6 opportunities every firm should consider

Accounting Today

MARCH 11, 2024

With a wealth of ways to move forward and build their practices, accounting firms need to figure of which to take, and which to pass up.

Accounting Today

MARCH 11, 2024

With a wealth of ways to move forward and build their practices, accounting firms need to figure of which to take, and which to pass up.

Insightful Accountant

MARCH 11, 2024

A judge ruled the Corporate Transparency Act's ownership reporting unconstitutional for NSBA and its 60,000+ members by March 1, 2024. This may trigger similar cases nationwide, impacting BOI reporting. Practitioners need to plan their response.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Dent Moses

MARCH 13, 2024

In today’s business environment, companies are constantly seeking ways to optimize operations and enhance efficiency. One strategy gaining prominence is outsourcing, particularly accounting functions. Outsourcing accounting services can offer a myriad of benefits, revolutionizing a business’s financial landscape. Firstly, outsourcing allows companies to tap into a pool of skilled professionals without the burden of hiring and training in-house staff.

TaxConnex

MARCH 12, 2024

Since the first adding machine showed up on counters to help shopkeepers tack on the correct sales tax, automation has been part of compliance. Now the buttons and the lever have given way to behind-the-scenes software and automatic functionality. Good thing, too, as sales tax has evolved beyond a static percentage to involve thousands of tax jurisdictions and ever-changing calculations.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Canopy Accounting

MARCH 11, 2024

Have questions about accounting practice management software? We cover it all here. Learn what it is, how to use it, and much more!

Patriot Software

MARCH 13, 2024

Machine learning (ML), a branch of artificial intelligence (AI), is everywhere. It has transformed online shopping (“users also bought…”) and TV streaming (“because you watched…”). Machine learning has also revolutionized the field of accounting. Machine learning in accounting has made financial management more streamlined, accurate, and insightful.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Accounting Today

MARCH 11, 2024

The fate of the Child Tax Credit is in the hands of the Senate, but the IRS is ready to implement changes rapidly if the bill is passed.

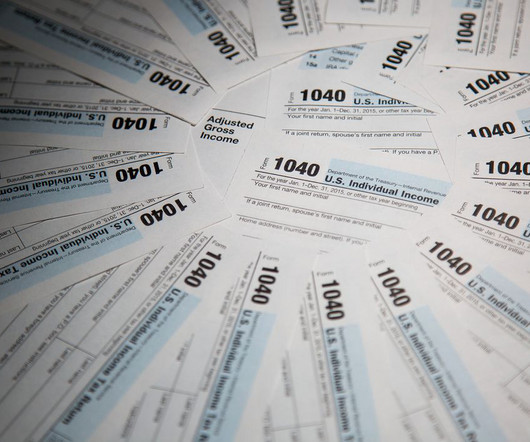

Accounting Today

MARCH 12, 2024

Despite a later start, tax filing is proceeding apace — though there are some unresolved issues.

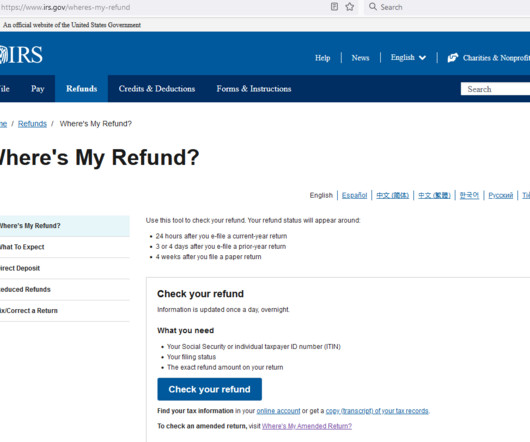

CPA Practice

MARCH 11, 2024

By Dave Eisenstadter, masslive.com (TNS) Did you end up unexpectedly owing money on your taxes this year? Statistics from the IRS ending on March 1 indicate you’re not alone. Compared with a similar point in the tax season the previous year, there have been nearly 6 million fewer refunds, IRS records show. By March 3, 2023, 42,040,000 refunds had been issued compared with 36,288,000 by March 1 of this year, a difference of 5.75 million or nearly 14%.

BurklandAssociates

MARCH 12, 2024

Clean Energy startups and other grant recipients have all the usual accounting requirements, plus additional grant compliance responsibilities. The post Grant Compliance 101 for Startups appeared first on Burkland.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

MyIRSRelief

MARCH 15, 2024

In the bustling city of Whittier, California, individuals and businesses alike face the daunting task of navigating the complex world of taxes. From unfiled tax returns to unpaid back taxes, and from employment 941 payroll issues to the intimidating process of IRS, FTB, EDD, and CDTFA audits, the challenges can seem insurmountable. However, tax relief services offer a beacon of hope, providing expert guidance and support to those in immediate need.

Accounting Today

MARCH 12, 2024

The pilot program is expanding in the 12 states where it's available.

Acterys

MARCH 13, 2024

Navigating Corporate Performance Management (CPM) needs has become a strategic force for businesses eager to harness data for insightful decision-making. To cater to the evolving needs of SMBs and enterprises, Acterys has emerged as a distinguished accelerator in the 2024 CPM Technology Value Matrix by Nucleus Research, showcasing its innovative approach to integrating analytics and planning.

Going Concern

MARCH 11, 2024

The 96th annual Academy Awards went off seemingly without a hitch last night but we’re not here to talk about that because this isn’t a movie blog and I haven’t seen Oppenheimer. We’re here to rehash what happened seven years ago because this website specializes in the beating of dead horses and reminding Big 4 accounting firms of the dumb things they’ve done over the years.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

CPA Practice

MARCH 15, 2024

The Internal Revenue Service continues to increase the amount of information available in multiple languages. Although the primary language of the agency is usually expressed in dollar signs followed by numbers and commas, the agency offers a variety of support tools to help people across multiple languages. The agency’s multilingual efforts are a part of its Strategic Operating Plan, which has received additional funding since the enactment of the Inflation Reduction Act.

Accounting Today

MARCH 12, 2024

While every company is different, there are 12 operational areas distressed businesses often miss, which can foretell a deteriorating financial condition.

Withum

MARCH 14, 2024

Explore Other Episodes #CivicWarriors #WithumImpact The post Let’s Help Promote Collaboration With NJ Association of Community Providers appeared first on Withum.

Going Concern

MARCH 13, 2024

*Technically the partners are being forced to retire but the headline was already way too many characters It’s been more than a year since Australian Financial Review blew the PwC Australia tax scandal wide open and it’s been nothing but migraines for PwC leadership (and their cousins at other Big 4 firms also subject to relentless grilling by Aussie senators) since.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

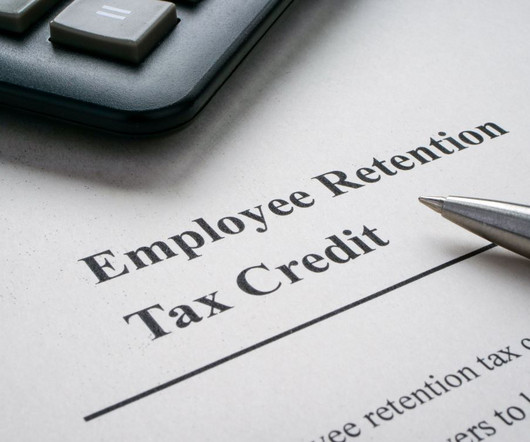

CPA Practice

MARCH 15, 2024

The Internal Revenue Service has renewed its message for businesses to review the Employee Retention Credit guidelines to avoid future compliance action for improper claims. Amid aggressive marketing that misled many businesses into filing claims for ERC, the IRS has sharply increased compliance action through audits and criminal investigations – with more activity planned in the future.

Accounting Today

MARCH 14, 2024

Zach Donah, the new CEO of the Massachusetts Society of CPAs has big plans for the organization.

AccountingDepartment

MARCH 14, 2024

How an ERP system, such as Netsuite, tailored for the unique needs of SMBs, can be a pivotal tool in propelling small businesses to new heights.

Going Concern

MARCH 15, 2024

The selection of “Grant Thornton” images on our stock photo site sucks, this office in Ireland is the best I could do sorry. This morning we received a tip: Grant Thornton with a “strategic partnership” with New Mountain Capital. All hands call at 12:30 CST to discuss Before we had a chance to go digging around — we haven’t heard a peep about this until now — our tipster sent over a link to a fresh Financial Times report : Grant Thornton US sells majorit

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

CPA Practice

MARCH 12, 2024

January 2024 had the highest percentage of employees making paid time off (PTO) requests since the beginning of 2019, according to the BambooHR Workforce Insights Report. The data, pulled from the BambooHR platform, also shows that the average number of employee performance reviews in companies is increasing annually and hiring is now outpacing turnover.

Accounting Today

MARCH 15, 2024

Private equity firm New Mountain Capital is taking a majority stake in Grant Thornton in the biggest deal to come along in PE firms' involvement in the accounting field.

Withum

MARCH 14, 2024

Withum is proud to share that Russell Goldberg , Partner in Charge of Withum’s Orlando Office , has been inducted into the University of Central Florida College of Business Hall of Fame. Russell is a proud graduate of the University of Central Florida (UCF) Kenneth G. Dixon School of Accounting. In his illustrious career of nearly 35 years, he has always prioritized giving back to the organization and nurturing the next generation of accountants coming out of UCF.

Going Concern

MARCH 9, 2024

Are the kids not alright? That’s the question posed by this recent r/Big4 post. Two themes repeatedly emerge from the comments: The early-career busy work has been outsourced away and this is the inevitable result The pay is too low and workload too high, new hires are wise not to bust their asses for the firm given these two facts And a third factor: Young people have always been kind of dumb and OP probably forgot how dumb they were when they were an associate.

Speaker: Joe Wroblewski, Senior Sales Engineer

Is your tech stack working for you—or are you working for it ? 🤖 In today’s world of automation and AI, technology should simplify workflows—not add complexity. Seamless integration and interconnectivity are key to maximizing productivity, optimizing workflows, and improving collaboration. Join expert Joe Wroblewski for a practical and insightful session on how you can build a smarter, more connected tech stack that drives efficiency and long-term success!

CPA Practice

MARCH 13, 2024

By Alex Baulf. In the midst of the accounting profession entering a brave new world where digitization of tax and accounting processes is increasingly the norm, it should come as no surprise that the humble invoice is now in the crosshairs of governments around the globe, including the U.S. The invoice is essential to tax compliance processes, and the electronic invoice (e-invoice) is not only inevitable, but upon us.

Accounting Today

MARCH 13, 2024

Affected businesses may turn to their accountants for help, but are firms the best source to help clients report beneficial ownership information to the feds?

Insightful Accountant

MARCH 14, 2024

On this episode of Accounting Insiders, Gary talks to Robin Hall of VARC Solutions and her journey with Family, Tech Trends and Personalized Accounting.

Going Concern

MARCH 13, 2024

BDO USA filed a federal trade secrets lawsuit against Ankura Consulting on Monday that alleges Ankura “unjustly enriched itself through the employee defections from BDO and stole the company’s confidential information.” The defections came in the form of several senior-level staff from BDO’s healthcare transaction advisory business who apparently left BDO with their national practice leader.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

Let's personalize your content