59% of accountants use AI to save about 30 hours a week

Accounting Today

APRIL 9, 2024

A recent poll of U.S. and U.K. accountants has found that 59% say they use AI at work, and through AI have saved about 30 hours a week.

Accounting Today

APRIL 9, 2024

A recent poll of U.S. and U.K. accountants has found that 59% say they use AI at work, and through AI have saved about 30 hours a week.

Insightful Accountant

APRIL 10, 2024

Accounting profession faces staffing shortages due to fewer graduates and an aging workforce. 42% of firms turn away work, 24% near burnout. First-time CPA exam candidates dropped by 33% from 2016 to 2021.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CPA Practice

APRIL 9, 2024

By Irana Wasti. The adoption of a new product or technology tends to follow a familiar cycle. First, there is skepticism about whether it will live up to the hype. A few proven use cases later, people are talking about whether it will enhance or upend their professional lives. Before we reach the final stage where the technology is widely adopted, we pass through a period of uncertainty, where we wonder if this technology will be too helpful — to the point of being a threat to job security.

Insightful Accountant

APRIL 8, 2024

Amid COVID-19, US relief programs like PPP and unemployment aid were exploited by fraudsters, resulting in $80B stolen from PPP and $90-400B from unemployment relief. This fraud may rival $579B for Biden's infrastructure plan.

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Ryan Lazanis

APRIL 10, 2024

Dive into the world of offshore accounting: Discover benefits, challenges, and best practices in this comprehensive guide. The post Offshore Accounting: Everything You Need to Know appeared first on Future Firm.

Canopy Accounting

APRIL 10, 2024

For the accounting firm focused on maximizing profit and efficiency, antiquated practice management solutions that only meet a few needs are no longer sufficient for accounting firms. Having an operating system that seamlessly connects all processes within an accounting firm is crucial for maximizing efficiency and providing a superior client experience.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

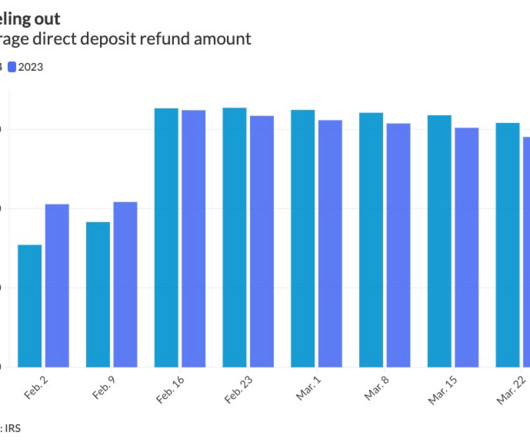

Accounting Today

APRIL 9, 2024

At 90,315,000, the number of individual returns received this tax season finally surpassed the same period last year, up 0.2% as of March 29, 2024.

CPA Practice

APRIL 9, 2024

By Nellie Akalp. As accountants and CPAs, dealing with payroll taxes is essential to managing finances for your business clients. Understanding the details of payroll taxes helps you better assist your clients in fulfilling their obligations and maximizing tax efficiency. The ever-changing complexities of payroll taxes can often seem overwhelming, especially for business owners, so we’ve compiled an easy guide you can share with them.

TaxConnex

APRIL 9, 2024

The common definition of dietary supplements and vitamins is a non-food item that includes a vitamin, mineral, herb, botanical, amino acid or dietary substance. For purposes of incurring sales tax in any state, that essentially translates into “sometimes.” Sometimes a state considers supplements and vitamins as drugs, groceries or food. Sometimes these products are taxable tangible personal property, sometimes not.

Withum

APRIL 10, 2024

In a recent development that underscores the dynamic landscape of Artificial Intelligence (AI) within government, the U.S. House has blocked the utilization of Microsoft’s Copilot by its staff, representing a noteworthy chapter in the ongoing narrative of AI’s journey through the hype cycle. Just as AI approaches the summit of the Peak of Inflated Expectations, there emerges a concerted effort, notably from the media, to hasten its descent into the Trough of Disillusionment.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Accounting Today

APRIL 12, 2024

Some of our favorite CPAs of the silver and small screen.

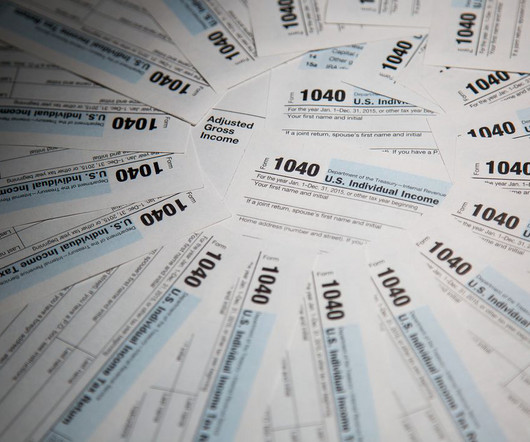

MyIRSRelief

APRIL 12, 2024

Tax debt can be a significant burden, causing stress and financial strain for many individuals. However, there are several avenues for tax relief available to those who owe the IRS. This comprehensive guide will explore the options for obtaining tax relief, aiming to provide clarity and hope to those grappling with tax debt concerns. Get professional representation today!

BurklandAssociates

APRIL 9, 2024

HR recordkeeping is one of the last things most startup founders want to think about, but non-compliance can lead to major fines, reputation damage, and due diligence pitfalls. The post Navigating HR Compliance: Recordkeeping Essentials for Startups appeared first on Burkland.

Going Concern

APRIL 9, 2024

The annual 100 Best Companies to Work For list from Fortune and Great Place To Work® is out and once again a lil firm from Michigan has the honor of being best-er than the accounting firms that follow it. Everyone, let’s congratulate Plante Moran for another impressive showing and coming in 12th on the 2024 list. This year, they only narrowly beat out Deloitte again.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

APRIL 11, 2024

From BOI reporting to tax legislation in limbo, even the most 'normal' filing season in a several years still has unresolved questions.

CPA Practice

APRIL 9, 2024

In an email to tax professionals on April 5, the IRS said it’s making changes that will impact how practitioners obtain a client’s tax transcripts, as part of the agency’s efforts to combat identity theft and protect taxpayers’ personal information. Starting April 8, tax professionals must now call the Practitioner Priority Service (PPS) to request transcripts to be deposited into their Secure Object Repository (SOR).

Withum

APRIL 12, 2024

Withum Soars on Vault Top Accounting Firm List Vault named Withum #17 on their annual top 25 accounting list. Known for its influential ranking, Vault recognized Withum for their outstanding training programs, benefits and compensation. Over the years, the Vault survey has consistently shown that Withum Team Members accept positions and remain at the Firm for the unbeatable culture and outstanding colleagues.

Going Concern

APRIL 9, 2024

I think I have something interesting for you today. Fresh academic research has found that audit seniors are more likely to offer better constructive feedback and coaching to their juniors via review comments if the seniors think they’ll be working with that staff again. The paper “ Coaching Today’s Auditors: What Causes Reviewers to Adopt a More Developmental Approach?

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Accounting Today

APRIL 11, 2024

The Institute of Management Accountants is examining the possibilities of artificial intelligence in the accounting profession while undergoing staff cutbacks.

CPA Practice

APRIL 8, 2024

With the increasing complexity of tax laws and regulations, tax professionals are constantly facing challenges in keeping up with the ever-changing landscape. CPA Pilot ‘s AI tax assistant leverages advanced algorithms to analyze data and offer precise insights quickly. This enables tax professionals to prioritize strategic tasks. CPA Pilot allows tax experts to focus on strategic and value add tasks for their clients and reduce the intensity of tax season.

Withum

APRIL 9, 2024

Withum is proud to announce that Chris has earned a spot on the Inside The Valley’s list for the second consecutive year. Chris is Partner-in-Charge of Withum’s Los Angeles office and has over 24 years of experience in the industry specializing in assurance and business consulting services to emerging and middle-market companies. As a prominent networker and influencer, Chris reaches a broad professional audience through his work as the Social Media CPA and as an active member of ProVisors and t

Going Concern

APRIL 7, 2024

The irony of me writing and publishing this on a Sunday. On April Fools’ Day, California Assemblymember Matt Haney announced he’s introduced AB 2751 , a proposal that “guarantees California workers uninterrupted personal and family time by creating a ‘right-to-disconnect’ from emails, texts, and calls after work hours.” His office’s statement explains : The bill mandates that all California employers create and publish company-wide action plans to implem

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Accounting Today

APRIL 10, 2024

The board imposed its largest-ever penalty of $25 million against KPMG's firm in the Netherlands, in addition to $2 million in fines against Deloitte's firms in Indonesia and the Philippines.

CPA Practice

APRIL 9, 2024

Let’s face it, the accounting profession has developed a bad reputation – toiling through long hours chained to a desk, crunching numbers, deciphering archaic tax codes and grinding out tedious tasks, all for lower starting pay and heavy licensing requirements. The sector is at an inflection point with staffing challenges – one that offers both risk and opportunity.

Cherry Bekaert

APRIL 9, 2024

On campuses around the country, the name, image and likeness (NIL) policy is revolutionizing the way student-athletes can obtain benefits while attending a college or university. As of July 2021, student-athletes can enter NIL deals if they comply with state law and the NCAA’s rules. Essentially, NIL allows college athletes to monetize their personal brand by profiting from their name, image and likeness through various opportunities such as endorsements, sponsorships, social media posts and mor

Going Concern

APRIL 12, 2024

In a renewed effort to appear to be doing something of value, the PCAOB was busy this week handing down hand slaps and fines for the crime of sharing answers on internal training. We were a bit too focused on KPMG Netherlands receiving the biggest fine the PCAOB has ever given out ($25 million) to mention that Deloitte Philippines and Deloitte Indonesia had fines of their own announced the same day.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Accounting Today

APRIL 10, 2024

Plus, Google is making massive changes to Chrome, AI-powered tax chatbots aren't performing well, and seven other things that happened in technology this past month.

CPA Practice

APRIL 9, 2024

By Oren Koren Tax season is underway, which means cyber criminals are hard at work. With the plethora of highly sensitive personal and financial data being shared between firms and clients, it’s the perfect time for bad actors to strike, especially as the April 15th deadline inches closer and CPAs push to get more done with less time. With an increase in activity from all sides – both to citizens who are filing taxes as well as CPAs looking for new clients – it’s critically important to underst

Cherry Bekaert

APRIL 8, 2024

Today’s technologies are continuously evolving, and Tableau’s software from Salesforce is transforming how organizations optimize their data using cloud capabilities and the power of artificial intelligence (AI). Advancements to Tableau will be on full display at the Tableau Conference 2024, and Cherry Bekaert is thrilled to announce its sponsorship of this highly anticipated event on April 29 – May 1 at the San Diego Convention Center.

Going Concern

APRIL 12, 2024

Footnotes is a collection of stories from around the accounting profession curated by actual humans and published every Friday at 5pm Eastern. While you’re here, subscribe to our newsletter to get the week’s top stories in your inbox every Tuesday and Friday. Comments are closed on Friday Footnotes and the Monday Morning Accounting News Brief by default.

Speaker: Joe Wroblewski, Senior Sales Engineer

Is your tech stack working for you—or are you working for it ? 🤖 In today’s world of automation and AI, technology should simplify workflows—not add complexity. Seamless integration and interconnectivity are key to maximizing productivity, optimizing workflows, and improving collaboration. Join expert Joe Wroblewski for a practical and insightful session on how you can build a smarter, more connected tech stack that drives efficiency and long-term success!

Let's personalize your content