How AI is transforming accounting

Accounting Today

APRIL 29, 2024

A recent survey from EY found that 90% of respondents already use at least some AI in their work, and other recent developments around the technology.

Accounting Today

APRIL 29, 2024

A recent survey from EY found that 90% of respondents already use at least some AI in their work, and other recent developments around the technology.

Basis 365

APRIL 10, 2024

A business’s ability to remain agile will ensure it can quickly adapt to emerging trends and opportunities. Agility is not only a mindset of the team but the infrastructure the business has built over the years. Bogging your business down with layers upon layers of employees and middle management can prevent you from seizing an opportunity faster than your competitors.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Reckon

APRIL 29, 2024

Guest post by AON. Here’s why keeping appropriate records can help during a claim. In a world where almost everything is paperless, keeping records and filing documentation is something that might slip your mind as you go about your usual business. While digitisation has made record keeping easier in some ways, it has also brought about some complexities.

CPA Practice

APRIL 22, 2024

By Chris Stephenson and Eric Hylton. The race to integrate Artificial Intelligence into the workflow of Certified Public Accountants is no longer a futuristic concept, but a current reality. Large accounting firms have made substantial strides in using AI to augment their services and deliver high quality outcomes. Yet, for many CPA firms, particularly small to mid-sized organizations, the current pace of technological advancement can seem dauting.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

CPA Practice

APRIL 16, 2024

By Lizzy McLellan Ravitch. The Philadelphia Inquirer (via TNS) Molly Kowal decided to become an accountant in part because she knew it would be a stable career. After graduating from college in 2021, she saw friends in other fields struggling to find work but knew she would be able to find a job. But that doesn’t mean she’s willing to work into the wee hours during busy season.

TaxConnex

APRIL 25, 2024

There’s nothing like just walking down the hall of your office or clicking into a virtual team meeting to get an answer on something as complex and important as your company’s sales tax obligations. To handle sales tax in-house, you need someone on staff who understands evolving rules and regulations; can track a galaxy of filing deadlines and notices; and understands how your company growth changes tax obligations.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Going Concern

APRIL 19, 2024

Rightworks has released their inaugural 2024 Accounting Firm Technology Survey and the results tell us what we already done knew: Accounting firms are hesitant to adopt next-gen technology. Hell, a bunch of them are hesitant to move to the cloud. In 2024. The survey of decision makers and influencers at accounting, tax and bookkeeping firms revealed that nearly 60 percent of respondents identified their firms as slow adopters of new technologies like AI.

Insightful Accountant

APRIL 29, 2024

Insightful Accountant proudly announces this year's Top 100 ProAdvisors along with our Emeritus ProAdvisors of the Year. Congratulations to all being recognized for this year's awards.

RogerRossmeisl

APRIL 24, 2024

As reported in IR-2024-46 Using Inflation Reduction Act funding and as part of ongoing efforts to improve tax compliance in high-income categories, the Internal Revenue Service announced on 2/21/24 plans to begin dozens of audits on business aircraft involving personal use. The audits will be focused on aircraft usage by large corporations, large partnerships and high-income taxpayers and whether for tax purposes the use of jets is being properly allocated between business and personal reasons.

BurklandAssociates

APRIL 23, 2024

Many startup founders fail to realize that neglecting HR compliance can lead to significant red flags during investor due diligence. The post 3 Common HR “Gotchas” That Could Get You During Due Diligence appeared first on Burkland.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

TaxConnex

APRIL 30, 2024

More states are plowing ahead with adding a new kind of expense to delivering in the eCommerce age. In what states do you have to watch for retail delivery fees (RDFs)? Q: Is this a “tax” or a “fee”? A: Most states refer to it as a fee, a distinction that allows lawmakers to avoid the voting process. RDFs are a relatively new concept: Colorado was first to roll one out, in July 2022.

Accounting Today

APRIL 30, 2024

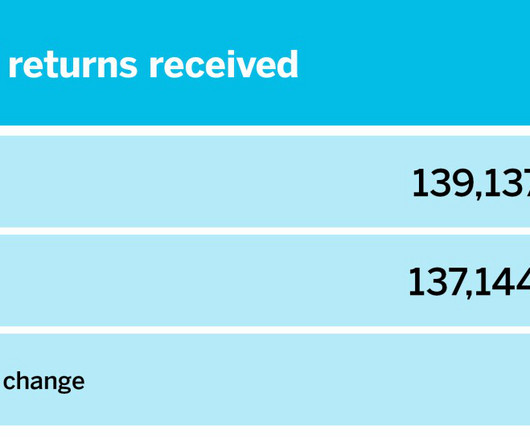

The number of individual income tax returns received rose by 16.34% in the final week of tax season.

CPA Practice

APRIL 23, 2024

From: Entrepreneurs’ Organization | Inc. [Via TNS.] By Kent Lewis, an Entrepreneurs’ Organization (EO) member in Portland, Oregon, is the founder of pdxMindShare , an online career community focused on Portland professionals: I recently shared a presentation on increasing employee engagement and retention by fostering a Culture of Caring with a group of Silicon Valley entrepreneurs.

Cherry Bekaert

APRIL 23, 2024

Download Whitepaper The impact of artificial intelligence on how we live, work and do business has been undeniable for over a decade. Its practical applications range from suggesting the next sentence when crafting emails to producing lifelike animations, from enabling smart and interconnected manufacturing robots to efficiently distribute workloads on assembly lines to predicting customers’ preferences or even helping land a plane.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

RogerRossmeisl

APRIL 30, 2024

As posted to the Munro Live YouTube Channel on 4/24/2024 (Run Time 18 min, 42 sec) Sandy Munro and Armin von Czarnowski demonstrate how steer-by-wire works and examine the components that make it possible in the Cybertruck. Steer-by-wire differs significantly from a normal steering system in that there is no mechanical linkage between the steering wheel and the front wheels.

BurklandAssociates

APRIL 30, 2024

Accountants and fractional CFOs play distinct but complementary roles in the financial management of venture-funded startups. The post Accountant vs. Fractional CFO: Choosing the Right Financial Expertise for Your Startup appeared first on Burkland.

TaxConnex

APRIL 9, 2024

The common definition of dietary supplements and vitamins is a non-food item that includes a vitamin, mineral, herb, botanical, amino acid or dietary substance. For purposes of incurring sales tax in any state, that essentially translates into “sometimes.” Sometimes a state considers supplements and vitamins as drugs, groceries or food. Sometimes these products are taxable tangible personal property, sometimes not.

Accounting Today

APRIL 24, 2024

Firms need to adapt to changes in technology at a pace that makes sense for them and their clients.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

CPA Practice

APRIL 28, 2024

The Internal Revenue Service is offering tax-related information to entrepreneurs in anticipation of the upcoming kick-off of National Small Business Week. The U.S. Small Business Administration coordinates the annual event, helping entrepreneurs with resources, benefits and other important business startup information that small business owners can use to launch their enterprises.

Withum

APRIL 10, 2024

In a recent development that underscores the dynamic landscape of Artificial Intelligence (AI) within government, the U.S. House has blocked the utilization of Microsoft’s Copilot by its staff, representing a noteworthy chapter in the ongoing narrative of AI’s journey through the hype cycle. Just as AI approaches the summit of the Peak of Inflated Expectations, there emerges a concerted effort, notably from the media, to hasten its descent into the Trough of Disillusionment.

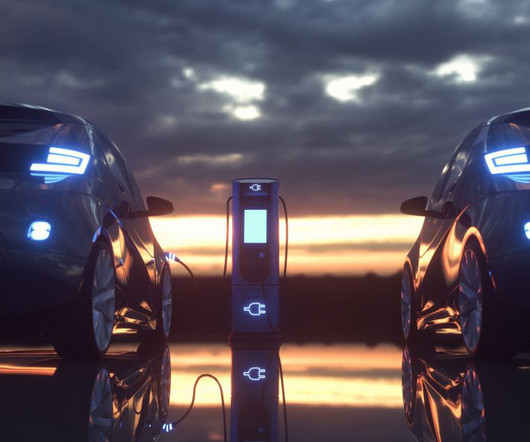

RogerRossmeisl

APRIL 30, 2024

According to the Treasury, the US government has provided auto dealers with >$580 million in advance payments for consumer electric vehicle (EV) tax credits since 1/1/2024. Before 2024, American car purchasers were only eligible for the new electric vehicle (EV) credit of up to $7,500 or the $4,000 credit for used EVs when they submitted their tax returns in the subsequent year.

MyIRSRelief

APRIL 29, 2024

Los Angeles, the City of Angels, beckons with its vibrant energy, diverse culture, and endless opportunities. It’s no surprise then, that thousands of ambitious entrepreneurs set up shop in the sprawling metropolis and its surrounding cities, forming the backbone of the Los Angeles-Long Beach-Anaheim, CA (LA Metro) economy. But for these go-getters, navigating the complexities of running a business, especially the ever-challenging world of taxes and accounting, can feel overwhelming.

Speaker: Joe Wroblewski, Senior Sales Engineer

Is your tech stack working for you—or are you working for it ? 🤖 In today’s world of automation and AI, technology should simplify workflows—not add complexity. Seamless integration and interconnectivity are key to maximizing productivity, optimizing workflows, and improving collaboration. Join expert Joe Wroblewski for a practical and insightful session on how you can build a smarter, more connected tech stack that drives efficiency and long-term success!

TaxConnex

APRIL 4, 2024

Economic nexus thresholds in many states depend on two numbers. Now, almost six years after the landmark Wayfair case ignited sales tax obligations for more remote sellers, one of those numbers might be falling out of favor. Since the Supreme Court’s decision in 2018, almost all states with economic nexus opted to have dollar volume of sales as one trigger for sales tax obligations.

Accounting Today

APRIL 17, 2024

Diverse teams and inclusive work environments produce better results.

CPA Practice

APRIL 24, 2024

The newly formed Alternative Dispute Resolution Program Management Office, an arm of the IRS Independent Office of Appeals, will work with the agency’s business operating divisions—Wage & Investment, Large Business & International, Small Business/Self-Employed, and Tax Exempt and Government Entities—to help taxpayers resolve tax disputes earlier and more efficiently, the IRS said on April 24.

BurklandAssociates

APRIL 16, 2024

Burkland’s Fractional CFO team shares a list of cost-saving tips that venture-backed startups can employ to optimize their financial resources. The post Cost-Saving Tips for Startups: Maximize Your Cash Runway appeared first on Burkland.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

RogerRossmeisl

APRIL 28, 2024

In commercial litigation, it’s common for business valuation experts to measure damages based on lost profits or diminished business value — or both. Here’s an introduction to these concepts. The basics Generally, it’s appropriate to estimate lost profits when a plaintiff suffers an economic loss for a discrete period and then returns to normal. On the other hand, diminished business value is typically reserved for businesses that are completely destroyed or otherwise suffer a permanent loss, su

MyIRSRelief

APRIL 22, 2024

Navigating tax issues can be daunting, especially when facing audits, unpaid taxes, or payroll problems. In Corona, CA, part of the Inland Empire, taxpayers and businesses often seek clarity on resolving these issues effectively. This FAQ guide provides insights into common tax problems and solutions available in Corona, CA. 1. What is Audit Representation and How Can It Help Me in Corona, CA?

SMBAccountant

APRIL 2, 2024

It's crucial to assess your eligibility for federal grants before applying, as pursuing grants for which you are not legally eligible can waste time and resources. For small businesses, understanding various factors is essential. This includes budgeting, expense tracking, and reporting to ensure funds are used appropriately and in compliance with grant terms.

Accounting Today

APRIL 12, 2024

Some of our favorite CPAs of the silver and small screen.

Speaker: Yohan Lobo and Dennis Street

In the accounting world, staying ahead means embracing the tools that allow you to work smarter, not harder. Outdated processes and disconnected systems can hold your organization back, but the right technologies can help you streamline operations, boost productivity, and improve client delivery. Dive into the strategies and innovations transforming accounting practices.

Let's personalize your content