The future of the trusted advisor: Challenges and opportunities

Accounting Today

DECEMBER 11, 2023

As the accounting profession enters a period of unprecedented change, the AICPA's Barry Melancon highlights the upsides and downsides.

Accounting Today

DECEMBER 11, 2023

As the accounting profession enters a period of unprecedented change, the AICPA's Barry Melancon highlights the upsides and downsides.

Canopy Accounting

DECEMBER 13, 2023

In this ebook, you'll learn 4 ways to create a top tier experience for clients while optimizing your firm's internal processes for long-term and more profitable relationships.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CPA Practice

DECEMBER 14, 2023

A new study by top 15 accounting firm Moss Adams revealed that 69% of accountants believe artificial intelligence will enhance rather than eliminate jobs and has a positive impact on the accounting profession as a whole, driving productivity and business growth. “AI is here, and accountants are actively embracing the technology,” Bill Armstrong, chief innovation officer at Moss Adams, said in a statement.

AccountingDepartment

DECEMBER 13, 2023

With a new year just around the corner, it's time for organizations to start thinking about their budgets for 2024 - if they haven't already. Effective budgeting and planning are critical to the success of any business. It helps in making smart financial decisions, optimizing resource allocation, and achieving business objectives.

Advertisement

Historical bookkeeping clean-up is like an archaeological dig for financial documents. It is a vigorous, systematic process that ensures thorough scrutiny of every document. From verifying inconsistencies to reconciling payments, each layer of exhaustive evaluation brings greater clarity into your company's financial past. In this article, we will walk through all that historical bookkeeping clean-up entails.

TaxConnex

DECEMBER 14, 2023

In sales tax calculation, you deal with the “hard” and the “less-hard.” Figuring out sales tax obligations for goods (aka, tangible personal property, or TPP) is the less-hard part; you merely have to bear in mind that every state that taxes TPP does it a little differently. Services, on the other hand, are the hard calculation. Not every state taxes services not every state taxes the same ones, and those that do tax services do so in a galaxy of ways.

CPA Practice

DECEMBER 13, 2023

By Clement Feng. Like many other large legislative bills, the Inflation Reduction Act is filled with lots of taxpayer goodies that are hard to find unless you know where they are. Yet, in this case, identifying them is worth the time and effort since they can make a big difference in tax filings for eligible homeowners and business property owners. In fact, this particular legislation may help many more of your clients than CPAs realized when it was first passed in August 2022.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Mark Lee

DECEMBER 12, 2023

Historically most clients stay with their accountant for many years. They generally move only when they feel their accountant doesn’t care enough about them, puts their fees up significantly or messes up. Of course there are also those clients who only ever wanted to go to the cheapest accountant around and move on whenever they think they can do better.

Insightful Accountant

DECEMBER 12, 2023

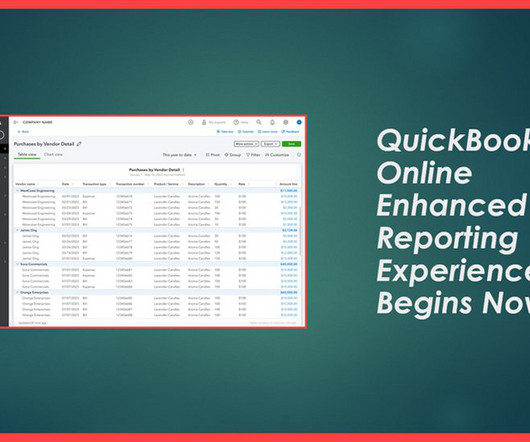

Intuit will initiate major reporting enhancements for QuickBooks Online and QuickBooks Online Advanced users starting December 15, 2023.

Accounting Today

DECEMBER 14, 2023

The Institute of Management Accountants reported increased salaries and job opportunities for Certified Management Accountants as opposed to those without certifications.

TaxConnex

DECEMBER 12, 2023

Business truism has it that limited liability corporations and similar entities shield the personal property and assets of their owners and major shareholders from company bills and missteps. That’s true for many of the fiscal messes that can befall a company. But not for sales tax liability, where most states still maintain strong responsible party laws.

Advertisement

By ditching paper and manual checklists, UNIFY embraced ART’s cloud-based solution for seamless automation. The robust dashboards, exception reports, and completion date reports allowed the team to easily track progress and resolve bottlenecks. ART’s flexible access for auditors ensured tight deadlines were met effortlessly. With competitive pricing and a rapid setup, ART cut costs and minimized disruptions, enabling UNIFY’s team to concentrate on high-impact tasks.

BurklandAssociates

DECEMBER 11, 2023

The IRS recently provided new interim guidance around expense categories, contract research, and foreign R&D activities. The post R&D Tax Credit and Section 174 Update for Startups appeared first on Burkland.

MyIRSRelief

DECEMBER 15, 2023

Top 10 Tax Planning Concepts for W-2 Earners As a W-2 earner, understanding tax planning concepts can help you maximize your tax savings and ensure you’re making the most of your income. Here are the top ten tax planning concepts you should know. 1. Understanding Your W-2 Form Your W-2 form is a crucial document that outlines your income and the taxes withheld from your paycheck.

Accounting Today

DECEMBER 11, 2023

The Treasury Department and the Internal Revenue Service expect to issue proposed regulations to address the application of the foreign tax credit and related rules and the dual consolidated loss rules to certain types of taxes described in the GloBE Model Rules.

CPA Practice

DECEMBER 14, 2023

There are slight changes in the IRS-issued optional standard mileage rates for 2024, which are used to calculate the deductible costs of operating an automobile for business, charitable, medical, or moving purposes. Beginning on Jan. 1, 2024, the standard mileage rates for the use of a car, van, pickup truck, or panel trucks will be: 67 cents per mile driven for business use, an increase of 1.5 cents from 2023. 21 cents per mile driven for medical or moving purposes for qualified active-duty mem

Advertisement

Uncover the latest trends in expense management for small and medium-sized businesses. Our 5th Annual Trends Survey reveals that corporate card use is skyrocketing, but expense software isn't keeping up. This mismatch is creating real challenges for finance teams, who now take an average of 14 days to close their books. Travel policies are shifting to accommodate hybrid work, but many companies are struggling with off-tool bookings.

Going Concern

DECEMBER 12, 2023

Mere hours ago, Wall Street Journal reported that EY is laying off “dozens of partners across all U.S. business” and not only in lower-demand service lines. As with most of the cuts we’ve seen this year, consulting is most affected with their partner ranks being trimmed by ten percent, four percent in strategy and transactions. Says WSJ , there will be cuts in audit and tax as well though they didn’t share numbers.

Withum

DECEMBER 14, 2023

On December 13, 2023, the Financial Accounting Standards Board (FASB) finalized Accounting Standards Update (ASU) 2023-08 “Accounting for and Disclosure of Crypto Assets”. The amendments in the expedited ASU aim to improve the reporting of crypto assets by requiring entities to present crypto assets at fair value instead of the previously used cost-less-impairment model.

Accounting Today

DECEMBER 13, 2023

The Financial Accounting Standards Board released its long-awaited accounting standards update to improve the accounting for and disclosure of certain cryptoassets.

CPA Practice

DECEMBER 11, 2023

A Top Technology Initiative Article – Dec. 2023. Artificial intelligence (AI) has rapidly transitioned from science fiction to everyday reality, transforming industries and disrupting long-held paradigms. AI’s influence is pervasive and ever-growing, from self-driving cars to personalized healthcare. As we enter 2024, it’s natural to wonder what the future holds for this transformative emerging technology, especially for accountants.

Speaker: Duke Heninger

With the rise of fractional finance roles, many CFOs, FP&A professionals, controllers, and accountants are stepping into independent consulting. The expansion of fractional services presents new opportunities for finance professionals, but many face challenges in navigating this transition, finding it daunting. Whether you’re new to fractional work or refining your approach, this webinar will equip you with a repeatable system for success.

Going Concern

DECEMBER 14, 2023

Actually RIP the entire four-part CPA exam. Tomorrow, December 15, 2023, is the last day anyone will ever sit for BEC before it shuffles off into examination heaven and takes written communication with it. That’s right, no more written communication on the CPA exam. Wyoming and Idaho were the states with the latest application deadline for BEC — November 15 — while most others cut off re-exam NTSs on November 12 and first-time NTSs on October 1.

Withum

DECEMBER 15, 2023

It is no secret that the pandemic forced dealerships to pivot. Conventional operating procedures, strategies, inventory management, staffing, and numerous other standard practices had to change to combat reduced inventory, staffing shortages, and increased online competition. It is only recently that we are seeing a shift back to our former standards.

Accounting Today

DECEMBER 13, 2023

The International Federation of Accountants wants organizations to combine sustainability reporting with their existing internal control and governance frameworks.

CPA Practice

DECEMBER 13, 2023

By Mike D’Avolio, CPA, JD. The Inflation Reduction Act of 2022 was signed into law on Aug. 16, 2022, providing numerous tax deductions and tax credits for individuals, families and businesses. New tax incentives were added, and existing tax incentives got extended and enhanced. This article covers two home energy tax credits for your individual clients to take advantage of by saving money on their tax returns and conserving energy to help out the environment.

Advertisement

Accounting firms must embrace digital transformation to stay competitive. From improving efficiency and client experience to ensuring data security, digital tools offer the edge needed in a digital-first world. Discover how Fincent can streamline your transition. The accounting industry faces a digital revolution. As technology reshapes business, firms must adapt or risk obsolescence.

Insightful Accountant

DECEMBER 13, 2023

Fashion shoe brand Manolo Blahnik uses NetSuite to enhance supply chain efficiency, consolidate financial processes, and improve visibility into its growing global operations.

Withum

DECEMBER 14, 2023

Withum is proud to share that Accounting Today has once again named Jim Bourke , Managing Director of Advisory Services and Ed Mendlowitz , Emeritus Partner, on their annual Top 100 Influential People in Accounting. The Top 100 are chosen for their outstanding contributions to the industry, including their leadership, mentorship, and how they use their voice to promote and advocate for the profession.

Accounting Today

DECEMBER 11, 2023

The International Federation of Accountants' planned revisions will include some new and revised learning outcomes to meet the demands for sustainability reporting and assurance.

CPA Practice

DECEMBER 15, 2023

Ask dozens of accounting professionals and most will agree that using accounting software is an important part of managing a business. Accounting software also simplifies tax preparation by identifying taxable income and deductions with ease. Not all small businesses are on board yet. While Codat’s Global Accounting Guide estimates that 64% of small businesses in the U.S. currently use accounting software in their business, leaving 35% of small businesses still using a manual accounting system

Speaker: Igli Laci, Strategic Finance Leader

In today’s competitive market, pricing is more than just a number — it’s the cornerstone of profitability. The right pricing strategy ensures that you capture the true value of your offering, paving the way for sustainable growth and long-term success. Join Igli Laci, Strategic Finance Leader, in this exclusive session where he will explore how a well-crafted pricing approach balances customer perception with business objectives, creating a powerful tool for securing both competitive advantage a

Insightful Accountant

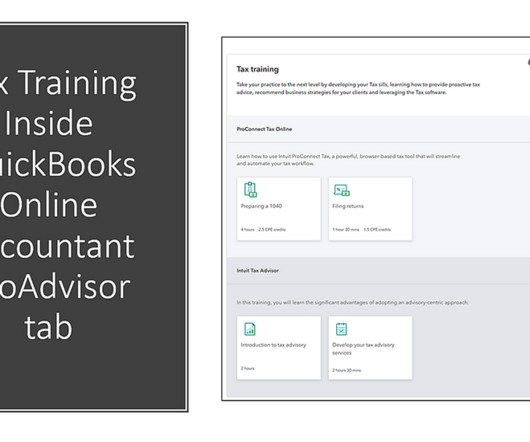

DECEMBER 14, 2023

Tax training has been added to the QuickBooks Online Accountant, ProAdvisor Training tab. Training is available for both ProConnect Tax Online and Intuit Tax Advisor products.

Going Concern

DECEMBER 15, 2023

In case you missed this year’s Microsoft Excel World Championships, the sporting event of the year for spreadsheet wizards everywhere, the king of Excel has been crowned. For the third year in a row, Andrew Ngai wiped the floor with the competition to take the top spot as GOAT in the rows and columns. View this post on Instagram A post shared by Microsoft 365 (@microsoft365) INCREDIBLE. the Microsoft Excel championships is peak human performance pic.twitter.com/gJxDcq8irR — gaut (@0x

Accounting Today

DECEMBER 14, 2023

The American Institute of CPAs provided information for U.S. accounting professionals on the potential impact on their out-of-state engagements if some of the pending legislation in some states on licensure requirements is enacted.

CPA Practice

DECEMBER 11, 2023

By Leada Gore, al.com (TNS) The maximum contribution amount for employees participating in a flexible spending account will increase in 2024, according to the IRS. Starting in 2024, employees can contribute up to $3,200 tax-free to an FSA through payroll deduction, an increase of $150 from this year. The account can be used to pay for medical expenses not covered by other health plans—including copays, deductibles and a variety of medical products, as well as eye and dental care—and contributio

Advertiser: Paycor

Year-end can be a hectic time for HR professionals, but with proper planning and organization, you can navigate it smoothly. Learn the main watch outs for year-end HR prep with Paycor’s helpful checklist covering employee data, wage and tax information, and special situations. Ensure compliance and efficiency by downloading today!

Let's personalize your content