8 Steps to Improving Cash Flow Forecasting

Insightful Accountant

SEPTEMBER 13, 2023

MineralTree's Jose Garcia explains how accurately projecting future cash inflows and outflows can help you anticipate short- and long-term financial circumstances.

Insightful Accountant

SEPTEMBER 13, 2023

MineralTree's Jose Garcia explains how accurately projecting future cash inflows and outflows can help you anticipate short- and long-term financial circumstances.

CPA Practice

SEPTEMBER 5, 2023

Joseph Graziano, CFP®. Accountants are part of an evolving industry where 82% of accountants agree that client expectations have widened. If you’re behind the trends, you risk becoming “obsolete.” Clients may still need your services, but they want an accountant to go the extra mile for them. Preparing for tomorrow can help you situate your firm to be: Streamlined Profitable today and in the future Sellable in the future (if that’s something you ever consider) You can begin prepping for the futu

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Withum

SEPTEMBER 14, 2023

The IRS continues to pound the table with its most recent press release on employee retention credit (ERC) claims. On September 14, 2023, the IRS announced a moratorium on processing new ERC claims until at least 2024. It wants to “protect against fraud but also to protect the businesses from facing penalties or interest payments stemming from bad claims pushed by promoters.

Going Concern

SEPTEMBER 22, 2023

Here we are again talking about the accountant shortage. Don’t blame me, blame WSJ. Mark Maurer at Wall Street Journal wrote today about a young man named Omer Khokhar who realized after six years in accounting that he was done. The article title: “Job Security Isn’t Enough to Keep Many Accountants From Quitting.” Ruh-oh. The New York resident found accounting work monotonous, with little room for creativity or growth, and maximum salaries weren’t as high as he would have liked

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Ryan Lazanis

SEPTEMBER 6, 2023

Navigating the ever-evolving landscape of accounting requires efficient client management, and that’s where client portals come in. In this article, I present a curated list of the top 12 client portals available in the market today. Let’s explore their features, advantages, and drawbacks to help you make an informed choice. Let’s go! Table of Contents What are Client Portals for Accountants?

CPA Practice

SEPTEMBER 7, 2023

A new report from Xero , the global small business platform, shows that 48% of U.S. small business owners have experienced an extreme or high impact from inflation on their cash flow over the past six months, and 44% expect inflation to continue to have a similar impact throughout the next six months. Xero’s report, titled “ Money Matters: The impact of economic conditions on the cash flow of US small businesses “, interviewed more than 500 small business owners across the United States on the

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Withum

SEPTEMBER 11, 2023

It’s that time of year when extended pass-through business returns are being finalized, and owners are beginning to receive their K-1s. If you are one of those owners, have you ever looked at your K-1? Do you know what information is being provided to you? To move forward on explaining your K-1, we first must take a step back. Businesses that are structured as LLCs (that haven’t elected C status), partnerships or S corporations are all considered pass-through entities.

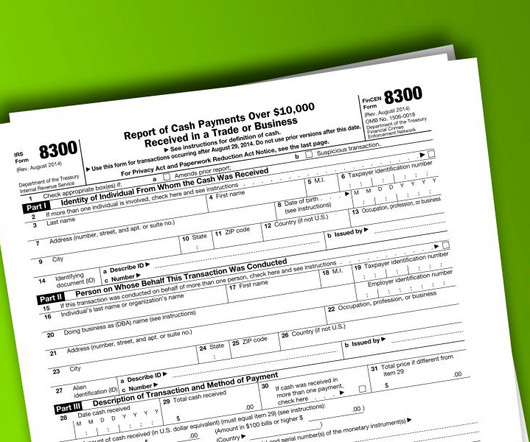

RogerRossmeisl

SEPTEMBER 18, 2023

Does your business receive large amounts of cash or cash equivalents? If so, you’re generally required to report these transactions to the IRS — and not just on your tax return. The requirements Each person who, in the course of operating a trade or business, receives more than $10,000 in cash in one transaction (or two or more related transactions), must file Form 8300.

Accounting Today

SEPTEMBER 11, 2023

The Big Four firm plans to stop offering some types of services to SEC-registered audit clients, and to cut the compensation of top leaders if the firm's audits fall short on quality.

TaxConnex

SEPTEMBER 26, 2023

The short answer: Maybe not. Let’s look at a few factors that could make relying solely on an eCommerce platform for your compliance risky for your company. A complex environment Economic nexus. The 2018 Supreme Court decision in South Dakota vs. Wayfair opened the floodgates for economic nexus throughout the U.S. In almost all states now, any derived revenue for your company will create nexus for the company making that revenue ($100,000 revenue or 200 transactions in a year, for instance).

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

BurklandAssociates

SEPTEMBER 25, 2023

New investment brings new financial reporting requirements to keep your investors and board of directors updated and informed. The post Financial Reporting for Newly Funded Startups appeared first on Burkland.

CPA Practice

SEPTEMBER 12, 2023

Big 4 accounting firm Deloitte and Bitwave, an enterprise accounting platform for digital assets, have announced a strategic alliance that brings together Bitwave’s software platform with Deloitte’s accounting, tax and governance, risk and controls advisory services, to help deliver speed and process efficiencies, cost savings and compliance enhancements to businesses that utilize digital assets.

Airbase

SEPTEMBER 27, 2023

Procurement plays a pivotal role in cost management, risk mitigation, and financial performance. But until recently, many organizations struggled to define their processes and find the right tools to manage procurement. Let’s take a look at the basic elements of procurement, and how different organizations and systems approach this vital function. What is procurement?

RogerRossmeisl

SEPTEMBER 4, 2023

As reported in IRS News Release IR-2023-157 The Internal Revenue Service announced that starting 1/1/2024, businesses are required to electronically file (e-file) Form 8300, Report of Cash Payments Over $10,000, instead of filing a paper return. This new requirement follows final regulations amending e-filing rules for information returns, including Forms 8300.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Accounting Today

SEPTEMBER 6, 2023

The Financial Accounting Standards Board voted to adopt its eagerly awaited standard for cryptocurrency like Bitcoin held by companies.

TaxConnex

SEPTEMBER 28, 2023

You’ve learned what states you have nexus in and you know where your products/services are taxable. Now it’s time to register with the states to collect and remit sales tax. Where to begin? You complete your sales tax registrations and file them with the departments of revenue or taxation in each state. These registrations are called sales tax permits, sometimes licenses.

BurklandAssociates

SEPTEMBER 19, 2023

Fintech is a diverse sector with KPIs that vary between companies, but these five metrics should matter to wide swaths of the industry. The post Metrics Matter: Five KPIs for Fintech Startups appeared first on Burkland.

Acterys

SEPTEMBER 25, 2023

Most businesses would benefit from better financial planning and analysis (FP&A), whether it’s through extended planning horizons, more frequent updates or taking a different approach to planning. Over 60% of organizations plan to make changes to their FP&A , according to Deloitte’s global planning and budgeting survey. Microsoft Power BI can simplify the financial reporting process, but it’s not an out-of-the-box solution for every need.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

MyIRSRelief

SEPTEMBER 15, 2023

1. What is an IRS bank levy? An IRS bank levy is a legal action taken by the Internal Revenue Service (IRS) to collect unpaid taxes. When the IRS levies your bank account, they freeze the funds in it and eventually withdraw the amount owed to satisfy your tax debt. 2. Why would the IRS levy my bank account? The IRS may levy your bank account for various reasons, including: a.

RogerRossmeisl

SEPTEMBER 18, 2023

The SECURE 2.0 law, which was enacted last year, contains wide-ranging changes to retirement plans. One provision in the law is that eligible employers will soon be able to provide more help to staff members facing emergencies. This will be done through what the law calls “pension-linked emergency savings accounts.” Effective for plan years beginning January 1, 2024, SECURE 2.0 permits a plan sponsor to amend its 401(k), 403(b) or government 457(b) plan to offer emergency savings accounts that a

Accounting Today

SEPTEMBER 8, 2023

The SEC's recently finalized rule on private fund advisors will impose new requirements.

TaxConnex

SEPTEMBER 19, 2023

Telecommunications companies face tougher problems than most other businesses when trying to comply with federal, state and local tax and regulatory obligations. Most of the taxes that telecom companies contend with are administered by the individual states’ Departments of Revenue (DOR) and local jurisdictions. These taxes go by various names: sales tax, communications services tax, utility users’ tax, local license tax and so on.

Speaker: Joe Wroblewski, Senior Sales Engineer

Is your tech stack working for you—or are you working for it ? 🤖 In today’s world of automation and AI, technology should simplify workflows—not add complexity. Seamless integration and interconnectivity are key to maximizing productivity, optimizing workflows, and improving collaboration. Join expert Joe Wroblewski for a practical and insightful session on how you can build a smarter, more connected tech stack that drives efficiency and long-term success!

BurklandAssociates

SEPTEMBER 11, 2023

Startups should invest their excess capital with the objective of earning market-based returns on near risk-free instruments. The post Low-Risk Investment Instruments for Venture-Backed Startups appeared first on Burkland.

Acterys

SEPTEMBER 25, 2023

Microsoft Power BI is a powerful analytics and business intelligence tool that helps users connect, model and visualize business data and integrate those visuals into commonly used apps and services. Businesses looking to make data-driven decisions rely on the platform for meaningful solutions and insights. But even if you’re using Power BI planning and forecasting to streamline your financial planning and analysis (FP&A) process, there’s probably more you can do to maximize its impact.

Airbase

SEPTEMBER 15, 2023

Unicorn companies all have different origin stories, but most growth paths share a similar landscape, one that is covered with obstacles and navigated at a breakneck pace — straining people, processes, and systems. Things get done reactively, with ad hoc procedures developed to keep moving. Even after reaching unicorn status, the resulting chaos isn’t sustainable, can easily lead to burnout, and may not support continued growth.

RogerRossmeisl

SEPTEMBER 18, 2023

The federal student loan “pause” came to an end on August 31 after more than three years. If you have student loan debt, you may wonder whether you can deduct the interest you pay on your tax return. The answer may be yes, subject to certain limits. The deduction is phased out if your adjusted gross income exceeds certain levels — and they aren’t as high as the income levels for many other deductions.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

Accounting Today

SEPTEMBER 28, 2023

Leading practitioners and accounting technology experts share their favorite tools for work and life.

TaxConnex

SEPTEMBER 14, 2023

Are subscriptions taxable? Depends on what they’re for and where they’re delivered. Over the past few years, subscription box services, for instance, have exploded in popularity as buyers have signed up for regular delivery of everything from food, makeup, music, books, pet supplies, flowers, clothes and more. This industry has ridden the wave of eCommerce to join long-established subscription markets for publications and memberships.

BurklandAssociates

SEPTEMBER 5, 2023

An active approach to treasury management can help startups reduce financial risk while putting excess cash to work. The post Dimensions of a Basic Treasury Policy for Venture-Backed Startups appeared first on Burkland.

SMBAccountant

SEPTEMBER 11, 2023

Purchasing is an important function for any size business, whether large or small, because it has a direct impact on costcontrol, efficient operations, quality, and vendor relationships. Failure to follow best practices when purchasing goods and services can expose a small business to compliance violations, cash flow problems and missed savings opportunities.

Speaker: Yohan Lobo and Dennis Street

In the accounting world, staying ahead means embracing the tools that allow you to work smarter, not harder. Outdated processes and disconnected systems can hold your organization back, but the right technologies can help you streamline operations, boost productivity, and improve client delivery. Dive into the strategies and innovations transforming accounting practices.

Let's personalize your content