Dual Certifications Mean Big Bucks for Accountants

CPA Practice

JANUARY 2, 2024

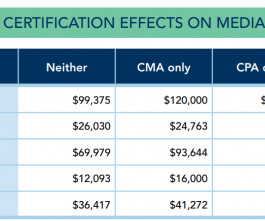

Accountants in the U.S. who earned the CMA and CPA designations make more than $38,000 than their noncertified counterparts, according to the 2023 Global Salary Survey from the Institute of Management Accountants (IMA). According to data from IMA members surveyed in the U.S. and Canada, management accountants who are both CMAs and CPAs have a median base salary of $137,800 compared to $99,375 for accountants who hold neither certification.

Let's personalize your content