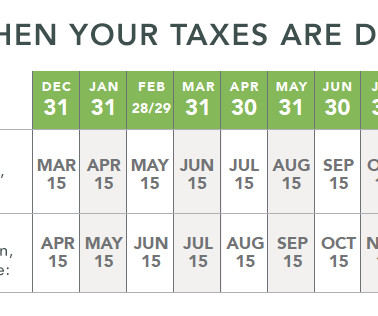

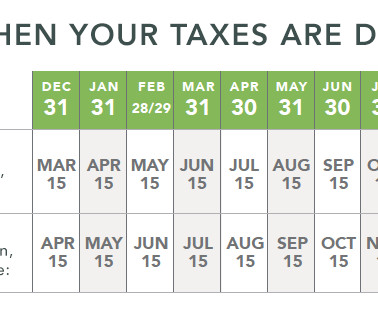

It's that time again to begin exploring ways we can manage tax season, stay sane, and still be intentional about how we lead our firms. In this webinar we'll discuss some capacity management tips for those running a tax season with a virtual team (which is more difficult to do than brock and mortar!).

Let's personalize your content